Athens needs to identify another ?11.7 billion in spending cuts by 2014.

China's attempt to manage inflation in the real estate market is putting pressure on local governments and pushing homebuyers overseas.

The defense of Jerry Sandusky has focused on inconsistencies in opposing witness testimony and presenting mostly character witnesses.

Housing starts fell 4.8 percent in May to an annual rate of 708,000, but building permits climbed 7.9 percent to the highest level in nearly four years, the U.S. Commerce Department said Tuesday. Economists surveyed by Reuters had forecast a reading of 720,000.

Shares of J.C. Penney Company, Inc. (NYSE: JCP) plunged mid-Tuesday by 10.15 percent, or $2.47, to $21.86 in the wake of president Michael Francis' departure, as the department store struggles to change its discount model and increase revenue.

In a radical shift for Bill Gates' 37-year-old software company, Microsoft unveiled a tablet in Los Angeles on Monday. The Surface aims to be a direct competitor to Apple's iPad, sporting a form factor that's thinner than Apple's tablet, and it also tackles several things the award-winning iPad can't do, like type well or stand up straight.

A month after the $16 billion mammoth but botched initial public offering of Facebook (Nasdaq: FB), the No. 1 social networking site, the ice may be breaking for technology companies.

German economic sentiment has deteriorated in June, according to the ZEW economic indicator which fell 27.7 points to minus 16.9, its strongest decline since October 1998.

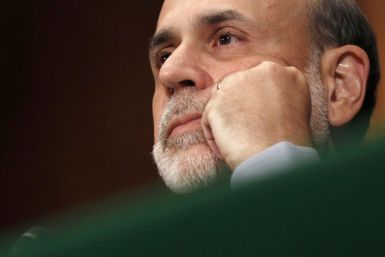

Chairman Bernanke will announce his policy decision Wednesday at 12:30 EST, and considering the recent escalation in the European debt crisis

Markets are largely ignoring some very negative indicators this morning, seeming to feel that further support from central banks is imminent.

Gary Giordano, a former suspect in the disappearance of his travel companion Robyn Gardner, has filed suit against American Express in an effort to collect on an insurance policy he took out on the missing woman.

The prolonged crisis in the euro zone, coupled with signs that the U.S. economic recovery is faltering, have led to speculation that the Federal Reserve will provide more monetary stimulus, most likely through extending its Operation Twist program, at the June two-day Federal Open Market Committee meeting, which concludes on Wednesday June 20.

South Korean electronics giant LG Group said it would step back from the tablet sector after Microsoft (Nasdaq: MSFT), the biggest software developer, introduced its Surface tablet for shipment in the second half.

On Monday, Microsoft finally took the wraps off its much talked about Surface tablet that had created a lot of hype even before its release. However, it seems that the mysteries surrounding the device have not been solved completely.

American Express, BroadVision, Oracle Corp, Las Vegas Sands, Transocean, Infosys and Western Gas Partners are among the companies whose shares are moving in pre-market trading Tuesday.

After mesmerizing Android fans with its latest flagship smartphone, Galaxy S3, Samsung is now eyeing enterprise customers and has announced its first SAFE-branded Android smartphone in the U.S. - a secured version of the new Galaxy S3.

The dissolution of Fannie Mae and Freddie Mac, the two largest U.S. mortgage guarantors, would have only a minimal impact on home ownership level, according to a new report that downplays the link between low interest rates and increased ownership.

Here's what a nursing home in Mobile, Ala., has in common with the regal Bergdorf Goodman department store in Manhattan: They're both facing micro-unions, groups of employees who organize apart from the rest of a company's workforce.

On May 18, Facebook closed its first day as a public company at $38.23, valuing itself around $105 billion. On Tuesday at mid-day, it traded near $31.50. Still, despite the vilification of the IPO, the slumping share price and dozens of class action lawsuits filed in federal courts in New York and California, Facebook, a damaged brand, has followed the advice of New York image guru Clive Chajet who said it should ignore the press and stick to its knitting.

U.S. stock index futures signal a mixed opening Tuesday as optimism following the Greek election results fades and Spain's increasing borrowing costs raise investor concerns.

European markets rose Tuesday but investors remained cautious as concerns about the debt crisis looming over the euro zone were revived with increasing borrowing costs of Spain.

Asian markets fell Tuesday as investor concerns on the euro zone debt crisis were revived amid fading optimism after the Greek elections and increasing borrowing costs of Spain.

Crude oil futures declined Tuesday as rising Spanish and Italian bond yields outweighed optimism over the Greek election results.

Stock markets in China and Hong Kong declined Tuesday as renewed concerns over Spain's financial woes offset optimism over the Greek election results.

The top after-market NYSE gainers Monday were: Dana Holding, Alliant Techsystems, Yingli Green Energy Holding, Celanese and Fusion-io. The top after-market NYSE losers were: J.C. Penney, IHS Inc, Western Gas Partners, HCP and Boise Inc.

Japan's Nikkei 225 Stock Average fell Tuesday as optimism over the Greek election results subsided and concerns over the financial stability of Spain revived.

In our quest to have a more stable source of income, active or passive, we come across many options: the stock market, property market, currency trading.

The markets' relief from Greece's vote Sunday to try to remain in the euro swiftly faded under a cascade of bad news out of Spain.

Microsoft unveiled its own family of tablets Monday evening to rival Apple's iPad.

Asian shares slipped on Tuesday as a post-Greek election relief rally quickly ran out of steam, with rising Spanish and Italian bond yields signaling that European leaders still have much to do to contain the euro zone debt crisis.