Time Warner, Which Announces Q2 Results Wednesday, Could Receive Fresh Offer From Murdoch

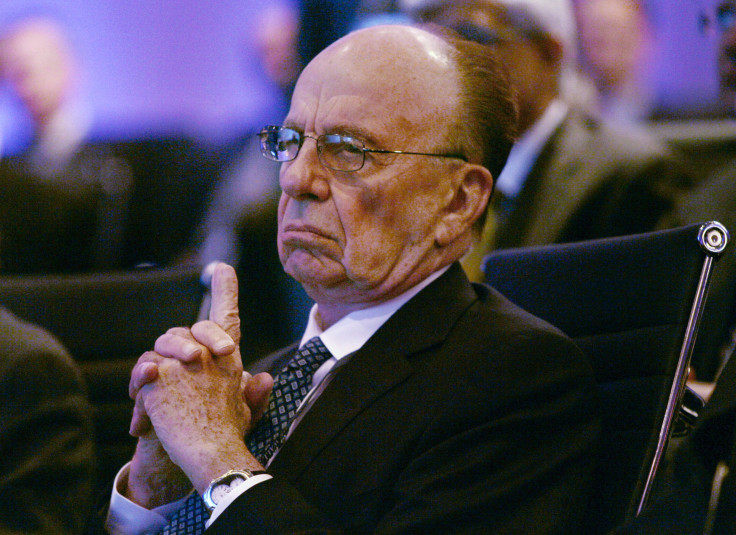

Rupert Murdoch’s Twenty-First Century Fox (NASDAQ:FOX), which had earlier made an unsuccessful $80 billion bid for Time Warner Inc. (NYSE:TWX), is likely to pitch a fresh number to its investors on Wednesday, when the company’s second-quarter financial results are announced, Reuters reported Tuesday.

Murdoch’s $85-a-share bid, which amounted to about $80 billion in total, was rejected by Time Warner on July 16, which termed it an “unsolicited proposal” and claimed that its “strategic plan” was “superior to any proposal that Twenty-First Century Fox is in a position to offer.” According to the Reuters report, Fox is expected to raise its offer to about $95 a share. However, there has so far been no indication that Time Warner CEO Jeff Bewkes and his board will accept the offer.

“To reject the $85 a share offer, you would have to believe that Time Warner would get to $95 a share on its own," Todd Juenger, a Bernstein Research analyst, wrote in a client note, according to Reuters. "We don't find very many people who think it will be easy to get there."

While the value of Time Warner’s shares has reportedly increased by about 20 percent since news of the rejected bid came out and the company has enjoyed healthy growth over the past five years, the company’s investors would want to know its exact worth when quarterly earnings are announced Wednesday, according to a Bloomberg report. The company's earnings-per-share, or EPS, grew by 15.2 percent in the last five years, Reuters reported.

If Murdoch does decide to raise the bid to $95 a share, he is expected to find it difficult to convince shareholders of the decision. According to Bloomberg, the company’s shares have dropped 10 percent since its bid was rebuffed by Time Warner.

If the two companies announce a merger, it would result in the formation of one of the world’s largest media conglomerates, with joint ownership of news networks like Fox News, pay-TV channels like HBO, and cable-TV networks like TBS.

Time Warner's stock rose 2.06 percent while Twenty-First Century Fox stock fell 1.57 percent in Monday trade.

© Copyright IBTimes 2025. All rights reserved.