4 Ways To Survive Crypto Winter

Year-to-date, Bitcoin and Ethereum, as leading cryptocurrencies with over half of the total crypto market cap, are down by over 60%. This is a signal for a crypto winter, a period of prolonged decline in the prices of cryptocurrencies which now aligns with the real winter.

Crypto winter is a challenging time for investors, as many digital assets will dry out in this harsh market environment, never to be seen again. However, can we figure out the causes and the road ahead?

Why Is There a Crypto Winter?

Just over one year ago, Bitcoin reached its all-time high of $68,700, only to fall down 75% from that price point in November 2021. The problem is, this was a period when the money market signal was scrambled. Specifically, the Federal Reserve bloated its balance sheet by approximately $5 trillion under a near-zero interest rate regime.

According to the Bank for International Settlements (BIS), 87% of global FX trade is settled in dollars, making the USD the global reserve currency under Federal Reserve control. Therefore, we were left with a two-year period of massive liquidity pump. Some of that liquidity poured into cryptocurrencies, led by Bitcoin as an on-risk signal receiver against currency (USD) debasement.

But what happens when the Fed starts raising interest rates and ramping the hikes every month from March to combat the inflation it caused? Predictably, on-risk assets like cryptocurrencies go down, while the dollar strength index (DXY) goes up.

Of course, the Fed tightening its liquidity dollar spigot was not the only culprit. The implosion of Terra and FTX, together with their respective contagions, had shrunk the total crypto market cap by at least 20%, in addition to eroding investor confidence.

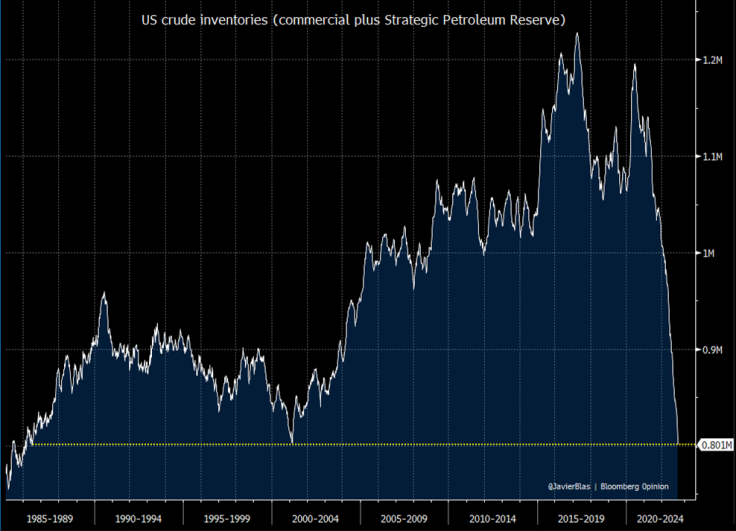

At the end of 2022, we are left with a recessionary outlook. We can already see this from record low oil demand, falling to a 36-year low. This typically happens when consumer and business demand is lowered, resulting in prolonged and reduced economic activity — recession.

BlackRock, the $9 trillion asset manager that the Fed hired to handle the March 2020 crash, makes it very clear what is on the economic horizon.

"Recession is foretold as central banks race to try to tame inflation. It's the opposite of past recessions... Central bankers won't ride to the rescue when growth slows in this new regime, contrary to what investors have come to expect. Equity valuations don't yet reflect the damage ahead," a team of strategists from BlackRock said.

Other banks, such as Bank of America and Morgan Stanley, warned that the stock market could go down by another 20% in 2023. Typically, cryptocurrencies follow stock market trends. So, what does this mean for crypto investors?

Unfortunately, Bitcoin was launched after the Great Recession of 2008, so there is no historical data indicating how digital assets would behave. But because they are considered on-risk, you should act accordingly during the crypto winter.

1. Look for Emerging Altcoin/NFT Opportunities

Even in a prolonged bear market, crypto opportunities pop up as if there is a crypto spring. This includes not only altcoins but also non-fungible tokens (NFTs). For example, at the same time as NFT sales dropped by 68% in Q3 2022, a novel NFT project Art Gobblers generated $50 million in secondary sales.

As the cherry on top, Art Gobblers' mint was free, so investors had to only pay for gas fees.

