WeWork Goes Public: Company Looks To Rebound After Turmoil

Shared-office space company WeWork (WE) went public Thursday on the New York Stock Exchange after the company suffered notable setbacks that included an initial public offering in October 2019 that flamed out.

“You’ve said this is a story with drama,” WeWork Executive Chairman Marcelo Claure said Thursday on CNBC’s “Squawk Box.” “Sure, this is a story where a lot of people wrote documentaries that it was the end of WeWork. Well the resistance, the persistence of these people is incredible. This company is here, is stronger than ever, and no doubt that we’re going to be celebrating many more milestones.”

WeWork is looking to rebound after the struggles from the failed IPO in 2019 and from the pandemic. The Wall Street Journal noted how the New York-based company "closed locations, renegotiated leases and cut thousands of jobs to reduce expenses during the Covid-19 pandemic."

WeWork's business model is fairly simple. It signs long-term leases with landlords. Then, after it renovates and furnishes the space, it subleases small offices or even entire buildings on a short-term basis.

WeWork went public by merging with special-purpose acquisition company BowX. The company is expected to raise as much as $1.3 billion from the deal.

Shares were issued at $10. As of 12:48 p.m. ET, shares of WeWork were trading at $11.55.

WeWork, which was founded in 2010, is valued at $9 billion. In 2019, WeWork was valued by SoftBank Group at $47 billion.

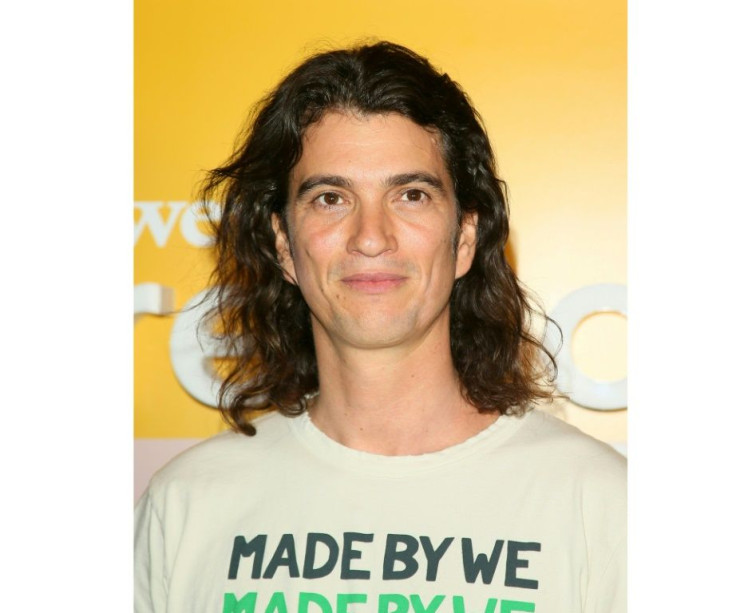

The company’s IPO failed in 2019 after concerns were raised about the business practices and model run by founder and then-CEO Adam Neuman. While facing ballooning losses, Reuters reported in November 2019 that the New York State Attorney General was investigating whether Neumann was involved in self-dealing.

New York Times reporter Amy Chozik would describe the nearly three months of turmoil and the failed IPO as "an implosion unlike any other in the history of start-ups."

Neuman would later step down with a $1.7 billion package that relinquished his voting rights. He was replaced by real estate industry veteran Sandeep Mathrani, who is still CEO.

In the second quarter of 2021, WeWork generated $250.1 million from its U.S.-based locations, down 42.3% from the same period last year.

As businesses continue to regroup during the pandemic, Mathrani said Wednesday that "WeWork is uniquely positioned to offer the space and services that can power solutions built around flexibility."

© Copyright IBTimes 2025. All rights reserved.