Turkish Consumers Take Gold Profits, After Strong Year For Demand In 2013

Turkish consumers are taking advantage of gold’s recent rally to sell off the precious metal, even as trade statistics show a remarkable year for Turkish gold demand in 2013.

“A lot of people are selling back the gold they purchased last year, having made quite a reasonable return on it,” Andrew Leyland, manager of precious metals demand at the Thomson Reuters GFMS metals consultancy, told International Business Times.

Turkish consumers flocked to buy gold at bargain prices in 2013, after a steep price plunge in April made the culturally important metal more affordable. That mirrored bargain buying in China.

Local gold, which often sells at a premium to benchmark London prices, have traded slightly lower in recent days, at a discount of $2 per ounce, according to Leyland, who visited Turkey last week. That points to the volume of investors booking profits from gold’s rally in early 2014, as it moved from $1,205 per ounce on Jan. 1 to $1,331 on Wednesday, up 11.5 percent.

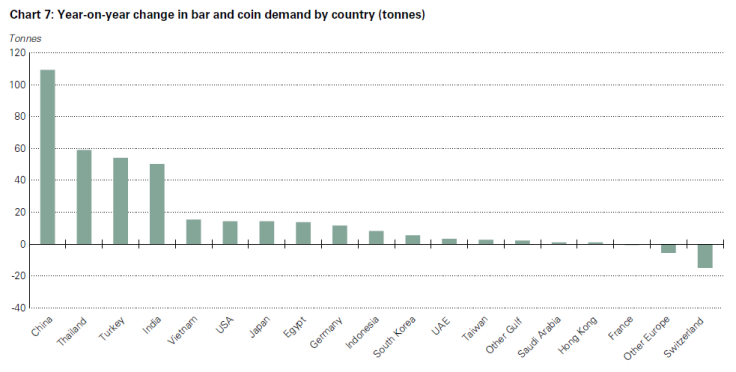

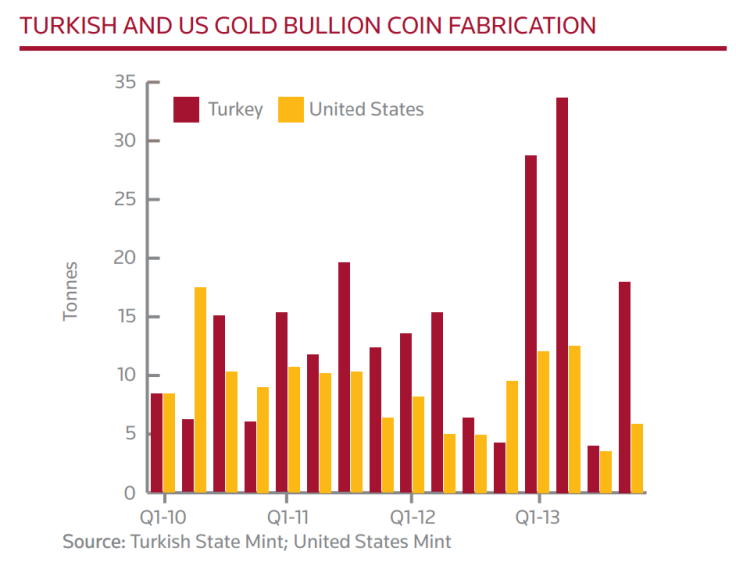

Turkish demand for gold remained robust in 2013. The country mints the most gold coins in the world by a stretch and has been dubbed the world’s largest gold coin market by industry body the World Gold Council. Consumer demand for the metal rose 60 percent in 2013, the third fastest in the world after China and Thailand.

Demand for bars and coins doubled, though the country still consumes small amounts of gold relative to China, India and the U.S., the three top consumer markets for the metal.

On the strength of bar and coin demand, Turkey is the only market that didn’t see its consumer gold market contract in value in the last quarter of 2013, compared to the year before, World Gold Council data show.

