Record Number Of US Business Applications Have COVID-19 Stamped All Over Them

KEY POINTS

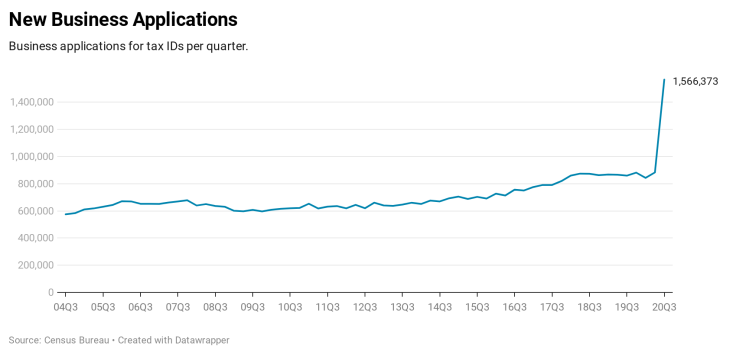

- Nearly 1.6 million new business applications were filed in the third quarter of 2020, an outrageously large jump compared to 20 years of records

- Covid-19, and the resulting business closures and layoffs, became a wakeup call in businesses of all sizes, no matter how prominent their positions. Many workers often think of going out on their own. The pandemic apparently pushed many to doing more than dream.

- The surge in filings may mean a better future for the economy, but it’s too early to know.

When Uber Works, a division of the rideshare company that wanted to automate temp worker hiring, closed down this summer, many were suddenly were out of jobs. They included Janeesa Hollingshead and Julia Lemberskiy, respectively heads of expansion and central operations for the group.

Instead of heading to a virtual unemployment line, the two teamed up to create a marketing agency—JJ Studios.

“It was a very uncertain time,” Lemberskiy said. “We are people, when there is uncertainty, who need to regain control. That’s where our kind of plan B, C, D, E happened.”

They weren’t the only ones.

Nearly 1.6 million new business applications were filed in the third quarter of 2020, an outrageously large jump compared to 20 years of records.

The pandemic seems to be the major cause. Individuals responded to the potential, or reality, of losing their jobs. Companies were managing mergers and acquisitions put off from earlier this year. Some smaller businesses wanted to be in a better position to potentially apply for more federal aid.

Fortune 500 Bailouts

Covid-19, and the resulting business closures and layoffs, became a wakeup call in businesses of all sizes, no matter how prominent their positions. Many workers often think of going out on their own. The pandemic apparently pushed many to doing more than dream.

“Like every employee of any company, there are days when you wish you could be your own boss,” Lemberskiy said.

The idea of jumping ship can become more enticing when a job is consuming, with hundred-hour weeks, as was true for Lemberskiy and Hollingshead.

“If you’re going to do that, you should do it for yourself,” said Hollingshead. She and Lemberskiy already claim an annual revenue rate of $250,000 a year while working from home offices in Chicago and New York City, and the business continues to expand.

“I think there’s some sense that people are coming up with a plan B,” said Adrian Hernandez, senior vice president of lending at Omaha, Nebraska-based Dundee Bank. “[Pandemic layoffs] might have created some sense of urgency among people who might start a business out of necessity.”

Brad Wales was at a Fortune 500 financial services firm when the writing on the wall became legible. “I was entrepreneurial my entire life, but it was a series of events that brought me closer [to starting my business],” he said.

Wales made plans; filed for his new company Transition to RIA, a niche business to help professional financial advisors; and left his job in September.

“I had mapped out on what day I wanted to give my notice for some strategic reasons,” Wales said.

“Literally the day before [I planned to give notice], they announced a large layoff. I was not one of them.”

When he finally reached out to coworkers he had known over the years, “I didn’t know who had or had not been caught up in the layoff.”

Kaylee Yarrow of New York City still has a Fortune 100 job in an industry that has seen consolidation and layoffs in the last few years.

“[Uncertainty has] come to the forefront for a lot of people this year, myself included,” said Yarrow. “An option is to go back to grad school. But you want to know before you go to grad school and spend all that money that it will be a good fit for you.”

