Amazon (AMZN) Versus Toys R Us: Holiday Price Wars For Video Games, Other Toys

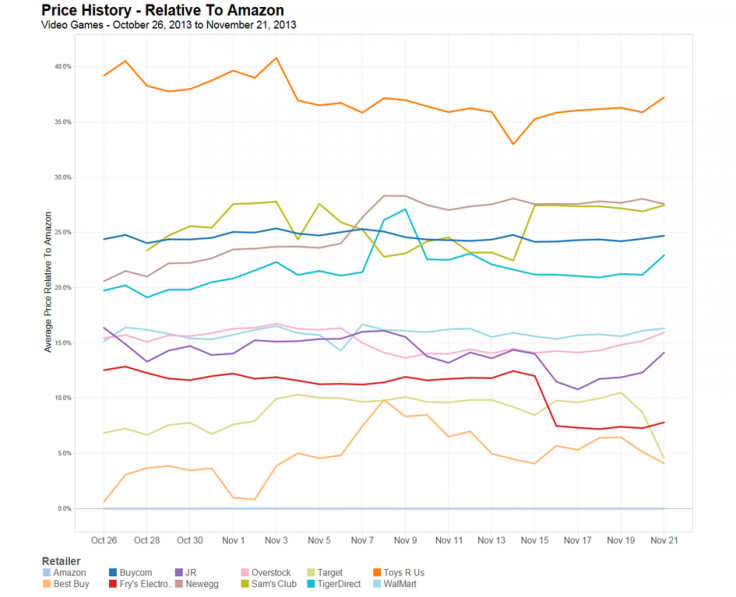

Toys "R" Us, Inc. may be pricing itself out of the holiday season, at least for gamers, since its video games cost 37 percent more on average than those of Amazon.com, Inc. (NASDAQ:AMZN), according to retail pricing researcher 360pi.

That data tracks prices as of Nov 21.

“We found that the toy retailer [Toys "R" Us] has been keeping prices high over the last month and even increasing them over the past week, which may point to a deep discount strategy next week,” a 360pi spokeswoman told IBTimes on Friday.

Wayne, N.J.-based Toys “R” Us, Inc.’s video game prices over the past month have been considerably higher than those offered by fellow brick-and-mortar retailers like Target Corporation (NYSE:TGT) and Wal-Mart Stores, Inc. (NYSE:WMT). At one point, Toys "R" Us also sold video games that were 40 percent more expensive than Amazon’s deals, on average. Amazon and Toys "R" Us sell more than 400 of the same video game titles.

360pi marketing vice president Jenn Markey told IBTimes in an email that she had no direct knowledge of the Toys "R" Us pricing strategy for the near future, but added, “The question is how and why can TRU [Toys R Us] compete in video games category if they’re 37% more expensive than Amazon?”

The company may rely on shoppers who don’t price check and add video games to already packed shopping carts, or they may be revealing deals this week ahead of Black Friday, she said, outlining two possibilities.

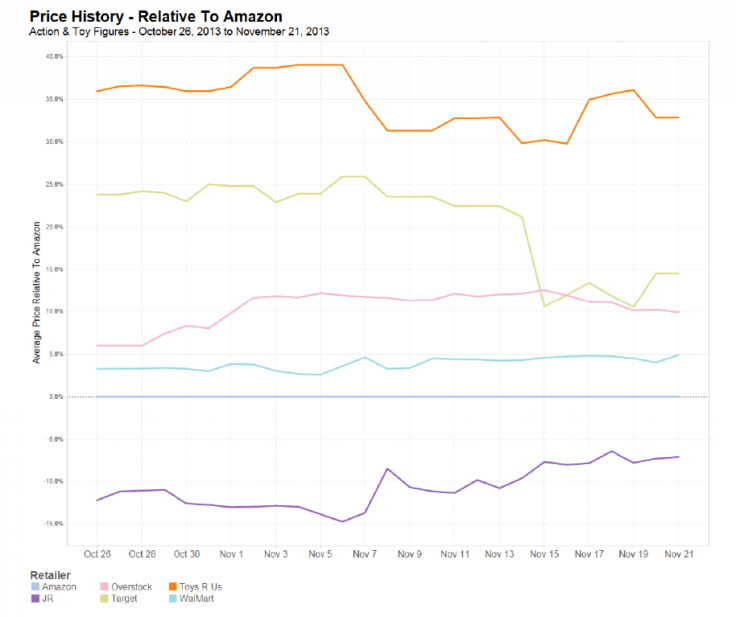

In broader toy pricing, only Sears Holding Corp (NASDAQ:SHLD) could beat Amazon on action figure pricing on that day. Over the past month, Toys "R" Us toys cost 30 to 40 percent more than Amazon’s products, on average, and Target sold more expensive toys than Wal-Mart.

Only New York retailer J&R offered toys and action figures at a discount to Amazon in the past month.

Top toys this holiday season include toy cars from VTech, the Furby Boom! and Flutterbye Fairies, according to a Citigroup Inc. (NYSE:C) research note from October.

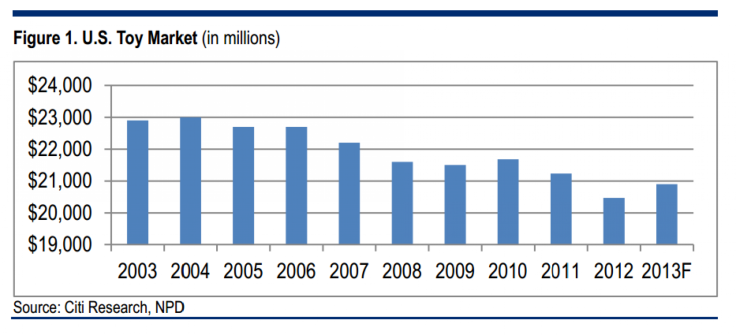

The toy industry is worth $20 billion, according to Citi, with as much as 80 percent of annual sales appearing in the last six weeks of the year. The industry will grow slightly in 2013, despite a tough sales environment this year, though it’s still worth some $2 billion less than it was in 2003.

Sears, for one, has experimented freely with pricing heading into the holidays, according to 360pi. The company showed “dramatic pricing shifts” across all nine gift categories, which may show it attempting to gain a competitive edge by trial-and-error. Other retailers have shown much more stable pricing.

Staples, Inc. (NASDAQ:SPLS) and Toys "R" Us are the least competitive on prices relative to Amazon. Best Buy Co., Inc. (NYSE:BBY), Target and Wal-Mart stuck closest to the e-commerce giant on prices.

© Copyright IBTimes 2025. All rights reserved.