What Is Crypto Winter And How To Survive It?

Those who have been following the crypto market for at least four months know that something was supposed to happen at the end of 2021. Across the board, technical analysts and social media influencers were reading on-chain data, forecasting that Bitcoin will reach at least $80k–$100k in 2022.

Yet, the opposite happened. Bitcoin at several points entered the sub-$40k territory, effectively resetting its price to the beginning of 2021. Moreover, Bitcoin's price started to be in sync with the stock market. Specifically, with the tech-heavy Nasdaq index. As a result of these upturns, many media personalities switched the narrative, foretelling of “Crypto Winter.” Although it is nearly impossible to tell if the new narrative will turn true, one should be prepared for it.

Brief recap of market downturn

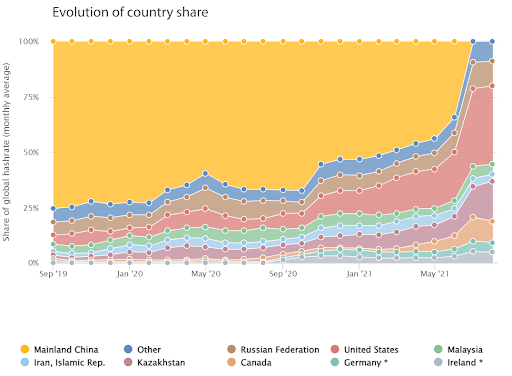

To understand the dynamic that led us to discuss about Crypto Winter, it would be useful to understand what exactly happened. For years, China's Bitcoin mining share was dominant at over 70% due to its cheap coal to generate electricity for hungry Bitcoin miners.

However, over the years, China has been repeatedly “banning” Bitcoin, increasing in urgency and severity. In H2 2021, the People's Bank of China ramped this FUD up, finally leading to a miner exodus from China. More importantly, this caused sustained selling pressure by Chinese Bitcoin holders.

It is good to remind ourselves that the price of an asset like Bitcoin, with its limited 21 million coins, depends on the balance between buy and sell pressures. By market demand, if the selling wall is higher, it means that the asset gets cheaper, and vice-versa. This brings us to the second major factor, the Federal Reserve.

Also, nearing the end of 2021, the Federal Reserve has been signaling that it will start interest rate hikes to squash rampant inflation, the highest one in 40 years. This had a cascading effect on all markets. The stock market, in particular, grew dependent on the Fed's money borrowing spigot, resulting in their taper tantrum. With interest rates set to rise, those company CEOs were boarding up and started selling riskier assets.

I took a deeper dive into #Bitcoin vs. stock market movement... The correlation is undeniable.

— ₿lake (@blaakke) February 25, 2022

My takeaways? 👇

Crypto needs a healthy stock mkt.

If stocks rally from here -> #BTC & #Alts can fly. 🚀

W/ a deeper stock correction -> capitulation is possible. pic.twitter.com/bMx9ouaXzL

(Over time, the more institutional adoption Bitcoin received, the more it correlated with the stock market, mirroring the new investor class mindset. Refer tweet above)

You guessed it, many of these institutional investors view Bitcoin as a riskier asset. Of course, all of this was happening in conjunction with mass COVID-19 protests, supply chain disruptions, and geopolitical tensions. In other words, external economic and geopolitical factors trumped seemingly bullish on-chain data.

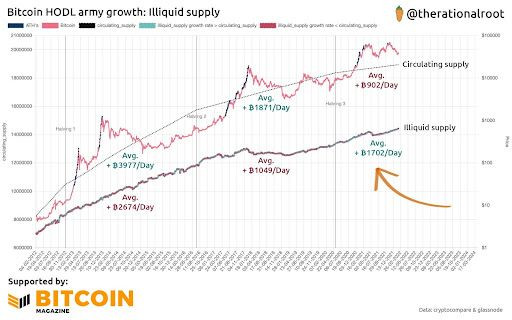

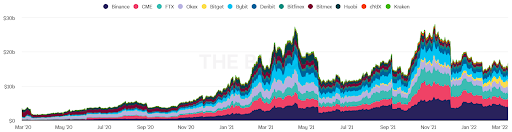

As of February, it still remains true that Bitcoin's illiquid supply is rising, a major bullish indicator. It means that there is less available Bitcoin on exchanges. Furthermore, long-term holders remain confident that the cryptocurrency will eventually get over its slump as a tech-like stock.

