Are Cryptocurrency Mixers Legal?

Cryptocurrency mixers have a notorious reputation in the financial world — and even, to a degree, in the cryptocurrency world. It is often associated with hackers, bad actors and state-sponsored groups that have committed theft. However, several exist and many entities — both good and bad — use it for various reasons.

Given the vast number of mixers in existence and their continued popularity, one becomes inclined to think: Are they actually legal? Are countries putting a stop to their use or at least attempting to?

Cryptocurrency mixers have become a growing presence and, as such, they have caught the attention of authorities. We will look into those aforementioned questions in this explainer.

What Are Cryptocurrency Mixers?

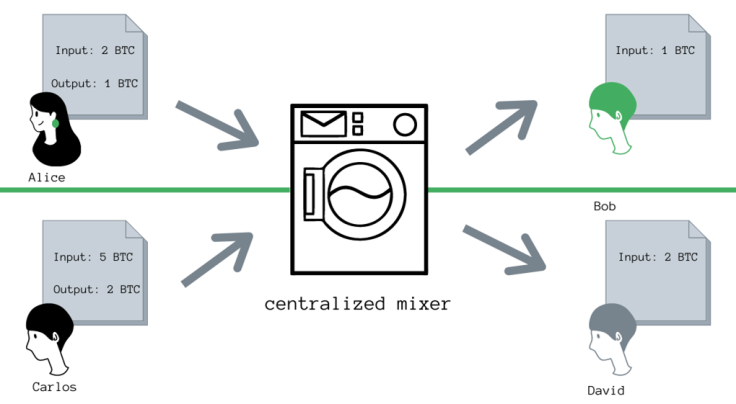

Also known as cryptocurrency tumblers, cryptocurrency mixers are services that obfuscate a transaction with others to hide the source of the transfer. They make it nearly impossible to identify who sent the payment — and this is why they are so popular with bad actors.

The way a cryptocurrency mixer works is that it pools funds from various sources, "mixing them" for random periods of time, before sending them to the intended destination address. This is a high level of privacy, and those that want to hide their financial activity have considered such services.

However, it is largely the prerogative of those who have stolen funds from DeFi protocols, for example, to use a mixing service. These entities send the stolen funds to various mixing services, making the transaction difficult to trace. However, exchanges and other entities have become wise to these tactics and often act quickly to mitigate losses.

As such, various individuals and organizations have called for the ban or criminalization of mixing services, saying that it can facilitate money laundering. Clamping down on this service may be a practically difficult task, as the nature of cryptocurrencies and related technology make it immune to quick centralized shutdowns.

Cryptocurrency tumblers do run on centralized servers — so a shutdown may not be hard. However, it does not take much for another service to pop up. This will be a difficult task for authorities, who will want to prevent any illegal activity stemming from the crypto market.

Are Cryptocurrency Mixers Legal?

The answer to this question is not straightforward. To be clear, there is nothing inherently illegal about cryptocurrency mixers. When it is used for an illegal act, such as money laundering, then it does become illegal. However, many governments are pre-empting actions to prevent their use in illegal activities.

For the first time ever, Treasury has sanctioned a virtual currency mixer. https://t.co/FqzTn4UISd is used by the DPRK to support malicious cyber activities & money-laundering of stolen virtual currency. https://t.co/LS0pnsOlqB pic.twitter.com/ISCoQgBxkv

— Treasury Department (@USTreasury) May 6, 2022

For example, the popular mixing services Blender and Tornado Cash have been sanctioned by the United States Treasury Department, with the services completely illegal for U.S. citizens, companies and residents. That should tell you how the major governments feel about crypto mixers. Such services have also been shut down over time, with these cases largely taking place in the U.S.

While the amount of money laundering taking place through crypto mixers is still a comparatively small figure to the overall sum, authorities are trying to nip this in the bud. The potential criminalization of mixers by other governments may be a preventative measure, as these services are a prime service for bad actors.

It appears that the U.S. government is taking the lead in examining the legality of cryptocurrency mixers. However, many governments tend to follow its lead and generally do not want untraceability. As such, it may be the case that cryptocurrency mixers become illegal.

Furthermore, there are companies working on demixing the transactions, so mixers themselves may become a thing of the past. This space, and all the surrounding examination, is only just getting started, as everything about it is novel and presents unprecedented challenges to authorities.

Privacy Coins Complicate the Problem

Assuming that governments crack down on cryptocurrency mixing services, their concerns are not all assuaged. Several "privacy coins" exist, and these have privacy features built-in to the protocol. These are inherently decentralized, so while law enforcement can shut down servers, they cannot shut down a decentralized protocol.

These privacy coins use a multitude of techniques to obfuscate sender and recipient information, as well as transaction amounts. It can offer complete anonymity, and governments may find that individuals who want to hide financial activity simply flock to them instead.

There have been some attempts to stem the growth of privacy coins. South Korea has banned it entirely for the reasons stated in previous sections. This works to some degree, as centralized exchanges cannot allow the listing of privacy coins. This reduces the access the wider public has and is successful in limiting its spread.

Can You Crack Monero? IRS Offers $625,000 Bounty for Anyone Who Can Break Cryptocurrency's Privacy https://t.co/sd79qwQa9u pic.twitter.com/kXsuHCoE7t

— Graham Cluley 🇺🇦 (@gcluley) September 15, 2020

At this point, it does not seem possible that the government can entirely limit their use. There are other solutions available — there are some efforts being made to trace privacy coins. The United States Internal Revenue Service has offered grants for the creation of software that allows privacy coins transactions to be traced.

In any case, the use of protocols and services to hide transaction information is a complicated matter. It is going to be a key part of the discussions behind cryptocurrency regulation, and there will be inevitable regulation.

A Crackdown on Mixers May Happen

Cryptocurrency mixers exist — for now. There may be a time when they are criminalized, and the powers that be come down swiftly and hard to prevent any potential misuse. So far, the U.S. government has taken some actions, as mixers have become a popular tool with bad actors in 2022.

In the short to medium-term future, those actions may rise exponentially. Many crypto-mixing services still exist, and governments could impose blanket bans on them. They may not prevent the obfuscation of transactions entirely in the crypto market, but they will make a noticeable dent in the ability of bad actors to hide their actions.

The next two years will be monumental in terms of overall regulation, so individuals will want to keep a close eye on how the market evolves. They can be assured that the traceability of transactions will be a top priority for authorities.

Rahul owns less than 1 BTC and 40 LRC.

International Business Times holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

© Copyright IBTimes 2025. All rights reserved.