Top 5 Decentralized Exchanges In 2022

With centralized exchanges receiving a lot of criticism for their issues, most notably FTX, crypto enthusiasts are increasingly turning to decentralized exchanges. The latter are non-custodial and do not have the same security issues, so they are much safer for investors to hold their assets.

DEXs, as they are also known, have become increasingly popular over the years for those reasons. As a result, there has been an explosion in new platforms, and this can make it hard for beginners to know where to begin.

Here, we list the Top 5 decentralized exchanges in 2022. In each, we discuss why it's popular, what it offers and a bit of background on them.

Why Do Decentralized Exchanges Matter?

Before we get into the best decentralized exchanges in 2022, we should talk about why they matter in the first place.

First, and what many crypto enthusiasts will immediately explain, is that DEXs are KYC-free. Anyone can set up a wallet without offering personal information. This offers those with a lack of documentation the ability to enter the crypto market — and by extension, other markets, as there are synthetic versions of real-world assets in DeFi.

DEXs are also more secure in the sense that they do not hold your assets. In other words, they are non-custodial. A centralized exchange holds your assets to make an exchange on your behalf. This can lead to issues like what occurred with FTX.

DEXs are also cheaper, provided network conditions are operating normally. Usually, this is the case, so users can make their trades much more cheaply.

Do Decentralized Exchanges Have Risks?

DEXs may have many benefits, but that doesn't mean they aren't without risks or disadvantages.

One of the primary issues is that they are simply more complicated to use than a centralized exchange. New users may take some time to get used to them, but they can be learned fairly quickly.

There's also the issue of rug pulls and scams. Any token can be listed on a DEX. If that token doesn't have enough liquidity, it can lead to a scam, as users can be tricked into thinking they are buying the right token but instead are buying an imposter.

DEXs can also be susceptible to smart contract vulnerabilities, which could lead to exploits and the loss of tokens. However, the best decentralized exchanges are fully audited by security companies and put a high priority on security.

Top 5 Decentralized Exchanges

1. Uniswap

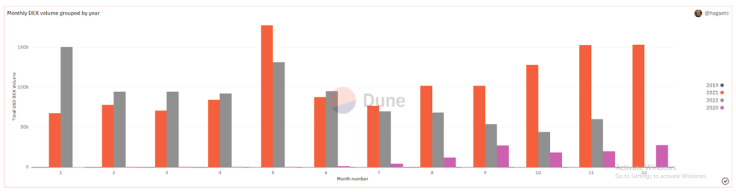

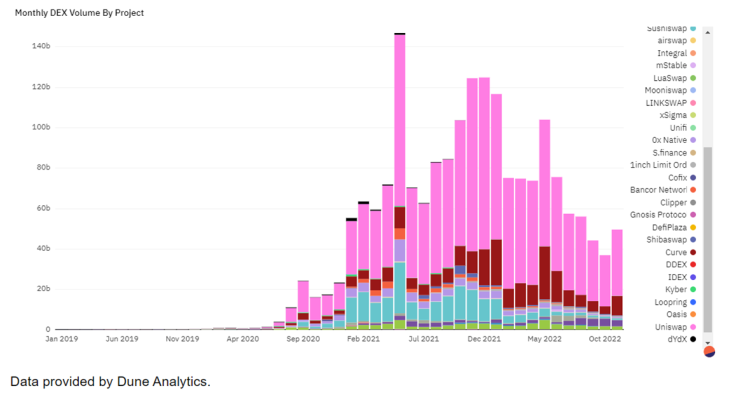

Uniswap is by far the most popular decentralized exchange on the market, which the chart above shows clearly. It set the standard for DEXs, being one of the earlier ones, and has since gone through multiple upgrades, which have only bettered it. The platform also released the UNI token, which has also fared well.

Built on Ethereum, Uniswap was first launched in 2018. Being open-source, it has led to a lot of other DEXs building off of its base, most notably SushiSwap. At its peak, it had a TVL of over $10 billion, which most other DEXs can aspire to. It continues to dominate the market.

