U.S. market regulator said former Goldman Sachs Group Inc and Procter & Gamble Co board member Rajat Gupta tipped Galleon hedge fund founder Raj Rajaratnam in phone calls about confidential company information. Gupta's lawyer said the allegations are baseless.

Former Goldman Sachs Group Inc director Rajat Gupta leaked secret details to Galleon Group hedge fund manager Raj Rajaratnam about Warren Buffett's plan to invest $5 billion in the Wall Street bank at the height of the financial crisis, a U.S. securities regulator charged.

FrontPoint Partners, the $4.5 billion hedge fund ensnared in the government's insider trading probe, is back on its own after more than four years of living with investment bank Morgan Stanley .

She did it for love, a designer handbag and shoes. Bonnie Hoxie, a former Walt Disney Co (DIS.N) executive's secretary, told a federal judge on Tuesday she was blindsided by love and did not make the correct choices in giving confidential company information to her then-boyfriend a year ago.

Investors in Diamondback Capital Management, one of four hedge funds raided by federal authorities last year as part of an insider trading probe, have asked to pull more than $1 billion from the firm, a source familiar with the fund's communications to clients said on Tuesday.

Former Qwest Communications chief Joseph Nacchio voluntarily withdrew an appeal of his criminal conviction on Friday, marking what may be the final chapter of his long running insider trading case.

The Securities and Exchange Commission is investigating whether exchange-traded funds are being used to hide insider trading, according to the Financial Times.

Two hedge fund managers were arrested on insider trading charges on Tuesday, while another portfolio manager and an analyst agreed to plead guilty in connection with the probe, the latest development in a broad investigation of hedge funds' trading activities.

A investigation into allegations of insider trading in the hedge fund industry for the first time reached former employees of billionaire trader Steven A. Cohen's SAC Capital Advisors.

Three hedge fund managers and a hedge fund analyst will be charged with insider trading, U.S. prosecutors said on Tuesday, the latest development in a broad probe of funds' trading activities.

Tighter budgets at the U.S. Securities and Exchange Commission could mean killing vital technology upgrades needed to catch swindlers, the agency's chief said on Friday in a blunt appeal for more funding.

Steven A. Cohen, whose hedge fund firm SAC Capital Advisors has drawn scrutiny in a federal insider trading probe, may be facing a more pressing problem: diminishing returns.

The U.S. Securities and Exchange Commission said on Thursday it has charged six former consultants and employees of California expert network firm Primary Global Research with insider trading.

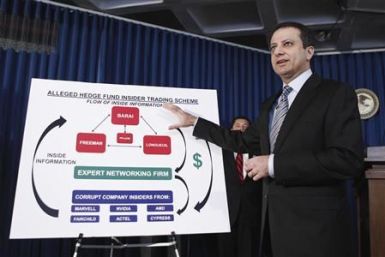

The founder of U.S. hedge fund firm Barai Capital Management has been drawn into the government's insider trading probe that involves expert network firms, the Wall Street Journal said, citing people familiar with the matter.

Two former Galleon Group portfolio managers admitted to charges of insider trading on confidential company information, strengthening the government's case against Galleon hedge fund founder Raj Rajaratnam a month before his trial

A Morgan Stanley banker named Kamal Ahmed is under investigation by U.S. authorities for leaking information regarding an upcoming takeover that ultimately was passed on to Galleon Group founder Raj Rajaratnam, the Wall Street Journal said, citing people close to the situation.

Washington Mutual Inc could be out of bankruptcy in March after reworking its recently rejected plan of reorganization, the attorney overseeing the company's bankruptcy said on Tuesday.

Two former executives of Iceland's failed Landsbanki bank have been arrested on charges of market manipulation.

A former technology analyst with Primary Global Research pleaded guilty on Tuesday to leaking confidential company information to hedge funds, part of the U.S. government's broad insider trading probe.

The Securities and Exchange Commission brought civil insider trading charges against the co-founder of a one-time $900 million hedge fund as part of the ongoing Galleon hedge fund probe.

Three people who were arrested by the federal agents last month in an operation seen as part of a widening probe into insider trading were granted bail on Tuesday.

Three men accused of being part of an insider trading conspiracy to leak technology company secrets to hedge funds were allowed to remain free on bail on Tuesday.