China Flash Manufacturing PMI Drops to 11-Month Low In July, Sparking Concern And Stimulus Hopes

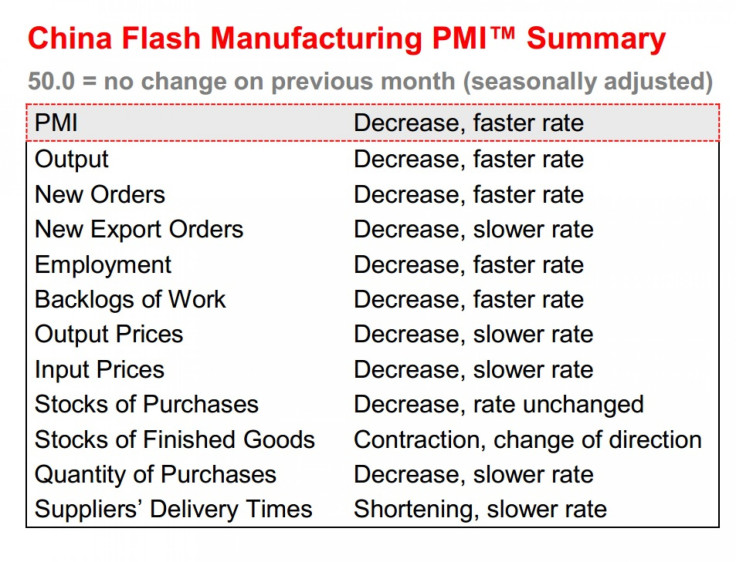

China’s manufacturing sector, in July, contracted for a third-straight month and at its quickest pace since last August, HSBC's Purchasing Managers’ Index, or PMI, released on Wednesday showed, triggering both concerns over the health of the world’s second-largest economy and hopes that Beijing would launch stimulus measures soon.

The preliminary reading of the survey for July at 47.7 -- an 11-month low -- was against market expectations for the PMI to hold steady at 48.2, and China’s Shanghai Composite index was down 1.3 percent after the news, but the data failed to significantly impact other markets in the region.

“The lower reading of the July HSBC Flash China Manufacturing PMI suggests a continuous slowdown in manufacturing sectors thanks to weaker new orders and faster destocking,” Hongbin Qu, chief economistf for China at HSBC, said in a statement. "This adds more pressure on the labor market," he added.

The flash China Manufacturing Output index for July stood at 48.2 -- a nine-month low – down from 48.6 in June, while the employment sub-index was at a 52-month low of 47.3, at its weakest level since March 2009. A reading below 50 indicates contraction while a reading above 50 indicates growth.

Most of the sub-indexes in the PMI survey fell in July, underscoring economists’ concerns that the world’s second-largest economy could miss its growth target of 7.5 percent for the year. At the same time, the slowdown has raised hopes that it will force Beijing to take strong measures to boost growth.

“As Beijing has recently stressed to secure the minimum level of growth required to ensure stable employment, the flash PMI reinforces the need to introduce additional fine-tuning measures to stabilize growth,” Qu said.

According to local media reports, China’s Premier Li Keqiang, on Monday, had said that the 7.5 percent growth target is the “bottom line” for growth and that the government would not allow the country's growth rate to fall below this threshold, and this assurance helped Asian markets rally on Tuesday.

"Such a negative scenario will not materialize and that China will announce new stimulus measures soon - modest and targeted ones but sufficient for growth to achieve this year's 7.5 percent goal. The worst the PMI the bigger the measures would be," wrote Darius Kowalczyk, strategist at Credit Agricole, CNBC reported.

Hong Kong’s Hang Seng Index was down 0.17 percent while South Korea’s KOSPI Composite index was up 0.32 percent. Australia’s S&P/ASX 200 rose 0.34 percent, while India’s BSE Sensex was trading down 1.32 percent on Wednesday. In Japan, the Nikkei lost 0.36 percent after the yen strengthened against U.S. dollar.

Earlier on Wednesday, Japan reported a 7.4 percent jump in exports helped by a weaker yen, which has depreciated more than 27 percent against the dollar over the past year. However, the data disappointed markets as analysts had expected exports to grow by 10.3 percent.

© Copyright IBTimes 2025. All rights reserved.