When it comes to altcoins, new opportunities typically emerge as the projects undergo major updates, or when a new trend appears. For instance, the popularization of AI assistance in image, code and text generation has spotlighted AI-focused altcoins.

It is also telling that funding for Web3 startups increased in Q3 2023 by 44% compared to the previous quarter. Overall, one should not fall into a trap of thinking that crypto winter is equal to not paying attention. It is quite the opposite because as most investors take a break, the more alert you should be alert to a project's updates, utilities and creative NFT projects.

2. Investing in Recession-Proof Stocks

Recession manifests as reduced consumer demand. However, demand for some products and services is constant and unavoidable. These are called consumer staple sectors such as large retail chains (Walmart, Target), utilities, healthcare and energy.

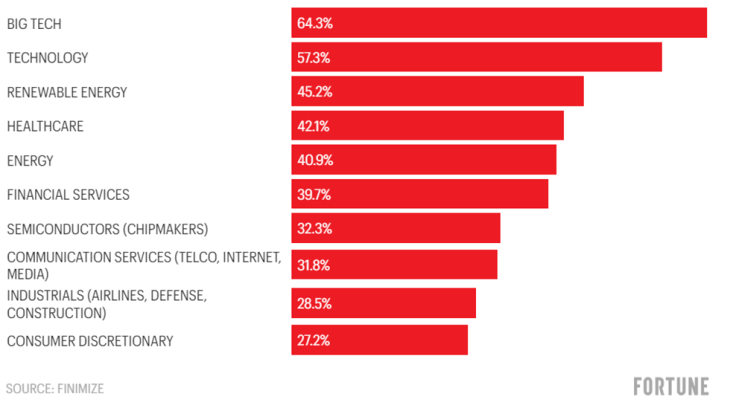

Moreover, many stocks will be undervalued in a bear market. This presents an excellent opportunity to buy low and sell high. According to a Finimize survey, retail investors are expected to invest more in 2022 — not less, with only 1% planning to sell — in the following categories, specifically.

While some crypto investors may balk at going into traditional finance, investing in discounted and defensive stocks may pay off more than merely focusing on risk-on assets like cryptocurrencies.

3. DCA on Crypto Staples

You may have noticed that the crypto market is in Bitcoin's shadow. As it falls or rises, so does the entire crypto market. To put it differently, although some altcoins may pop up occasionally, the vast majority of altcoins will only move up if Bitcoin does.

In this light, it makes sense to dollar cost average (DCA) on at least Bitcoin and Ethereum. While Bitcoin represents the most decentralized sound money, Ethereum represents the infrastructure for decentralized finance (DeFi). As such, both are extremely improbable to ever collapse, unlike what happened with the experimental Terra ecosystem.

To start DCA-ing, you can use this calculator, which is applicable for both stocks and digital assets.

Simply put, dollar cost averaging is an investment strategy in which you divide the total investment amount into equal parts and invest those equal amounts at regular intervals over a period of time, regardless of the asset's price.

For example, if an investor has $1,000 to spare and wants to use DCA, they might invest $200 per month for five months. This means that they would buy shares or cryptos every month, regardless of whether the asset's price is high or low at the time.

This can help smooth out the overall cost of the investment, potentially reducing the investor's losses if the asset's price drops.

4. Learn From Your Mistakes

If you are a crypto investor, have you ever thought about the Federal Reserve and why it is the global liquidity ruler that affects all other markets? Have you read any contrarian macroeconomic textbooks that go outside the Keynesian and Modern Monetary Theory (MMT) paradigms?

Investors who already did that saved themselves a lot of money this year. Likewise, the collapse of FTX and the entire lending crypto sector (BlockFi, Celsius, Terra, Genesis) is a fine learning opportunity on self-custody, centralization and the dangers of rehypothecation of capital.

In simple terms, rehypothecation is using assets that have been pledged as collateral for one purpose as collateral for another purpose. This is how now-defunct yield farming firms were able to promise double-digit yields until the Fed began draining its spilled liquidity splurge.

In essence, it is time to review the year. Identify past mistakes and fill those gaps with knowledge. By doing so, you will meet the next year, whatever it may turn out, as a craftier and more resilient investor.

© Copyright IBTimes 2025. All rights reserved.