Former Goldman Sachs Group Inc board member Rajat Gupta, who is on trial over insider trading charges, has decided not to take the risk of testifying in his own defence.

Stock markets in China and Hong Kong gained Monday as sentiment was buoyed on news that the euro zone will provide financial assistance to help Spain's troubled banks.

Japan's Nikkei 225 Stock Average rose Monday as euro zone finance ministers Saturday agreed to provide Spain with aid while May exports in China grew above expectations.

China's easy money and Spain's hard choice to accept a bailout of its cash-strapped financials sector appear to have market participants feeling pretty chipper in the early going on Monday.

GE Capital -- the financial-services unit of the General Electric Co. (NYSE: GE) -- may be in for a round of slicing and dicing by its corporate parent, according to an account appearing online in the Wall Street Journal.

Many analysts anticipated China's balance-of-trade figures for May would be OK, but the customs numbers reported Sunday were better than that expectation: Year on year, the country's exports rose 15.3 percent, and its imports rose 12.1 percent.

Combatants on the front lines in the war on cancer have a new weapon in the arsenal, as the U.S. Food and Drug Administration on Friday OK'd Perjeta -- flanked by Herceptin and docetaxel -- for deployment in a three-pronged attack on the enemy cells in people with HER2-positive metastatic breast cancer.

Indiana Gov. Mitch Daniels said on Fox News Sunday that public-sector unions should be abolished in the wake of Wisconsin Gov. Scott Walker's victory in a recall election.

As a weak economic recovery and cheaper gasoline alter the travel plans of Americans from international trips to domestic jaunts, the Gulf Coast could be a big winner.

Spain's prime minister said Sunday that despite financial assistance of as much as ?100 billion ($125 billion) for the country's ailing financials sector, the euro zone's fourth-largest economy will continue to suffer from high unemployment and shrinking gross domestic product.

By making the Internet universal and ubiquitous, though, technology also eroded corporate control. No longer will International Business Machines Corp. (NYSE: IBM) or Hewlett-Packard Co. (NYSE: HPQ) completely control everything in their networks, despite their networks of worldwide data centers.

Verizon and AT&T have opted out of the 50GB Dropbox cloud storage promotion for their versions of the latest Samsung Galaxy S3 smartphone.

Developments in Greece and Spain could lead first to rating reviews and then to rating actions on all 17 countries in the euro zone, Moody's Investors Service announced Friday.

Spanish officials appeared hesitant to recognize the reality of their country's situation on Saturday as the nation agreed to accept as much as ?100 billion ($125 billion) in a bailout of its cash-strapped financials sector by one or both of the euro zone's rescue funds.

Clean energy advocates may be celebrating the decline of coal-fired power. But in the heart of Kentucky's Appalachia, ground zero for coal country, mining is essentially the economy. And there, no coal means no recovery

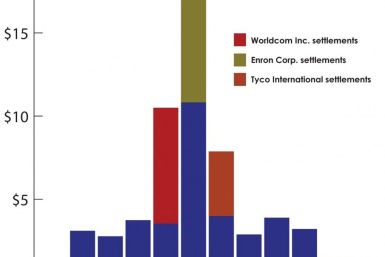

Within a week of Facebook Inc.'s (Nasdaq: FB) $16 billion initial public offering, at least six lawsuits were filed against its top officials, including CEO Mark Zuckerberg, as well as six investment banks involved in the deal. That in itself is not surprising, considering the IPO flopped. What would be surprising is if the shareholders actually get anything near what they feel they deserve.

While the euro zone fiscal crisis has grabbed the spotlight, the U.S. faces its own fiscal crisis. The simultaneous onset of tax increases and spending cuts scheduled for Jan. 1 -- which will trigger unless Republicans and Democrats can agree on a balanced budget solution -- will likely send the economy plunging off a $720 billion fiscal cliff and into the arms of another recession.

The rupee weakened on Friday on worsening global risk sentiment, but posted its first weekly gain against the dollar in more than two months as the local currency recovers from oversold conditions.

Asian stock markets reported their first weekly gains in six weeks amid hopes that major central banks, including the U.S. Federal Reserve, might act to tackle deteriorating global economic conditions.

Crude oil production from the Organization of the Petroleum Exporting Countries (OPEC) rose 40,000 barrels per day (b/d) to 31.75 million in May, a new survey has shown.

The Reserve Bank of India is expected to ease rates at the forthcoming mid-quarter review June 18 to lift constraints on lending as it seeks to tackle the shortage of cash in the banking sector and the slowing economy.

The top after-market NYSE gainers Friday were: RPC, Digital Domain Media Group, SuperValu, AK Steel Holding and Rogers Communication. The top after-market NYSE losers were: Metropolitan Health Networks, Yelp, Visteon Corp, Halcon Resources and Standard Pacific Corp.

Asian markets rose this week amid hopes that policy makers would take concrete measures to tackle the financial crisis and regain the economic growth momentum.

China's inflation cooled in May, giving Beijing more wiggle room to loosen policy and stimulate growth. Its consumer price index rose by 3 percent, and its producer price index fell by 1.4 percent.

France's agriculture ministry intends to revoke a key permit allowing the use of a pesticide believed by scientists to harm bumblebee and honeybee populations.

African governments -- and international animal-rights organizations -- contend the Chinese luxury consumer's appetite for ivory is driving a new wave of illegal killing of one of their continent's most iconic animals.

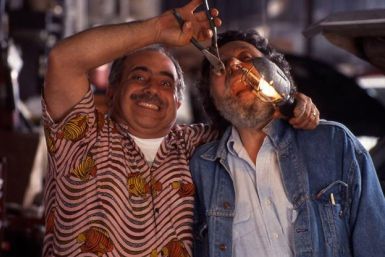

Tom and Ray Magliozzi, better known as Click and Clack the Tappet Brothers of Car Talk fame, are calling it quits on their popular NPR radio show, the duo announced Friday.

Two Chesapeake Energy Corp. (NYSE: CHK) directors -- members of the audit committee now dealing with the personal finances of the company's CEO -- offered their resignations Friday after they attracted little support at the annual shareholders meeting.

Adam Opel GmbH, an aging European subsidiary of the General Motors Co. (NYSE: GM), is hoping Chinese sales will be a panacea for miserable performance in the European market.

It is easy to see why the euro is falling.