JP Morgan Chase Posts Better Than Expected Second Quarter Earnings

KEY POINTS

- JPMorgan Chase posted second quarter earnings of $1.38 per share on revenues of $33 billion

- Bond traders alone recorded revenue of $7.3 billion, a 120% jump from last year

- The bank has also set aside $8.9 billion for expected loan losses

U.S. banking giant JPMorgan Chase (JPM) posted better-than-expected second quarter earnings of $1.38 per share on revenues of $33 billion.

Analysts had expected earnings of about $1.04 per share.

The bank’s results were boosted by trading revenue which soared by 79% to a record $9.7 billion. Bond traders alone recorded revenue of $7.3 billion, a 120% jump from a year earlier; while equities traders delivered revenue of $2.4 billion.

However, the bank has also set aside $8.9 billion for expected loan losses arising from the covid-19 pandemic. As a result, JPMorgan’s retail banking division recorded a loss of $176 million, versus a $4.2 billion profit a year earlier.

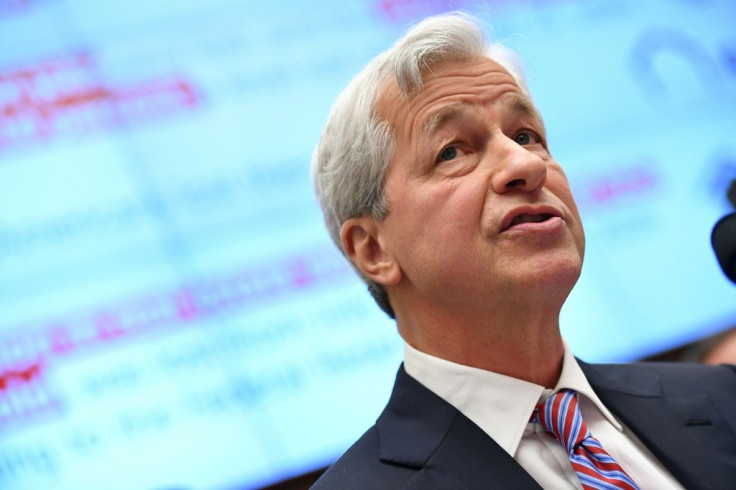

“Despite some recent positive macroeconomic data and significant, decisive government action, we still face much uncertainty regarding the future path of the economy,” said CEO Jamie Dimon. “However, we are prepared for all eventualities as our fortress balance sheet allows us to remain a port in the storm.”

JPMorgan Chase also benefitted from the Federal Reserve’s unprecedented measures to boost the credit markets.

Back in May Dimon said he expected the U.S. economy to rebound in the second half of the year, due to the reopening of businesses across the country. However, that prediction may have been compromised by new waves of infections and renewed closings in some states.

© Copyright IBTimes 2025. All rights reserved.