Sorry Humans: Industrial Robot Sales Seen Hitting Record Highs This Year, Which Bodes Well For ABB, FANUC, KUKA And Other Robotics Manufacturers

We may not be living in a world where robots rule yet, but when it comes to manufacturing, they sure do seem to be taking over.

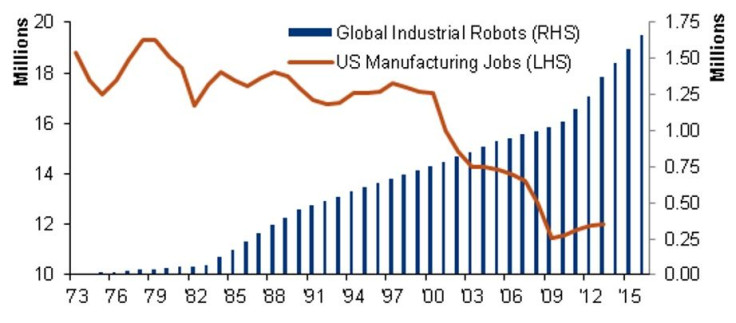

Consider this chart from Bank of America Merrill Lynch, showing the collapse of U.S. manufacturing jobs since the start of the century against the global rise of industrial robots.

There are many factors behind the loss of U.S. manufacturing jobs, such as the private sector’s desire to find the cheapest possible labor and least intrusive environmental and labor regulations under which to make goods, but the rise of robotics has played a role, and it looks like the effect is happening everywhere.

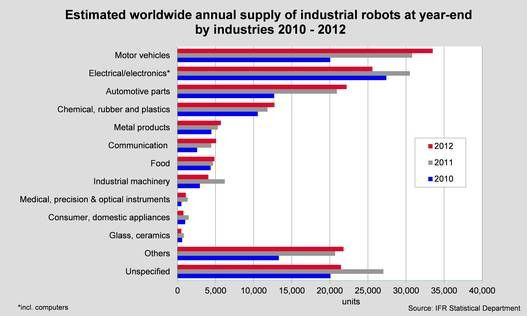

Global sales of industrial robots hit a record high in 2011 exceeding 160,000 units, according to the International Federation of Robotics. Sales declined about 4 percent in 2012, but we’re still seeing about a 30 percent increase in deliveries since the rebound from the global economic downturn and the automotive industry crisis began in 2010. To give you an idea of how fast demand for industrial robots has risen: A decade ago there were about 80,000 annual deliveries, so demand has roughly doubled so far in this century.

The IFR estimates the global market for all robots grew 2 percent last year and should set another all-time record this year. Beyond that the trade group sees demand for industrial robots growing by 6 percent yearly through 2016. The total value of the robotics market stands at around $13 billion. This includes consumer robots, like the Roomba vacuum cleaner made by iRobot Corporation (NASDAQ:IRBT) of Bedford, Mass., and professional services robots, such as the machines manufactured by Sunnyvale, Calif.-based Intuitive Surgical Inc. (NASDAQ:ISRG).

Industrial robots still rule, however, making up $8.5 billion of the total robotics market share. Japan continues to be the world’s largest market for industrial robots, followed by the U.S. Germany is Europe’s largest market.

This growth bodes well for industrial robot manufacturers such as Zurich-based ABB Ltd. (NYSE:ABB), Japan’s FANUC Corp. (TYO:6954) and KUKA AG (FRA:KU2) of Augsburg, Germany.

For the factory workers this technology is increasingly replacing, this doesn’t bode well at all. At least they can fall back on the lower pay and fewer benefits offered by the services industry . . . for now.

© Copyright IBTimes 2025. All rights reserved.