Snap Still Losing Users, Won't Turn Profitable Next Year

There was a lot of hope and promise going into Snap's (NYSE:SNAP) third-quarter earnings: the hope the vanishing-message app would return to user growth after a disastrous app redesign and the belief that profitability was on the horizon.

This article originally appeared in the Motley Fool.

Now that earnings are out, investors know Snap is still losing users and that the potential for profits is still a pipe dream for the foreseeable future.

A confused mind always says no

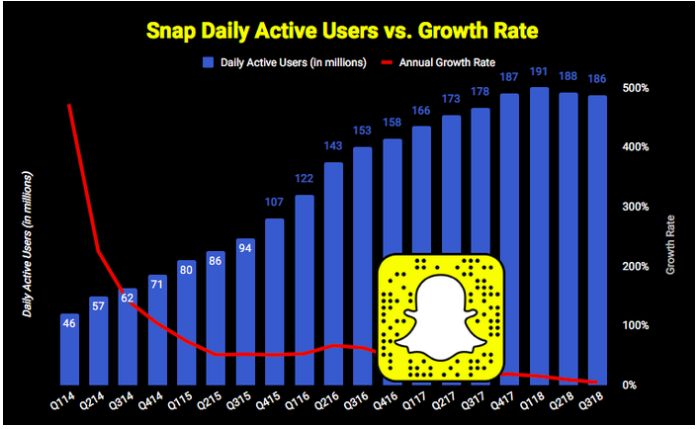

Snap lost another 2 million daily active users in the third quarter on top of the 3 million who fled in the second, giving it 186 million users, or less than it had at the end of 2017. The company is also expecting daily average users to decline again sequentially in the fourth quarter.

There also seems to be a decline in the amount of engagement users are generating with the app. Although the daily average number of users is actually 5% higher than the figure from a year ago, they're creating fewer Snaps per day now than they were then. CEO Evan Spiegel said users created 3 billion Snaps daily in the third quarter, the same as in Q2, but a half-billion decline in Snaps created from last year.

Spiegel admits it was his app redesign that is causing the decline, noting the number of daily Snaps created had been ramping up before then, and then fell afterward. He's promising more changes coming to Snapchat soon, pointing to the Discover section of the app, which he says is currently all jumbled together. Snap is also looking into how to better personalize the experience while meeting the demand for premium content and content from influencers, trying to find the right mix.

However, the constant changes to the app's design risks continuing to turn off users as they find it confusing to access. More changes and tweaks will likely not improve that view, particularly as Snap tries to reach older potential users.

Profitability is still in the future

Currently Snap's core demographic is concentrated in the 13-to-34 age group, but particularly in the U.S. and Europe, it needs to expand to the 35-and-older crowd. Earlier this year eMarketer said that grandparents are the fastest-growing age group on the app, and should account for more than half of Snapchat's user growth this year.

Yet the loss of users and the confusing nature of the app could upset those plans, especially in the advertising community. Although the ad business is currently growing after Snap switched to a self-service model, it came at the cost of pricing, which plunged 61% year over year and was down 15% sequentially.

Even so, revenues were 43% higher at $298 million, and on a trailing basis hit $1.1 billion, a 53% increase from the same period a year ago. That helped narrow Snap's losses from $468 million to $323 million, but Spiegel's "stretch goal" to break even in the fourth quarter of this year before turning profitable next year seems unlikely.

CFO Tim Sloan said fourth-quarter adjusted earnings before interest, taxes, depreciation, and amortization is forecast to be a loss of $75 million and $100 million, and while they're looking for acceleration of revenue growth and full-year free cash flow and profitability in 2019, this new stretch goal is simply an internal one to motivate progress. He stressed it "is not a forecast and it's not guidance."

Key takeaway

What Snap needs to do is motivate users to become engaged once again with Snapchat and not lose any more by constantly changing the app's look and feel. Further user reductions will only cause advertisers to wonder whether their dollars are best spent on the platform or if should they go elsewhere.

Facebook and Instagram have far more advertisers than Snap, and that gap will only widen unless Snap stops hemorrhaging users.

Rich Duprey has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Facebook. The Motley Fool has the following options: short November 2018 $155 calls on Facebook and long November 2018 $135 puts on Facebook. The Motley Fool has a disclosure policy.