Tax Bill: Bob Corker Demands Answers From Chairman Orrin Hatch About Last-Minute Tax Provision

Facing a firestorm of criticism, Sen. Bob Corker, R-Tenn., sent a letter Sunday night to Senate Finance Committee Chair Orrin Hatch, R-Utah, asking how the final tax bill ended up including a special tax cut provision experts say would particularly benefit investors in real-estate related LLCs. The letter follows an International Business Times investigative series showing that Corker, President Donald Trump, House Speaker Paul Ryan and a handful of key GOP lawmakers overseeing the tax bill have multimillion-dollar ownership stakes in such LLCs, meaning they could be personally enriched by the provision, which was added to the final tax legislation released on Friday.

Corker this week could decide the fate of the entire $1.5 trillion tax bill in the closely divided U.S. Senate. He cast the lone Republican vote against the original Senate bill, which did not include the provision, but on Friday he announced he would support the final version of the legislation after GOP leaders added the provision to the final bill. Economist Dean Baker estimated that based on his financial holdings, “Corker could be saving as much as $1.1 million from this late addition to the tax bill.”

Under fire for switching his position after a personally lucrative provision was added to the legislation, Corker demanded to know how the language got into the final bill.

“Because this issue has raised concerns, I would ask that you provide an explanation of the evolution of this provision and how it made it into the final conference report,” he wrote to Hatch, who is the chairman of the Senate panel that wrote the tax bill. “I think that because of many sensitivities, clarity on this issue is very important and hope that you will respond in an expeditious manner.”

Corker is not a member of the Senate Finance Committee that wrote the bill, and he was not one of the Senate conferees who negotiated the final bill with House counterparts. In his letter, Corker said Republican aides insisted to him that the provision was not new -- an assertion that drew a swift rebuke from experts who have been tracking the legislation.

“This new language can't be found in either the House-passed or Senate-passed bills,” said Matt Gardner of the Institute on Taxation and Economic Policy, which has opposed the legislation. “Someone on the conference committee decided, behind closed doors, that neither the House nor the Senate bill gave a big enough tax break to businesses with few employees and lots of assets. We can't know that the unknown author of this amendment had real estate investors like Senator Corker, or President Trump, in mind when this egregious giveaway was added to the bill, but it's hard to see another obvious explanation."

A Debate Over Pass-Through Income

At issue is so-called “pass-through” income generated by entities such as LLCs, partnerships and S-corporations which don’t pay corporate taxes. Since reducing the tax burden on businesses has been a central tenet of the Republican tax reform effort, House and Senate Republicans passed bills that would both reduce the corporate tax rate and give a new tax break to pass-through businesses.

The House version of the tax bill included a sweeping tax cut for income from such entities, imposing a 25 percent cap on the taxation of pass-through income. The Senate bill that Corker voted against, however, used a 23 percent deduction to reduce levies on pass-through businesses. The Senate bill also included language designed to prevent the tax cut from being utilized by pass-through entities which do not pay wages -- a provision which Congressional Republicans say helps ensure that this particular form of tax relief goes to job creators.

But in the conference committee that drafted the final reconciled bill, negotiators created a novel provision that was not in the House or Senate bills. They adopted the Senate framework of the bill, including its restrictions, but crafted special new language to allow partnerships with depreciable assets that pay little or no wages to still take advantage of the bill’s 20 percent deduction on pass-through income. It is unclear which legislator added the provision to the final conference report.

Speaking to IBT on Saturday, Corker said he didn’t have any knowledge of the provision, and admitted he had not read the final tax bill before switching his vote from “no” to “yes.” Just hours before the final bill was publicly released Friday, Corker issued a statement announcing he would support the bill, which he called “far from perfect.”

“Left to my own accord, we would have reached bipartisan consensus on legislation that avoided any chance of adding to the deficit and far less would have been done on the individual side with items that do not generate economic growth,” Corker said in a statement.

“But after great thought and consideration, I believe that this once-in-a-generation opportunity to make U.S. businesses domestically more productive and internationally more competitive is one we should not miss.

“Senator Corker’s Understanding Is Wrong”

Corker is under intense pressure: since reversing himself and announcing he would support the bill, he has faced a wave of outrage — including the Twitter hashtag #CorkerKickback — for switching his vote. In his letter, Corker suggested the provision was not a new last-minute addition to the final bill, as IBT reported, but instead an extension of the House-passed tax bill.

“My understanding from talking to leadership staff today is that a version of this provision was always in the House bill — from the Ways & Means markup, through House floor consideration — and in reconciling the divergent House and Senate approaches to pass-through businesses this House approach stayed in the final conferenced version,” he wrote.

That characterization was disputed by experts contacted by IBT.

“Senator Corker’s understanding is wrong: the House bill allowed lower rates for income from pass-through businesses, but did not have a wage guardrail,” Steve Rosenthal of the Senior Urban-Brookings Tax Policy told IBT. “The Senate bill allowed lower rates for income from pass-through businesses, but added a wage guardrail, to limit, for higher-income taxpayers, the lower rates to income from businesses with substantial payroll. The conferees generally followed the Senate bill, but lifted the wage guardrail for real estate and, perhaps, other businesses without substantial payroll. The House bill did not have any wage guardrail to lift.”

David Kamin, a New York University law professor and former special assistant to the president on economic policy, said the final bill did create a new provision — one that would specifically benefit real-estate-related LLCs.

“In the House, there was never any requirement that firms pay wages in order to get the benefit of the pass-through tax cut, but the Senate bill required firms to pay wages to get the tax cut, with only a few exceptions,” said Kamin, who served in the Obama administration. “The conference committee included many of the Senate limits, but then created a new provision that made sure the final bill gave LLCs and other partnerships with no wages access to the tax cuts. Real estate partnerships and others with property but few employees would be the beneficiaries of this new provision.”

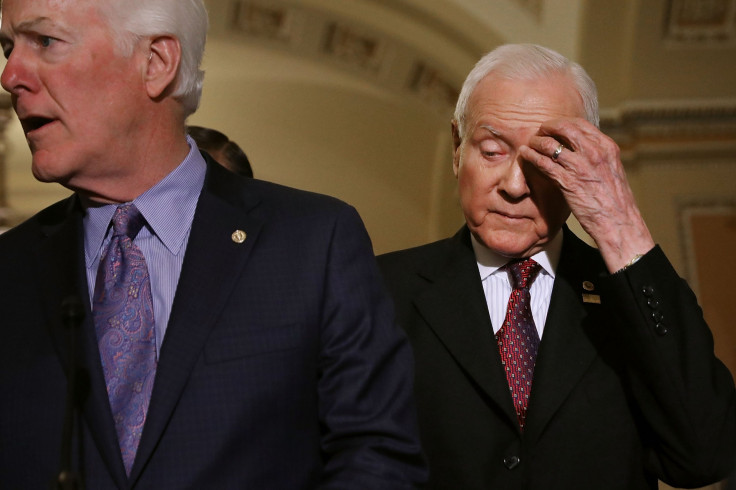

Corker’s letter came hours after ABC’s George Stephanopoulos asked Sen. John Cornyn, R-Texas, why the provision was added to the bill. Cornyn said : “We were working very hard. It was a very intense process. As I said, the Democrats refused to participate. And what we've tried to do is cobble together the votes we needed to get this bill passed.”

© Copyright IBTimes 2024. All rights reserved.