Asian Shares Mixed, European Markets Struggle To Make Gains Amid Lingering China Growth Fears; Glencore Plunges

UPDATE: 6:40 a.m. EDT -- Shares of the commodity trading and mining company Glencore Plc fell to a record low during early trade Monday, as worries grew over how the mining giant would cope with plunging commodity prices.

Shares in the company fell nearly 26 percent after an investment bank issued a warning on the risks for Glencore’s earnings outlook, before recovering slightly and trading down 22 percent. The company’s shares have fallen more than 76 percent this year, making it the worst performer on London’s benchmark FTSE 100 index.

Analysts at Investec warned, in a note to investors Monday, that if commodity prices remained at the current levels, “Glencore may have to undertake further restructuring beyond the dividend suspension, capital raising and asset sales programs it has already announced.

“Debt is fast becoming the most important consideration for mining company management. … The challenging environment for mining companies leads us to the question of how much value will be left for equity holders if commodity prices do not improve,” Investec reportedly said.

Original story:

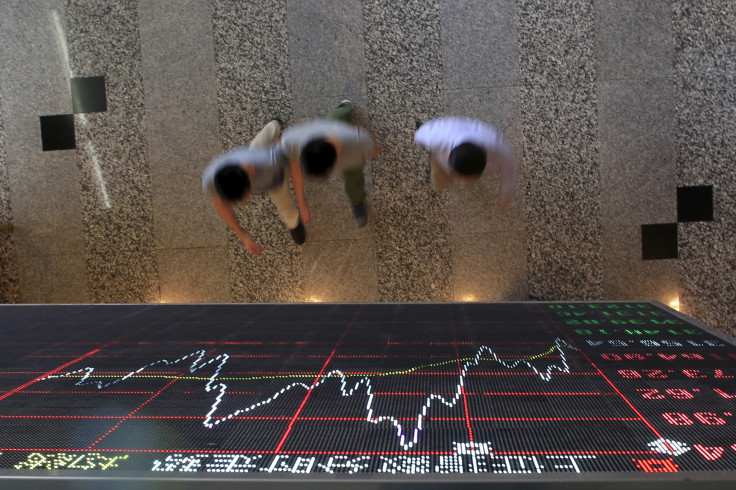

Asian equity markets were mixed Monday, as investors awaited the release of key economic indicators in the U.S. and China. Concerns over an economic slowdown in China and its potential impact on the U.S. Federal Reserve’s plans to normalize monetary policy after years of record low rates has fueled market volatility in recent weeks.

The Shanghai Composite Index, which fell sharply following the release of official data, which showed an 8.8 percent decline in Chinese industrial profits in August from a year earlier, recovered during afternoon trade to close up nearly 0.3 percent.

Japan’s Nikkei 225 index closed down 1.3 percent, ahead of Wednesday’s Japanese industrial profits data, Thursday’s China Caixin Purchasing Managers’ Index (PMI) and U.S. non-farm payrolls data to be released Friday. India's S&P BSE Sensex traded down 0.7 percent. Markets in Hong Kong, South Korea and Taiwan were closed for the Mid-Autumn Festival.

“Investors would not take large positions until they digest the outcomes of these key data, so directionless trading is expected this week and volume is likely to be thin,” Takuya Takahashi, a strategist at Daiwa Securities in Tokyo, told Reuters. “If these data are better than expected, the market will likely start recovering next week.”

Meanwhile, in Europe, where markets had rallied Friday after Fed Chairwoman Janet Yellen laid out plans for an increase in rates by the end of the year, shares dipped lower during early trade Monday.

The pan-European STOXX 600 was down nearly 0.7 percent, while London’s FTSE 100 traded 1 percent lower. Germany’s DAX and France’s CAC 40 were both down more than 1 percent, as markets in the region failed to sustain their short-lived rally.

In the U.S., stock markets also looked set to open lower Monday, with futures for the Dow Jones Industrial Average and S&P 500 both down 0.4 percent. Futures on the Nasdaq exchange were down 0.5 percent.

© Copyright IBTimes 2025. All rights reserved.