The Institutional Revolutionary Party is poised to retake power on Sunday after a decade out of power, led by the charismatic presidential candidate Enrique Peña Nieto. Would a change mean a much different relationship with Mexico's big neighbor to the north?

The Federal Housing Administration (FHA) won't adopt a new restriction that could have prevented thousands of prospective home buyers from obtaining low-cost mortgages.

A wave of retiring U.S. baby boomers may lead to an increase in unconventional loans known as reverse mortgages in coming years, but the practice comes with risks, according to a report released Thursday by the Consumer Financial Protection Bureau.

The European Central Bank may soon ease its lending standards in what appears to be an effort to prevent Spain's sovereign debt crisis from worsening, according to reports published Thursday. But the move could also impair the credibility of ECB.

A driver involved in a Southern California freeway brawl that was captured on video and went viral on the internet, said he regrets getting out of his and should have called the police. Jerry Patterson, a mortgage consultant and father of three said he suffered a concussion from the incident when three brutes had attacked him on the freeway, repeatedly punching and kicking him in the head.

U.S. 30-year fixed-rate mortgages fell to a new record low of 3.66 percent following weak economic indicators, mortgage financier Freddie Mac said Thursday.

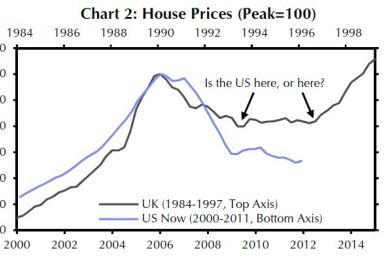

U.S. housing prices won't just hit the bottom this year -- they'll rise by 2 percent, according to a report by Capital Economics released this week. But that doesn't mean the market is in great shape.

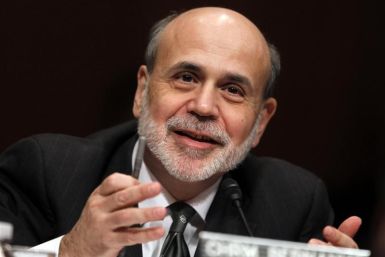

The powerful rate-setting committee of the Federal Reserve decided to extend its current strategy of manipulating the credit markets to artificially depress the cost of long-term financing, a strategy colloquially known as Operation Twist, until the end of the year.

China's attempt to manage inflation in the real estate market is putting pressure on local governments and pushing homebuyers overseas.

Chairman Bernanke will announce his policy decision Wednesday at 12:30 EST, and considering the recent escalation in the European debt crisis

The dissolution of Fannie Mae and Freddie Mac, the two largest U.S. mortgage guarantors, would have only a minimal impact on home ownership level, according to a new report that downplays the link between low interest rates and increased ownership.

I think the real importance of the ?Fifty Shades? series is that it has made explicit erotica more acceptable, more public, one male reader said. In a society that is often repressive and puritanical, I find this reassuring.?

Four years after the 2008 financial crisis began gathering steam, the government has collected another piece of the remaining billions in bailout money that it's owed.

U.S. 30-year fixed mortgage rates increased to 3.71 percent, reversing six weeks of declines after modestly positive economic data, mortgage financier Freddie Mac said Thursday.

U.S. foreclosure filings increased for the first time in three months by 9 percent in May, according to a Thursday report by listings site RealtyTrac.

U.S. investors are getting back into real estate, but their efforts are being complicated by the uncertain housing market.

Dinner with Barack -- for the liberal Democrat, few things sound better than free food with their fearless leader. Four prize dinners with the Great One -- awarded by drawing -- have come and gone; but have no fear, Dinner with Barack V is here.

The IOU that is being laid on the doorsteps of U.S. taxpayers in the form of the national debt is far greater than most Americans realize. That's because the federal government does not report the true size of the national debt -- now nearly $80 trillion.

Each panelist at a recent Toronto real estate conference had a reason why the city's condo market is not a bubble. But the developers, the lender, the receiver, the marketer and the real estate agent each talked about the things that worry them.

As a weakening economic recovery and cheap gas lead Americans to curtail international vacations, domestic tourism is poised for a solid summer.

The Federal Reserve is proposing that U.S. banks, large and small, abide by a rigorous interpretation of an international capital standards agreement known as Basel III.

An increase in the spurt of mortgage applications, following low mortgages rates and a rising demand for refinancing activities