Ex-SAC Capital employees charged in trading probe

A investigation into allegations of insider trading in the hedge fund industry for the first time reached former employees of billionaire trader Steven A. Cohen's SAC Capital Advisors.

Two of four people charged on Tuesday with insider trading worked for Cohen's $12 billion Stamford, Connecticut-based hedge fund during the period that U.S. authorities allege the men received confidential corporate information.

One of the former SAC Capital employees, Noah Freeman, has agreed to plead guilty and is cooperating with the investigation, according to prosecutors.

The other former SAC Capital employee, Donald Longueuil, was arrested Tuesday morning at his Manhattan home on charges of conspiracy and obstruction of justice.

SAC itself was not charged with any wrongdoing. A spokesman for Cohen said the high-profile hedge fund manager was outraged by the alleged actions of two former employees and noted SAC had fired the two in 2010.

The other two charged Tuesday were hedge fund manager Samir Barai and an analyst who worked at his fund, Jason Pflaum.

Barai, a former Citigroup hedge fund manager who left to launch Barai Capital Management, surrendered to federal authorities in Manhattan early Tuesday morning.

Pflaum has agreed to plead guilty and like Freeman is cooperating with the investigation.

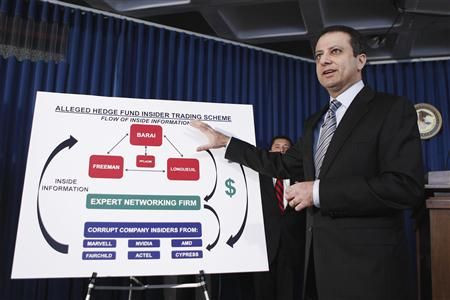

The charges against the four were announced by federal prosecutors investigating ties between hedge funds and consultants for so-called expert networking firms -- businesses that match hedge funds seeking information with industry consultants.

Since November, prosecutors have charged more than a dozen people in this newest crackdown on insider trading in the $1.9 trillion hedge fund industry.

'VERGING ON CORRUPT BUSINESS MODEL'

SAC Capital spokesman Jonathan Gasthalter said what the former junior portfolio managers did required active circumvention of our compliance policies and are egregious violations of our ethical standards.

The criminal complaint, unsealed by prosecutors in Manhattan, paints a picture of all four hedge fund employees obtaining and sometimes sharing confidential information provided by consultants, some of whom worked for California expert network firm Primary Global Research.

Manhattan U.S. Attorney Preet Bharara, speaking at a press conference, said the investigation had raised serious questions about the expert network industry and revealed the potential for widespread abuse.

Given the scope of the allegations to date, we are not talking simply about the occasional corrupt individual. We are talking about something verging on a corrupt business model, Bharara said at a news conference.

Authorities also alleged Barai and Longueuil sought to conceal their activities by destroying documents, emails and computer records. For instance, prosecutors said that in a recorded conversation, Longueuil told Freeman he had destroyed a log, meaning a flash drive, after reading about the investigation in a media report.

In a related action, the Securities and Exchange Commission filed civil securities fraud charges against the defendants.

Manhattan U.S. Attorney Preet Bharara said both Barai and Longueuil believed the federal authorities were closing in and systematically set about destroying any and all evidence linking them to the criminal scheme.

In court papers, neither prosecutors nor regulators identified SAC Capital or the other hedge funds where the people charged Tuesday allegedly engaged in wrongful activity. But people familiar with the investigation confirmed the identities of some of funds where the men had worked.

One of the sources said Barai and Longueuil were friends, and the complaint says they communicated during this period, sharing tips. It says Freeman had a tape of Longueil describing his attempted cover-up.

Freeman worked in SAC's Boston office from June 2008 until early 2010. Longueuil worked in an SAC Capital office in New York from July 2008 to June 2010.

Prior to joining SAC Capital, Freeman was a tech analyst with Boston-based hedge fund Sonar Capital, which is in the same building as SAC Capital's Boston office.

SUBPOENAS

Prosecutors alleged Freeman received inside information while working at two hedge funds. People familiar with Freeman's career and publicly available information on the Internet match those time periods to his tenure first at Sonar and later SAC Capital.

In the complaint, these sources said Sonar is identified as hedge fund A and SAC Capital is identified as hedge fund B.

Neil Druker, Sonar's manager, who was not charged with any wrongdoing, did not return a phone call seeking comment.

After leaving SAC, Freeman, a Harvard University graduate, became a teacher at the Winsor School, an exclusive school for girls in Boston. The Winsor School's website says Freeman teaches economics.

Tuesday's charges mark the expansion of the probe beyond expert networking firm consultants and employees to hedge fund employees who allegedly were recipients of secret tips on technology stocks.

The new charges come a few weeks before hedge fund billionaire Raj Rajaratnam is scheduled to go on trial in Manhattan federal court on insider trading charges. Rajaratnam nearly two-dozen others were charged with insider trading in October 2009 in the massive investigation that made extensive use of covert wiretaps.

Some of the information gathered during the investigation of the Galleon Group hedge fund manager spawned this new inquiry.

A key cooperating witness in the Galleon investigation is Richard Choo-Beng Lee, a former SAC Capital analyst. Lee, who hasn't worked at SAC Capital for many years, entered into a plea deal with prosecutors that requires him to tell them about any insider trading he may have committed while working at Cohen's hedge fund, court records show.

Ben Rosenberg, a lawyer for Freeman, did not immediately return a call requesting comment. Michael Grudberg, the attorney for Pflaum, as well as the attorneys for the other defendants, also could not immediately be reached for comment.

Speaking of Freeman and Longueuil, Gasthalter said: The government alleges that their improper conduct together began at their prior firms in 2006 and continued after they joined SAC in mid-2008. They were employed at SAC for a short time and were dismissed in January 2010 and June 2010, respectively, due to poor performance. SAC is continuing to cooperate with the government's investigation.

Barai's fund was one of four raided by federal agents late last year when the trading probe was heating up. The raids shocked the hedge fund world, and were followed by dozens of subpoenas to hedge funds and mutual funds, including SAC Capital, that did business with various expert network firms and consultants.

Barai was charged with securities fraud, conspiracy and obstruction of justice, according to the court documents. He is accused of engaging in insider trading involving shares of Marvell Technology Group Ltd and Fairchild Semiconductor International Inc.

The case is USA vs. Samir Barai and Donald Longueuil, U.S. District Court, Southern District of New York, 11-332.

(Additional reporting by Martha Graybow, Jonathan Stempel, Emily Chasan and Svea Herbst-Bayliss; Editing by John Wallace, Derek Caney, Dave Zimmerman and Steve Orlofsky)

© Copyright Thomson Reuters {{Year}}. All rights reserved.