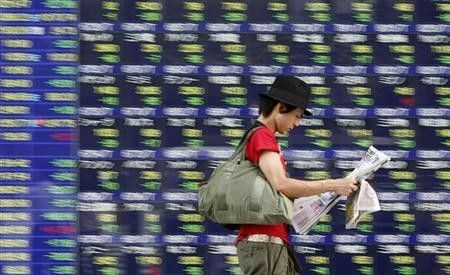

Asian Stock Markets Advance As Europe Concerns Fade

Asian stock markets advanced Tuesday, recovering from their biggest fall in six months in the previous session on concerns over election results in France and Greek.

The Japanese benchmark Nikkei gained 0.68 percent or 62.02 points to 9,181.16, Hong Kong's Hang Seng advanced 0.07 percent and South Korean KOSPI Gained 0.49 percent while Indian benchmark BSE Sensex and Chinese Shanghai Composite slipped more than 0.10 percent.

Sentiment improved slightly as concerns over election results in Europe faded and better-than-expected economic data in the US and Germany renewed optimism about economic recovery.

The US Consumer Credit for March surged at the fastest pace since late 2001, helped by rebound in credit card use and higher student and car loans. Total consumer credit surged 10.2 percent, or $21.36 billion, to hit $2.542 trillion in March.

German factory orders rose more than expected in March on strong demand from non-Eurozone countries. Orders rose 2.2 percent in March compared to an upwardly revised gain of 0.6 percent in February while economists surveyed by Bloomberg News expected a 0.5 percent gain.

Meanwhile, French markets rallied Monday after Socialist Francois Hollande's win, with benchmark CAC 40 Index rising more than 1.65 percent.

It appears that investors are tempted to believe that in France François Hollande will be able to impose a growth initiative, while keeping the commitment for more fiscal discipline. In any case, the way to promote more growth is still under discussion, said a note from Credit Agricole.

In Japan, tech companies' shares led the rebound after the benchmark Nikkei 225 slumped in the previous session.

Advantest Corp. gained 1.9 percent and Toshiba Corp. surged 3.9 percent while Hitachi Ltd advanced 2.14 percent.

Honda Motor Co. Ltd gained 1.95 percent after the company stock was upgraded to outperform rating at Credit Suisse while Capcom Co Ltd surged 4.44 percent after the company said its full year net income will increase 46 percent.

In Hong Kong, declines from Chinese property developers weighed on the benchmark index. Longfor Properties declined 0.83 percent and Agile Property Holdings Ltd. slumped 4.13 percent.

© Copyright IBTimes 2025. All rights reserved.