“Turkish people choose gold as an inflation hedge, and they also invest in gold," said Gokhan Sen, a vice president for research at Turkish investment brokerage and researcher Ak Yatirim.

“Ordinary citizens invest in gold because financial markets here are weak,” he said. “People just don’t invest in stocks or bonds,” he added, citing local preferences for real estate, gold, and foreign exchange markets.

Gold has also become a particularly sensitive topic for Turkey’s state-owned Halkbank, which has been accused of trading gold in exchange for Iranian oil and gas, circumventing U.S. sanctions on Iran. Gold has become a medium of exchange in that trade, Sen noted.

“Gold was being sent to Iran for trade,” he continued. “It wasn’t a normal exchange.”

Turkey’s gold imports hit a record 300 tonnes in 2013, GFMS data show. Imports could increase if sanctions on Iran are eased in exchange for nuclear concessions, a point under negotiation in ongoing talks.

After Turkey’s hyperinflation and financial collapse in the 1990s, normal Turkish citizens came to trust gold, dollars and euros, as a store of value, Turkish resident and investment expert Enis Taner of Risk Reversal told IBTimes.

“Gold has always been a favorite investment vehicle for the Turkish population because the lira has always been quite weak,” Taner said.

But gold’s rise from around $280 per ounce in January 2000 to $1,200 by January 2014 left many Turkish consumers, who often buy small gold products as gifts, feeling pinched.

“In 2013, gold went down quite a bit in dollar terms. So that actually for Turkish consumers was viewed somewhat positively," Taner said. "All of a sudden wedding gifts became a little cheaper.”

Stringent regulations for pooling assets mean that Turkish institutional investors and money managers don’t maintain large gold holdings, however, he said.

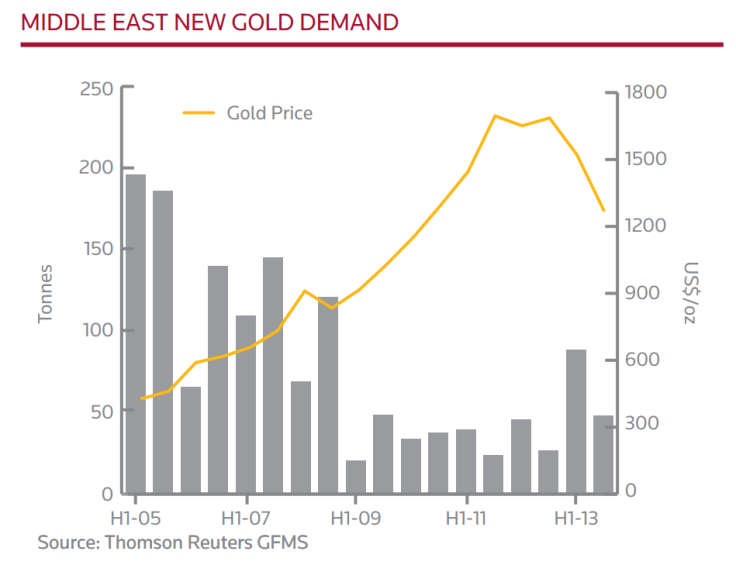

But Turkey’s demand for gold may not reflect wider regional trends. New Middle East gold demand has slumped since 2005, falling from almost 400 tonnes annually to about 150 tonnes in 2013, as gold became more expensive.

“Turkish people don’t necessarily hoard the gold all the time. They’ll quite often sell it back to the market,” GFMS’ Leyland said. “At the grand bazaar in Istanbul, you’ll see a lot of little gold exchange shops. It’s almost like a bureau de change. People will treat gold like another currency.”

Turks may be selling gold to buy dollars or euro, in turn to protect against further weakness in the Turkish lira, he said. The lira has fallen 5 percent this year, hitting a record low on Jan. 27.

© Copyright IBTimes 2025. All rights reserved.