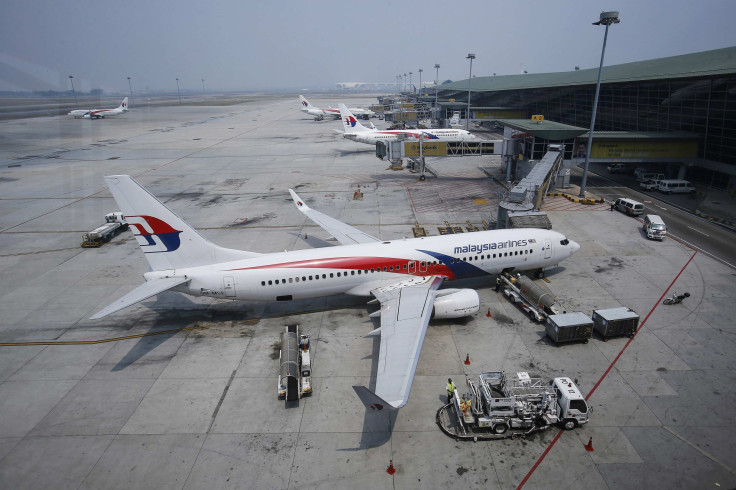

Malaysia Airlines Privatization Likely As State-Owned Parent Seeks Greater Control: Reports

Following the crash of Malaysia Airlines Flight MH17, which is the carrier's second disaster in four months, the loss-making airline is planning to present a revival plan to Khazanah Nasional Bhd. -- the government fund that holds a majority stake in it -- according to a Bloomberg report.

Khazanah, the investment fund owned by the Malaysian government, which currently holds a 69 percent stake in the company, is reportedly contemplating a range of measures, including taking the company private or declaring bankruptcy. According to a Wall Street Journal report, Khazanah had been considering buying out the rest of the company, along with other restructuring proposals, even before the crash of Flight MH17 on Thursday.

“Malaysian Air doesn’t have a huge balance sheet...it’s still struggling from perception issues,” Mohsin Aziz, an analyst at Malayan Banking Bhd. told Bloomberg. He added that the company would soon have to implement some “drastic measures” to stay afloat.

Hugh Dunleavy, the airline’s director of commercial operations, had ruled out a bankruptcy, earlier in May.

Privatizing the company would involve purchasing the 31 percent stake, valued at around $315 million, that Khazanah doesn’t own in the company.

Flight MH17, with 298 passengers on board, was shot down over eastern Ukraine on July 17. It came down near the village of Hrabove, near the conflict-ridden Donetsk region near the Ukraine-Russia border.

The incident, which came four months after the disappearance of Malaysia Airlines Flight MH370 in March, caused the shares of the company to fall by 11 percent in just one day. Malaysian Airline System Bhd.’s (KLSE:MAS) shares have plummeted 34 percent in the last one year.

And, even before the Flight MH370 incident, the company had reportedly accumulated nearly $1.3 billion in losses over the last three years. The airline also carried 3.1 percent fewer passengers in 2014 over the previous year, according to Bloomberg, and managed to fill only 77 percent of its seats, compared to 84 percent in 2013.

The Journal, citing unnamed sources, said that the details of a plan to privatize the airline might be announced in August.

Wan Saiful Wan Jan, an analyst at the Kuala Lumpur-based Institute of Democracy and Economic Affairs, told the Journal that the decline in the company’s share price would make it cheaper for Khazanah to buy the shares it doesn’t already own.

“Hopefully, the crisis would also give them the opportunity to push through the much needed restructuring measures,” he added.

© Copyright IBTimes 2025. All rights reserved.