Yesterday the Fed announced that they will extend their yield curve 'twisting'

Advanced readings for German flash PMI came in at 44.7 versus a consensus of 45.2 while the euro zone services came in slightly better than expected at 46.8 versus 46.4

Manufacturing has been one of the few bright spots of the otherwise frail U.S. economic recovery, but Markit said weaker overseas demand could be starting to slow hiring in the sector. U.S. manufacturing grew in June at the slowest pace in almost a year and hiring in the sector also slowed.

U.S. sales of existing homes fell 1.5 percent to an annual rate of 4.55 million units due to low inventory, the National Association of Realtors said Thursday, missing expectations and raising doubts about a housing recovery.

A listing on the German division of online retailer Amazon has indicated a Dec. 21 release date for Nintendo?s Wii U console. However, this could just be a placeholder for the European launch of the Wii U, according to Game Informer.

It may not be the sexiest feature, but it may be one of the most rumored. Although Apple doesn't discuss product pre-releases, several tech sites claim that Apple has built smaller dock connectors for its new phone, dubbed the iPhone 5, by some. TechCrunch is the latest to report on the mini dock connector, but the first to confirm it.

U.S. 30-year fixed-rate mortgages fell to a new record low of 3.66 percent following weak economic indicators, mortgage financier Freddie Mac said Thursday.

Greek officials will present the proposed revisions at a euro zone finance ministers' meeting in Luxembourg on Thursday.

Expectations for U.S. company earnings are on a slippery slope down Wall Street. While the downward slide in estimates highlights the caution analysts and companies are expressing, investors should also be aware that companies are setting lower goals so that they can look better or be able to ?beat estimates? when the results come out.

First-time claims for jobless benefits in the U.S. fell by 2,000 to a seasonally adjusted 387,000 in the week ended June 16, Labor Department said Thursday, but the overall level still shows a weak labor market.

Rumors about Apple ditching the current 30-pin dock connector in favor of something smaller are nothing new. Reports surfaced last month suggesting that Apple would bring the change to its upcoming iPhone iteration, presumably called the iPhone 5.

Larry Ellison, the CEO of software giant Oracle, is said to have paid between $500 million and $600 million for the 141 square mile Pineapple island.

Onyx Pharmaceuticals, QuinStreet, Molycorp, EZchip Semiconductor, Red Hat, Ampio Pharmaceuticals, Mechel OAO, Chimera Investment and Nokia Corp. are among the companies whose shares are moving in pre-market trading Thursday.

The U.S. State Department has released a new report on human trafficking around the world and estimates that about 21 million people are directly victimized by the criminal practice.

African migrants in China have a life that is light years away from the glamour, adulation and affluence enjoyed by Drogba.

Microsoft has struck again. Just a couple of days after launching the Surface tablet, the Redmond company took the wraps off the latest iteration of its mobile operating system, the Windows Phone 8, during a nightclub-themed media event in California Wednesday. With an exciting set of new features, the upcoming mobile OS has indeed managed to get the first impression of many onlookers already.

Paul Simon once crooned: Every generation sends a hero up the pop charts. But the heroes of the latest generation of young music-hungry consumers are finding it difficult to get them to actually buy their work.

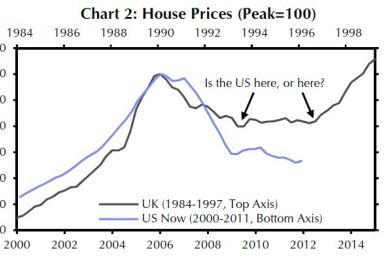

U.S. housing prices won't just hit the bottom this year -- they'll rise by 2 percent, according to a report by Capital Economics released this week. But that doesn't mean the market is in great shape.

The Indian rupee continued its downward slide for the fourth consecutive day Thursday to touch an all-time low of 56.57 against the US dollar.

Asian stock markets mostly declined Thursday as the Federal Reserve's limited help to bolster the domestic economy disappointed some market participants.

The millionaires in Asia outnumber their counterparts in North America for the first time while the overall financial wealth of high net worth individuals (HNWI) declined across all regions except the Middle East, according to a new study.

Crude oil futures declined Thursday, weighed down by an unexpected jump in the U.S. crude supplies and the Federal Reserve's limited help to revive the domestic economy.

U.S. stock index futures point to a lower opening Thursday after the Department of Labor's initial jobless claims report, which showed that more people than expected filed for unemployment benefits, and the National Association of Realtors' report on existing home sales.

European markets fell Thursday as investors were disappointed the U.S. Federal Reserve failed to announce any quantitative easing measures on Wednesday.

China's manufacturing activity fell in June compared to that in May and continued to contract for the eighth straight month, according to the preliminary HSBC Flash Purchasing Managers Index (PMI) released Thursday.

The top after-market NYSE gainers Wednesday were: Skilled Healthcare, VOC Energy, Oriental Financial Group, Alon USA Energy and Kindred Healthcare. The top after-market NYSE losers were: Red Hat, Main Street Capital, Vmware, Apartment Investment & Management and hhgregg.

Most Asian markets fell Thursday as investors felt let down by the U.S. Federal Reserve, which did not announce a further round of quantitative easing.

Sanford, Fla., Police Chief Bill Lee, who drew criticism for his department's handling of the killing of Trayvon Martin, was fired Wednesday, his spokeswoman said.

Asian stocks struggled and commodities fell broadly on Thursday after the Federal Reserve ramped up monetary stimulus by expanding Operation Twist, but disappointed some investors who had been hoping for more aggressive measures.

After much anticipation, storied British carmaker Aston Martin finally released its new flagship the AM 310 Vanquish, reviving the Vanquish name after an absence of years and securing a niche for the super grand tourer.

![Microsoft Reveals First Xbox Smart Glass Title: A Closer Look At How The New Feature Works With Windows Phone 7 [VIDEO]](https://d.ibtimes.com/en/full/691777/microsoft-reveals-first-xbox-smart-glass-title-closer-look-how-new-feature-works-windows-phone.jpg?w=297&h=199&f=5789d21788dc1ad7366f3c18920f45f4)

![Apple iPhone 5: Major Features, Specs, Schematics Released By Repair Site [REPORT]](https://d.ibtimes.com/en/full/690185/apple-iphone-5-major-features-specs-schematics-released-repair-site-report.jpg?w=385&h=257&f=31983749a93c6eb7c4f8e5eee3e70119)