2. PancakeSwap

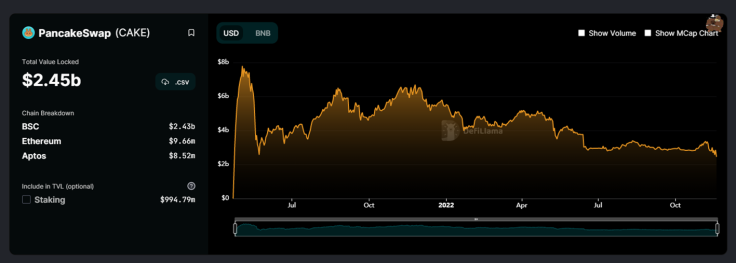

PancakeSwap is a DEX that was built on the BNB chain. While Uniswap focuses on ERC-20 tokens, PancakeSwap supports BEP-20 tokens, which Binance developed for its network. In other regards, it is much the same as Uniswap.

PancakeSwap hasn't quite reached the heights that Uniswap has, with the peak TVL of nearly $8 billion occurring early in its life. Like other DEXs, you can stake tokens and participate in liquidity pools to yield farm.

3. Balancer

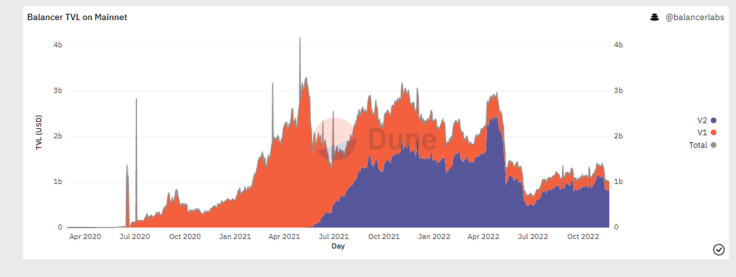

Balancer is another well-known DEX, and one of its key features is the ability to allow investment in what is essentially an automated index fund. Investors in Balancer pools allow you to create portfolios of up to eight ERC-20 tokens. Liquidity providers receive the fees that come from trading while also receiving BAL tokens for their efforts.

Balancer's TVL peaked at nearly $4 billion, with the current figure being $1.44 billion. While it's not as widely used as other DEXs, it has proven to be effective at what it does. Its offering of index funds in the DeFi space has attracted users and liquidity providers. The latter is something new market entrants may want to think about.

4. Curve

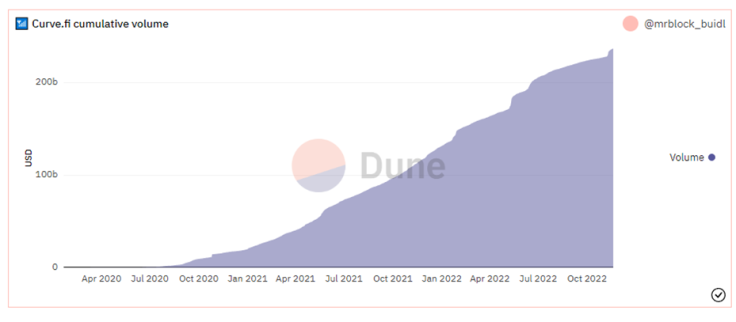

Curve is a DEX that's primarily focused on efficient stablecoin trading. The idea is to let investors earn from the high-interest rates of lending protocols, making it something of a fiat savings account. It also integrates well with other DeFi protocols, offering much more potential in earning revenue.

The CRV token can be obtained through yield farming or purchased on the market. It is also used in the governance process. Curve's TVL is currently at $3.76 billion, peaking at about $24 billion in April 2022.

5. SushiSwap

A spinoff of Uniswap, SushiSwap has seen its TVL decline over the months, but that doesn't mean it doesn't have its place in 2022. The exchange isn't quite as prevalent in headlines as it used to be, but it remains one of the most popular DEXs.

At the time of the launch, it added new features that made it different from Uniswap, like liquidity mining and governance. As such, a wealth of users joined the platform. Other features that it offers include lending and borrowing and staking. SushiSwap currently has about $410 million in TVL, with an all-time high being $6.6 billion.

Decentralized Exchanges Offer Several Benefits

Decentralized exchanges are only going to become popular as technology advances and becomes more intuitive. The space is still in its early years, and there's much more room for improvement. The best decentralized exchanges offer a variety of features and have adequate liquidity, and those mentioned above are among those. If you're looking to get started with a DEX, these will be good first platforms.

© Copyright IBTimes 2025. All rights reserved.