Worldwide PC Market Will Grow 5% In 2012: IDC

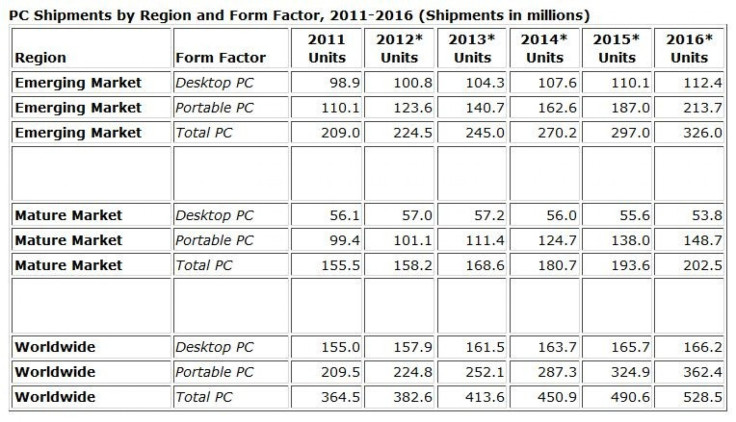

The worldwide PC market is expected to grow 5 percent year over year in 2012 with nearly 383 million shipments, a slight improvement over the moderate growth seen in 2011 as PCs continue to struggle for growth amidst intensifying competition from alternative devices, global political uncertainty and a still bumpy economic roadmap, says the latest International Data Corporation (IDC) report.

According to the IDC Worldwide Quarterly PC Tracker, apart from the increasing consumer saturation in mature regions, economic uncertainty, the launch of Windows 8 and growth of competing tablet devices are key factors affecting the market outlook. In addition, with the threat of a relapse into recession in several markets adversely affecting public spending and business confidence, the forecast for several key segments has been reduced, especially among small and medium-sized firms.

IDC has noted that while Windows 8 could help revive the PC consumer market that has lost a degree of enthusiasm in recent years. However, questions about the release date, functions, and pricing for Windows 8 limit the contribution the new operating system may make in 2012.

The consumer PC shipments are expected to see modest growth in 2012 with the revamp of a sleeker Wintel platform fueling additional growth in 2013 through 2016. IDC expects the forecast period to culminate with total PC shipments topping 528 million units in 2016.

The first quarter PC volume results showed an uptick over our forecast. However, much of the volume was due to a faster-than-expected recovery of hard disk drive (HDD) supply related to flooding in Thailand, said Jay Chou, senior research analyst with IDC's Worldwide Quarterly PC Tracker.

PCs continue to face pressure from a weak economic environment and growing competition. Consumer sentiment could be revived with UltraBook or Ultrathin systems provided the right price is reached. More price-cutting in the Android tablet landscape could free up some budget for PC purchases, but could also focus consumers on tablets rather than PCs.

According to David Daoud, research director, Personal Computing at IDC, the PC market will continue to struggle in the U.S. over the next two quarters.

Most consumers and businesses in need of PCs already have PCs and see no immediate reason to upgrade or expand. The market is also evolving amid a heated presidential election campaign, adding more stress to consumer and business confidence, with both segments refraining from spending or hiring, Daoud said. The good news, however, is that the forthcoming release of Windows 8 promises to bring new classes of products that could lead to a stronger refresh cycle as the year ends.

© Copyright IBTimes 2025. All rights reserved.