At press time, there are Bitcoin rallying signs, with its price heading above $43k. However, no one can tell if it is another fakeout. In view of this uncertainty, it is better to prepare with a viable set of alternatives. After all, preparedness is only a benefit, regardless of what happens.

DeFi staking

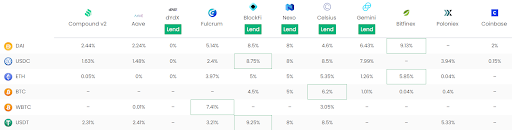

Just because the market is not bullishly rushing to new ATHs, doesn't mean there is no activity present. On the contrary, decentralized finance (DeFi) protocols are highly sought services because they lack any gatekeepers to borrowing and lending. Moreover, interest rates are still significantly higher than the national average of 0.06% in banking saving accounts.

As you can see, regardless of the platform, stablecoins tend to have the highest yields. That's because there is greater demand for stablecoins than there is supply. Furthermore, such platforms, from BlockFi to Celsius, operate on a leaner budget, so they can afford to give users greater cuts from profits.

In other words, if the current inflation rate is 7.5%, and your USD stablecoin equivalent can yield up to 9% yields, DeFi staking effectively nullifies inflation, without exposing you to crypto volatility.

Try Dollar-Cost Averaging (DCA)

Both HODLers and DCA investors have one thing in common. They are confident that Bitcoin price will eventually rise, pushing altcoins with it. However, instead of idle hodling, dollar-cost averaging is a superior alternative.

Simply put, DCA investing is distributing a sum over a longer time period in increments, which could be smaller or larger, depending on one's means. This strategy prevents overtrading and reduces the risk that happens when a large sum is invested all at once.

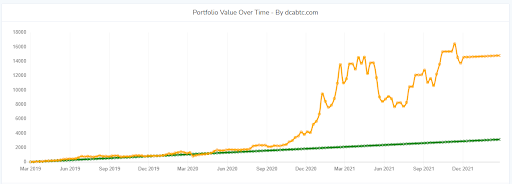

For instance, if you had started putting weekly $20 into Bitcoin, over three years ago, your profit margin would be 371.49%, from $3,140 total invested to $14,804 gained.

When put to chart form, the benefit is glaring. The green line represents incremental $20 investments going against Bitcoin's certain appreciation.

Manage risks — avoid speculative altcoins and short-selling

If there is an indication that Bitcoin is going down, many investors rush to make such a bet, trying to short it. Likewise, many such derivative trades resulted in wealth wipeouts. It only takes a single upturn to make the shorting into a major loss.

In other words, even in a severe bear market, it is highly unlikely that the market is going to zero, so the upside of buying is far greater than the upside of shorting.

By the same token, investors should avoid small-cap tokens (under $1 billion) during a market downturn. They are the most speculative assets, especially meme coins derived from Dogecoin (DOGE). Moreover, social media platforms are flooded with influencers who confidently forecast that 'Coin X will go up buy X, buy it now at a discount!'

They may be pump-and-dump schemes, or they may turn out true. The likelihood is in the former direction, so always do your homework by researching the altcoin. This includes a long-term roadmap on the problem it is trying to solve and checking developer activity on GitHub.

Keep things in perspective

Lastly, keep in mind that nothing unusual is actually happening. The market downturn was much more severe during 2021 and years prior. The crypto market has cycles as an envelope-pushing technology that aims to upset the world of gatekeepers and central banking.

That is to say, always consider the fundamentals. If it is now known that Canada, a supposed democracy, engaged in freezing bank accounts for protests it didn't prefer, does that increase or decrease the demand for cryptocurrencies?

Moreover, with Russia getting cut off from the SWIFT banking system, where does that leave its crypto adoption rate, of which Russians hold around $214 billion or 16.5 trillion rubles. These long-term trends instill confidence that crypto adoption, i.e., cash inflows, is yet to increase on a global scale.

Rahul owns no cryptocurrencies.

International Business Times holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

© Copyright IBTimes 2025. All rights reserved.