Instead of ivy-covered walls, Yarrow in October incorporated for a potential venture in career counseling.

“I’ve been working at home for eight months now,” she said. Helping the decision was “the opportunity to tune out the noise from the office and peers and family members who might give advice about staying in a stable job. This is probably a reflection of the mindset of somebody who has been stuck for a while.

Any new idea is very fragile and delicate because you’ve lost a lot of ability to get yourself unstuck.”

Franchise Futures

Franchise consultant Tom Scarda has seen business pick up after a few slow pre-pandemic years when unemployment rates kept dropping and people assumed the future was safe.

“A lot of people are uncertain of their future in their career, which is not uncommon,” Scarda said. Or they may realize the office isn’t a destination they want anymore. “People are at home and saying, ‘Wow, I really enjoy this, and I don’t want to return to the corporate rat race.’”

A franchise is one way some people are starting new businesses. “There are a lot of folks who are home and concerned that their company’s not going to be there when this thing lifts, if it ever lifts,” said Scarda.

“They’re looking for alternatives. They figure, ‘What worse could happen that could be happening now?’”

Matt Boily and his wife Debra moved from Seattle, where for the previous five years he was in management at two different companies in the aerospace industry. They landed in Columbus, Ohio, to open the first of three planned Milex/Mr. Transmission auto repair shop franchises. Business at his old positions had already received body blows because Boeing represented “probably a good 80% to 90%” of revenue.

“Then Covid hit the airline industry,” Boily said. “It wasn’t like we could go to Airbus or someone else and just be a supplier to them because their business had fallen off as well.

He and his wife filed for the new corporation in February. Columbus offered a location near family and Boily had in the past been an auto mechanic, so he can step in during a crunch, although with his MBA he will focus on running the new company.

The couple wanted to start in May or June but couldn’t. “The banks were tied up with the PPP program [until August],” Boily said. They finally got the loan and opened shop in September.

New Companies or Emergency Planning?

Lending activity has been on the rise for Dundee bank, “but I’d be hesitant to tie it to this piece of it,” Hernandez said. “If you’re of a certain age with a certain level of skills and experience, if you have something of a nest egg built, you can at times pivot and start a business without talking to a bank.”

Existing companies are also filing new business applications. The Law Offices of Pullano & Farrow in Rochester, New York have seen an increase, although not a “tremendous” one, according to attorney Aaradhana Tomar. Some are a result of merger and acquisitions work that came to a halt earlier this year.

“Some of our clients selling their businesses wanted to hold off and make sure they remained a lucrative operation,” Tomar explained. “There are clauses in your letter of intent, your memorandums, that say you have to be operating your business the way you were during the course of negotiations.” By waiting, the companies involved hoped to show performance that was closer to normal.

At the same time, many of the buyers want to purchase assets and not the existing liabilities of a company, so they create a separate company to hold what they bought.

“Typically, this kind of [expansion] happens in the fourth quarter rather than the third,” said business law attorney Shahara Wright Menchan of The Wright Firm near Houston. Most of what she saw was expansions of existing businesses, or a need for some future government stimulus program.

“What they were seeing, especially with the PPP [small business loan program], was that they weren’t getting as much as they would have,” Menchan said. Many owners didn’t have sufficient legal and financial separation from their businesses. “That blends the business and some of their personal things.”

The approach might have lowered personal taxes, but also made the businesses look smaller than they really were.

Don’t Wait for an Employment Renaissance

The surge in filings may mean a better future for the economy, but it’s too early to know.

“Largely speaking, most new firms fail,” said Andrew Butters, an assistant professor in the department of business economics and public policy at the Indiana University Kelley School of Business. “[And] despite the surge in new business formation, on net, we’re nowhere near the black in terms of employees.

Also, most of the filings are the types used by independent contractors and self-employed people. Only about a third were so-called high propensity filings, meaning they have a high chance of hiring employees.

It will take more than the distant sound of thundering hooves before the country can see if the cavalry is really on the way.

© Copyright IBTimes 2025. All rights reserved.