Learning From California: Don't Hike Taxes On The Rich

Opinion

Last week, Californians gave lawmakers permission to stop doing their jobs. They even offered their own cash to keep politicians from having to seek a real solution to the state's economic problems.

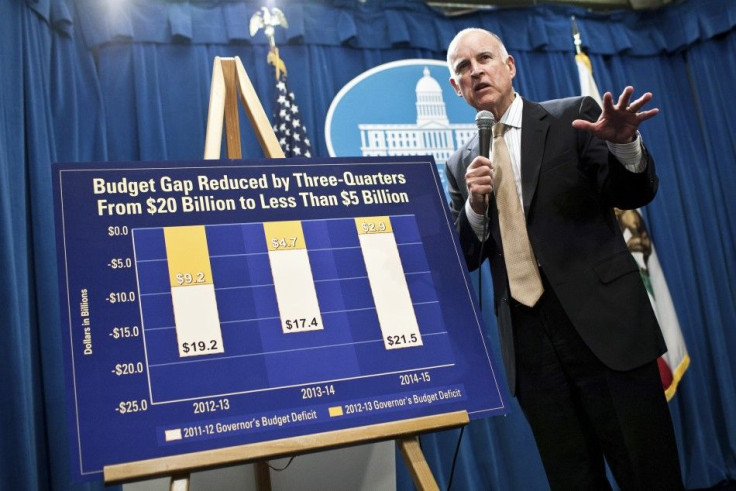

Voters passed Proposition 30, which balances the state budget by temporarily raising the sales tax, as well as the income tax on people who make more than $250,000 per year, before expiring in 2018. This must come as a huge relief to Gov. Jerry Brown, considering that the budget he signed last year assumed tens of billions from this tax hike to fill the gaps.

Its approval serves as an example of what people can accomplish with tireless manipulation. He threatened cuts to education -- think of the children! -- going so far as to have California State University email letters warning applicants that enrollment capacity would drop if it failed.

But Brown said its implications go far beyond saving his own behind. In an interview with CNN's State of the Union on Sunday, he told CNN's Candy Crowley he thought the vote marks the start of a “national tax hike sweep,” to use Crowley's words.

And he may be right.

After all, President Barack Obama wants to let the Bush tax cuts expire for some, which would raise federal taxes on the $250,000-and-up group from 36 percent to 39.6 percent.

But following California's lead on tax policy makes about as much sense as checking into a rehab center run by Lindsay Lohan. It has had the worst credit rating of any state during the past 11 years, according to the Pew Center on the States. And policies like this are exactly why.

The education sob story, like most, has another side. A 2010 Pepperdine University study of 52 California school districts showed that of the education spending from fiscal 2003-04 to 2008-09, less than 58 percent was spent in the classroom. So where did the cash go? Well, for one, supervisors and administrators got a 28 percent pay hike per student. You know. For the, uh, children.

Unfortunately, the language of Proposition 30 doesn't promise anything different. In fact, the actual text of the measure promises to spend the money on “programs in the state budget.” With a Democratic-controlled legislature, this could turn into a shopping spree that would put Elle Woods to shame.

And no matter what the cause, paying for it with tax revenue is notoriously unreliable. Especially from the richest Americans, who often make high-risk investments.

Yet even before Proposition 30 was a twinkle in Gov. Brown's eye, California has been depending on taxes from the rich to pay its bills. In 2010, the wealthiest 1 percent of residents paid 40.9 percent of California income taxes, according to government data cited in a Nov. 11 article in the Los Angeles Times.

Sure enough, the administration's most recent report showed that the cash it's bringing in from taxes has been 2.1 percent less than expected. But I'm sure Brown has a plan in case the tax revenue falls short -- like hoping his grandkids make enough in babysitting money to spot him.

Brown has promised he won’t waste any of voters’ hard-earned cash, but voters shouldn't take that seriously as it's coming from a man who wants to spend $68 billion for a high-speed rail that critics have called a “bullet train to nowhere.”

Which, by the way, Brown did not offer to abandon if the proposition failed. Support for the project has long been waning, according to a Nov. 12 article in Bloomberg Businessweek. Things like bullet trains don't tear at the heartstrings, but things like education do. If another gap appears in a future, he can tell them puppies will die or orphans will starve, and voters will fork it over.

The tax hike is bad news for California. And it would be the same for the country.

In June, Standard & Poor’s blamed California's budget crisis on its tax code, faulting tax revenue as increasingly unreliable, thanks in part to the state's increasing dependence on taxing the rich; a whopping 11 percent of its general fund came from taxes on the wealthiest 1 percent, compared with just 2.7 percent in 1979.

If the nation is foolish enough to follow California's example, it will suffer the same results. Forcing Americans to hand over even more cash to an administration that spends money like Joan Rivers at a plastic surgeon's office will not solve economic problems.

Americans must demand more from the federal government: real reform, solutions that hit at the root of the problem -- not a Band Aid-on-a-bullet-hole fix that will only create greater instability in the end.

Katherine Timpf is a 2012 Robert Novak Fellow with the Phillips Foundation. Follow her on Twitter @kctimpf.

© Copyright IBTimes 2025. All rights reserved.