Wall Street Still Bedeviled By Ethical Challenges: Survey

Seven years out of the depths of the financial crisis and five years after the Dodd-Frank regulatory overhaul, a new survey reveals deep and persistent ethical challenges in the banking industry.

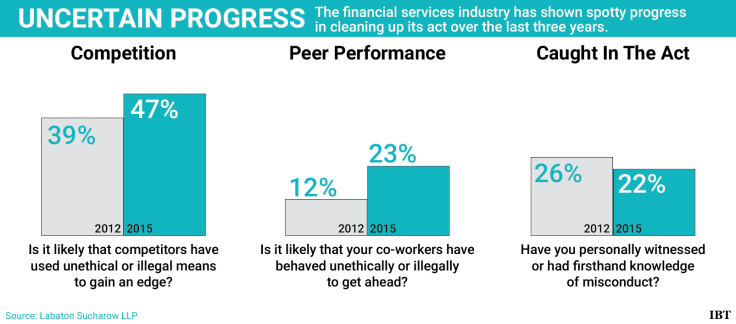

Nearly one in four financial services employees say it’s likely their co-workers have acted outside of the law. Dismaying as that statistic may be, it is nearly double the 12 percent who said the same in 2012.

The results of the study, which was conducted by the law firm Labaton Sucharow and the University of Notre Dame, raises concerns that post-crisis reform efforts have fallen short in bettering Wall Street's behavior.

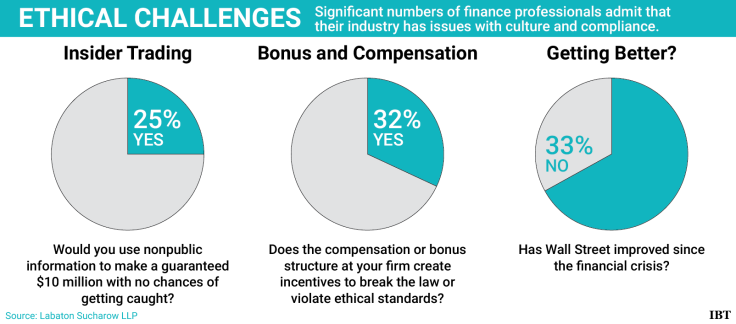

One-quarter of employees surveyed, for instance, would engage in insider trading if it meant a guaranteed $10 million. And nearly one in five felt that one must break the rules in order to succeed in finance -- close to twice the number of respondents who said that in 2012.

In fact, a full third of those queried felt the industry hasn't changed since the financial crisis.

The findings echo recent comments from regulators like Federal Reserve Governor Daniel Tarullo. “The hypothesis that this is all the result of ‘a few bad apples,’” Tarullo said in a speech last year, “has I think given way to a realization within many large financial firms that they have not taken steps sufficient to ensure that the activities of their employees remain within the law.”

The professionals surveyed cast an unflattering light on company leaders. Seventeen percent said that if their bosses caught a top performer trading on inside information, they would likely refrain from reporting it to law enforcement

The survey also reveals significant divides between respondents making higher salaries and their counterparts. Those earning more than $500,000 annually on the whole presented a gloomier view of Wall Street’s culture.

While 27 percent of those surveyed disagreed with the idea that the industry puts in the interests of clients first, 38 percent of the higher earners dismissed the notion. And 34 percent of the higher-salaried employees said they had actually witnessed misconduct, compared to 22 percent of respondents overall.

It’s not all bad news. The number of survey participants who said they had seen misconduct or knew about it firsthand decreased 15 percent. The survey also shows that nine in ten financial employees would report wrongdoing up the chain of command.

Yet it may be the upper echelons that often stifle employees’ better instincts. The survey found that 10 percent of respondents, and 25 percent of higher wage-earners, were forced to sign confidentiality agreements that kept them from blowing the whistle to authorities.

That finding strikes a blow at the Securities and Exchange Commission’s vaunted whistleblower program, a prize jewel of Dodd-Frank reforms. Though regulators have devoted increasing energy to curbing industry gag orders, which violate federal whistleblower law, a significant chunk of the industry still operates under a veil.

Although 37 percent of the respondents had no knowledge of the SEC whistleblower program, that represents an improvement from the 56 percent who were unaware in 2012.

The survey also included responses from British bankers, who in many respects seemed naughtier than their counterparts across the pond. They reported being more likely to take advantage of insider trading, less likely to report wrongdoing, and significantly more pessimistic about their industry: 42 percent of British respondents rejected the idea that clients’ best interests come first.

© Copyright IBTimes 2025. All rights reserved.