Is Wash Trading Prevalent In The NFT Space?

In February this year, Chainalysis released a report insinuating that investors have been selling NFTs to themselves to manipulate their value. The event where the seller is on both ends of an NFT trade is known as NFT wash trading.

NFT trading essentially means the purchase and sale of the digital assets in their relevant marketplaces. Since NFTs are characterized by non-fungibility, you cannot trade these assets in order book systems of exchanges or even AMMs.

They trade in their unique digital stores called NFT marketplaces, where you can go in, window shop, and purchase the NFT you want.

The tale of "selling" NFT sales

After understanding how NFT marketplaces operate, it's good to know what wash trading is. By definition, wash trading is the act where a trader is on both sides of a trade. Evidently, they act as both the buyer and seller. The concept is not new in the financial market landscape, especially in cryptocurrency exchanges.

Last year, a South Korean newspaper accused Coinbit exchange of faking crypto transactions. The report said that between August 2019 and May 2020, 99% of transactions in the Coinbit exchange were faked through wash trading. Bitwise Asset management network notes that 95% of the global bitcoin trading volume is fake.

We established a trend in crypto exchanges that some fake their trading volumes, especially in their early days, by wash trading. But our main area of focus was NFTs.

The Chainalysis report was clear enough that there is wash trading in the so-called NFT marketplaces. However, what did Chainalysis see that made them reach that conclusion?

NFT value depends on ability to attract new users

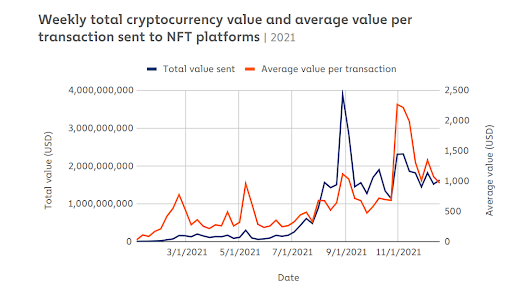

Research indicates that the value of an NFT is almost directly affected by the market activities around it. For instance, last August, when the first lot of Bored Ape NFTs were released, the total value of NFT sales hit $4 billion a few days later. In early October, when a Cryptopunk NFT sold for $532 million, the total trade volumes increased vastly.

Basically, in both cases, there were activities that attracted new users leading to high transaction values in the NFT space. Therefore, it's safe to conclude that the ability to attract new users is the primary driver of the growth in the value of NFT.

NFT traders want their assets to appear to attract users to increase value and generate income for them. Now, here is where wash trading could come in. As they strive to increase the prices, traders fake the transactions.

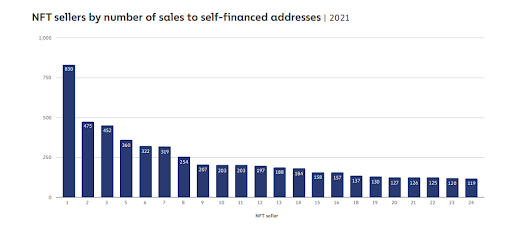

Another report by Chainalysis showed a graph of many NFT traders. This graph displays sellers 1 through 24 and their numbers of transactions. Seller 1 has about 830 sales in the period scanned, and if you consider the numbers, this trader must be making hefty profits.

However, the Etherscan exposes what this trader is doing. Seller 1, let's label them X, made an NFT sale at 0.4 ETH. Now, this trader X sent the NFTs from an address starting with the 0x828 to another address starting with 0x084. Now, the second address sent 0.4 ETH to the first address 0x828.

Chainalysis uses another tool called the reactor graph, which can track the flow of transactions using a single graph. The result showed that the same wallet that received the 0.4 ETH sent 0.45 ETH earlier. The 0.05 ETH was the gas fee.

So, this same trader was the seller and buyer of their own NFT. The reactor showed that although different assets are involved in Seller 1's trade, there are a lot of direct links with wallets, indicating a continued wash trading trend.

The research would not be conclusive if only one trader were investigated. However, the Chainalysis report shows that over 110 traders were investigated, and each of them was found to have completed over 25 wash trades, indicating an ongoing trend. Interestingly, while all these trades cost gas fees, the results of the 110 investigated traders showed that the profits were quite good.

In our research, we stumbled upon another claim from other sources about the OpenSea competitor, LooksRare marketplace.

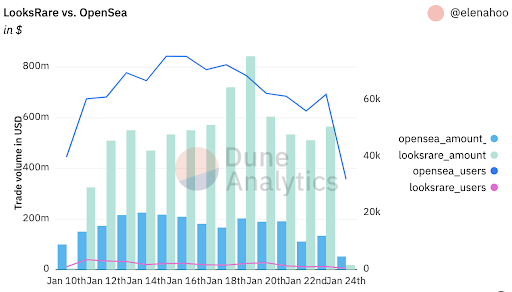

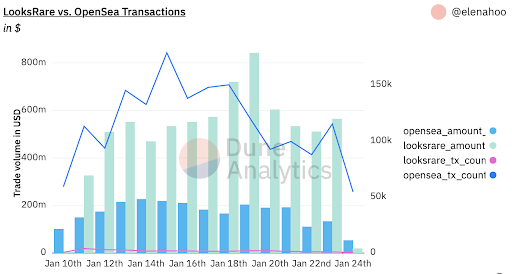

LooksRare, which was recently launched, faced criticism this January with claims that traders are wash trading on the platform. Some reports claimed that at least 87% of LooksRare trades are wash trading activities.

The Opensea network has more users and is generally a bigger and more trusted platform based on the graphs above. But, LooksRare's very few users are hitting higher trading volumes than Opensea's many and more loyal traders.

Now, it's not impossible, but for such to occur, the LooksRare traders must be making super high NFT trades, which no one knows about. This could be possible only if a few investors make many purchases and sales of NFTs, clearly indicating wash trading.

We just removed over $5 billion in #NFT wash sales from our sales volume figures.

— CryptoSlam! (@cryptoslamio) January 28, 2022

Read more about the @LooksRareNFT phenomenon and how we're now tracking "wash" transactions.

👉https://t.co/b4EO2plHA7 pic.twitter.com/AtyqbpAKwY

Dune analytics gives more profound insight into the wash trading activities seen in the LooksRare platform and even gives daily comparisons with OpenSea. While the heavy trades seen in January appear to have lowered, Dune analytics is still discovering various top traders who are still wash trading.

Verdict; Wash Trading is prevalent in NFT space

Based on the research and analysis we have gone through above, it's safe to say that wash trading is quite prevalent in the space.

The fact that individual traders completed over 25 trades each on OpenSea is one of the main reasons for this assertion.

LooksRare, a network that has been gaining success, had the worst cases of wash trading. Although Looksrare traders are just about 3% of those of Opensea's clientele, the traders recorded nearly thrice of OpenSea's transaction volumes.

1/ I see a lot of people talking about the wash trading on @LooksRareNFT.

— dingaling (@dingalingts) January 12, 2022

So is it actually happening? Yes

Is it by design? Probably

Is it a bad thing? I don't think so. In fact, I think it's genius.

Let's dive in 🧵

Wash Trading is gaining prevalence because it helps NFT holders gain massive values in return. Data analysis showed that the 110 traders made one collective profit of over $8.4 million in wash trading in 2021.

Rahul owns less than 1 BTC and 40 LRC.

International Business Times holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

© Copyright IBTimes 2025. All rights reserved.