What Are Ethereum L2 Solutions?

In the online world, the name of the game has always been bandwidth. This is true to such an extent that when the Internet upgraded to broadband speeds, entire industries changed. Netflix displaced Blockbuster, while the video gaming industry shifted to always-online, free-to-play, micro-transactions laden games.

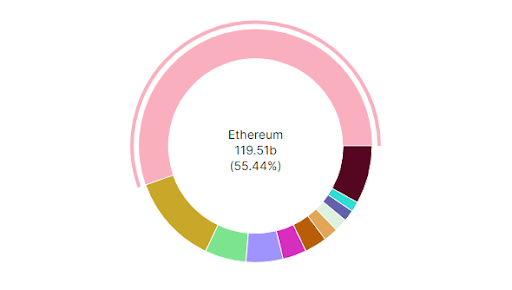

The blockchain world mirrors this to a TVL. When Ethereum, the largest smart contract platform with approximately $120 billion TVL, started launching DApps for lending, borrowing, token-swapping, and blockchain gaming, it became congested.

Although Ethereum's long-term roadmap deals with this congestion, including the transition to proof-of-stake (PoS) consensus, this is still a long way off. In the interim and beyond, layer 2 scalability solutions are Ethereum's congestion remedy.

Layer 1 vs. Layer 2 networks explained

Layer 1 is a reference to the core network without any tagalongs. These are Ethereum, Litecoin, Solana, Terra, Cardano, Avalanche, Fantom, Tron, and others. The only exception is Polkadot, which is a layer 0 network. Meaning, Polkadot is serving as a network of networks, in which layer 1 blockchains attach as parachains.

With that cleared up, it is easy to see where layer 2 networks fit in. They attach onto existing layer 1 blockchains just like a new road would attach to a highway to alleviate traffic. This is why they are often called layer to or L2 scalability solutions. Their sole purpose is to scale up existing main chains in order to avoid costly transaction fees.

There are multiple ways L2 networks offload traffic from the core L1 blockchains such as Ethereum. One of the most popular methods is called a rollup, or ZKrollups, in which ZK stands for zero-knowledge. The latter simply means that a user verifies their identity to another user without revealing their identity.

What are L2 rollups?

Layer 2 rollups do what the name implies. They roll up data from L1, which are hundreds of transactions executed on the main blockchain. After loading them to L2, they return them to layer 1 in a more compact form where multiple transactions are delivered as a single one.

In technical terms, the transaction data is recomputed from the Merkle Tree, commonly used in blockchain technology to efficiently encode data. Even more specifically, it manages hash functions as data that is transformed from text into an encrypted fixed-length string of bytes.

Suffice to say, without going into a month-long cryptography course, rollups remove the bulk of the data from L1. Because L2 interfaces with the main chain's smart contracts in charge of processing transactions, they don't lose the blockchain's inherent security features, such as immutability.

However, some types of rollups verify off-chain (those on L1) transactions differently. This is where the difference between different types of rollups comes in.

Proofing against fraud

One of the top L2 scalability solutions, Arbitrum and Optimism, are both rollup networks that diverge in how they verify off-chain data. They both use fraud proofs, instant finality of data blocks, and cross-chain bridges for L1-L2 token transfers.

However, Optimism, as the name implies, relies on a single-round fraud proof (FP). That is, this L2 network relies on the main chain to execute L2 transactions, delivering instant FP. The downside of this is that such executions cost more gas fees. Furthermore, its L2 gas fee is limited by L1's gas block.

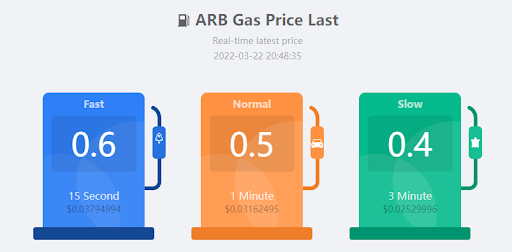

On the other hand, Arbitrum filters its off-chain transaction verification through multi-round FP. Whenever a disagreement pops up in the encoding mechanism, Arbitrum focuses on that single point, instead of the entire transaction batch. This delivers higher performance and lower gas fees.

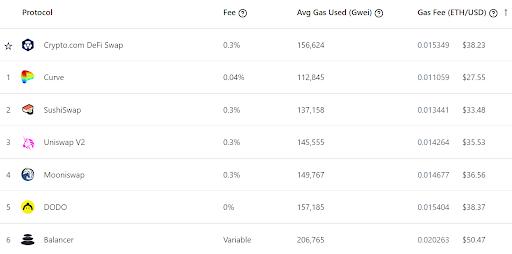

In fact, gas fees on Arbitrum are completely negligible.

Altogether, Optimism's L2 scalability solution relies on Ethereum's validators to remain honest, which is why it was dubbed Optimism. However, if Ethereum were to undergo an overhaul for its consensus algorithm, Optimism's and Ethereum's L1 transactions would lead to different states. After all, both Optimism and Ethereum use Ethereum Virtual Machine (EVM) which executes smart contracts.

In contrast, Arbitrum has its own Arbitrum Virtual Machine (AVM), so there is no such concern or Ethereum's dependency. While DApps have to be imported from AVM to EVM, this is an automatic process.

What are other L2 ethereum scalability solutions?

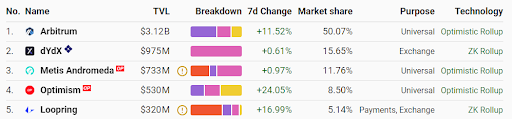

During 2021, Optimism was leading the market share as the top L2 solution, by the virtue of being first. However, with the rollup (no pun intended) of other L2 networks such as Arbitrum, it has fallen to fourth place by TVL (total value locked), at $530 million compared to Arbitrum's $3.12 billion.

As you can see, the top five L2 scalability solutions for Ethereum use variations of optimistic and zk rollup to gather data from L1, verify them, and return them to L1 in a compact form. They are all simple to use for anyone who is already familiar with the MetaMask wallet, with tutorials readily available.

However, one has to keep in mind that there is a gas fee cost associated between two different L2 networks. After all, a token would first need to be transferred to L1 and that to the other L2. Interoperability solutions to this problem are already in the works, such as Connext, StarkEX, cBridge, or Hermez’ Massive Migrations.

On a final note, even when Ethereum completes its PoS transition by docking with Beacon Chain, and completes sharding, it is likely that L2 networks will always be needed. The reason for this is simple. If Ethereum turns to become the infrastructure for Finance 2.0, it will have to handle transactions of billions of people.

Therefore, L2 scalability solutions are here to stay, so it is worthwhile learning how to use them.

Rahul owns no cryptocurrencies.

International Business Times holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

© Copyright IBTimes 2025. All rights reserved.