Critics say the event was all bark with no indication of how Republicans will execute the bite -- or, in fact, a dress rehearsal for the next presidential election

Three reports released this week demonstrated positive trends in the U.S. housing market, but experts warn that a real recovery is still months away.

Most of the country's largest merchandisers on Thursday reported solid same-store sales this month.

Citigroup Inc agreed to pay $590 million to settle a shareholder lawsuit accusing it of hiding tens of billions of dollars of toxic mortgage assets, one of the largest settlements stemming from the global financial crisis.

Shari Arison is the most powerful woman in Israel and the Middle East, and has a net worth of $3.9 billion to boot. But despite her numerous non-profit organizations and 25% stake in Israel's largest bank, Arison says she doesn't consider herself "a powerful person."

The top after-market NYSE gainers Friday were Delek US Holdings, Cenveo, Demand Media, Magnum Hunter Resources and Radioshack Corp. The top after-market NYSE losers were Stillwater Mining, Nationstar Mortgage Holdings, Hovnanian Enterprises, Standard Pacific Corp and SM Energy Co.

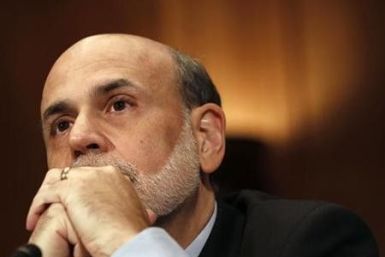

The Federal Reserve has room to deliver additional monetary stimulus to boost the U.S. economy, Fed Chairman Ben Bernanke told a Congressional oversight panel in a letter.

The government's role in the housing market does not generally inspire the same impassioned responses as abortion or health care, but the future of one mortgage tax policy could affect the fate of around $85 billion in taxpayer benefits.

The top after-market NYSE gainers Wednesday were Western Asset Mortgage, SunTrust Banks, Best Buy Co, Trinity Industries and Krispy Kreme Doughnuts. The top after-market NYSE losers were Guess?, Inc, International Rectifier, Hewlett-Packard, Big Lots and Whitestone REIT.

Are you entitled or empowered? Do you feel you are owed, or do you feel you own something? This simple choice reflects your view of the world. It stands for your self-image.

Maurice Jones-Drew could be traded after holding out from Jaguars training camp for 27 days. The New York Jets could be looking to trade for the running back.

In the United States, Mom typically has the most say when it comes to back-to-school shopping, but pre-teens are consumers, too, and they have more money to spend on backpacks and binders than they have had in years.

Amid the continue foreclosure crisis, some young people are taking to social media to redirect their frustration and coordinate larger acts of vandalism against abandoned properties.

The U.S. Treasury is accelerating taxpayer repayments by Fannie Mae and Freddie Mac, the mortgage finance companies that own or guarantee around 60 percent of the country's housing market, but the strategy will only work if the housing market continues to improve.

With the national housing market showing signs of a rebound, analysts are saying shadow inventory might not be such a threat after all.

A man killed two people, including an officer who was serving him an eviction notice at a College Station home near Texas A&M University, on Monday before police fatally shot him in a gun battle.

The Consumer Financial Protection Agency unveiled new regulations on Friday that would help shield consumers against foreclosures or sudden hikes in mortgage interest rates.

The Justice Dept. said there was "not a viable basis to bring a criminal prosecution" against Goldman Sachs, quietly ending a yearlong investigation into allegations the firm bet against the same subprime mortgage-backed securities that it also sold to its clients.

The Justice Department will not prosecute Goldman Sachs or its employees in a financial fraud probe, officials announce Thursday.

The mainstream news media can’t stop obsessing over Mitt Romney’s tax returns. “Will he or won’t he release them?” they keep asking. What terrible secrets are hidden among Romney’s mortgage interest deductions and depreciation write-offs?

Fannie Mae (OTC: FNMA), the largest government-controlled mortgage backer, reported its second consecutive quarterly profit for the first time in five years Wednesday, but its CEO said the company should cede business to private investors when the housing market finally recovers.

The Federal Reserve sent some strong messages in its latest policy statement that it is heading toward new easing measures to buck up the weak economy. But the central bank may have a different caliber of weapon in mind other than launching another round of large-scale asset purchases, or QE3.