The Cost Of Oil Around The World: How Will OPEC React To Prices?

This article was originally published on the Motley Fool.

The Organization of Petroleum Exporting Countries (OPEC) plays a vital role in the global energy markets. The 13-member cartel includes most of the key nations of the Persian Gulf region, including Saudi Arabia, Iran, and Iraq, as well as five African countries and two in the northern portion of South America. Given the diversity of representation within OPEC, it can be difficult for the cartel to speak with one voice. OPEC does have a stated philosophy about how it thinks about oil prices, and past actions such as the oil embargo of the 1970s give the cartel a historical basis on which it often bases future decisions.

• Motley Fool Issues Rare Triple-Buy Alert

OPEC's history of managing the oil market

OPEC's mission statement makes it clear that the cartel intends to play an active role in the oil markets. OPEC's goal is "to coordinate and unify the petroleum policies of its member countries and ensure the stabilization of oil markets in order to secure an efficient, economic, and regular supply of petroleum to consumers, a steady income to producers, and a fair return on capital for those investing in the petroleum industry." Stemming from the roots of many of its member countries as colonies of Western powers such as the U.K., France, Portugal, and Spain, OPEC emphasizes the "inalienable right of all countries to exercise permanent sovereignty over their natural resources."

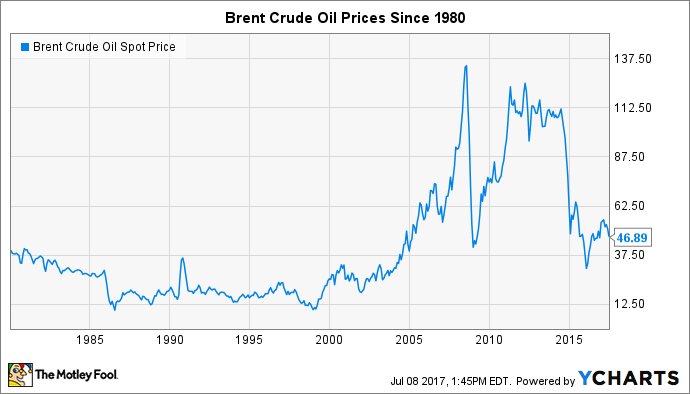

OPEC's first aggressive action took place in the 1970s. Arab countries led an oil embargo in 1973 that had a major upward impact on the price of crude in the global markets, and the outbreak of the Iranian Revolution in 1979 also led to market concerns about crude supplies that led to higher prices. After having traded for less than $10 per barrel throughout most of the 20th century, crude oil surged to as much as $40 per barrel by 1980.

• This Stock Could Be Like Buying Amazon in 1997

In the 1980s, oil prices fell from their peaks as conservation efforts took hold to reduce demand. OPEC responded with a group production ceiling that was allocated among member countries, and it also sought to coordinate with non-OPEC nations to try to impose greater stability on the energy market. The 1990s didn't see major price rebounds, in part because OPEC action mitigated what could have been a much larger impact from the First Gulf War early in the decade.

OPEC's mixed success of market control

OPEC responded to consistent weakness in oil prices by establishing price bands to target for global markets. The idea was that OPEC would remain firm with its policies as long as crude-oil prices stayed within the range, but would take action to boost or reduce production if prices fell or rose beyond the range's limits. However, the price-band practice went away in the mid-2000s, when the rise of the Chinese economy led to massive price increases as new demand for energy rattled the energy markets.

Even OPEC's production targets haven't always worked. Although the cartel has stated target levels, actual production routinely exceeds those levels, indicating that some countries aren't happy with their allocations under the targeting process.

What OPEC thinks now

Late last year, OPEC approved a long-term strategy that called for limiting supply to boost prices. The move was controversial even among member nations, with big producers such as Saudi Arabia having initially argued that supporting prices would backfire by allowing higher-cost producers to be profitable. The resulting release of supply could bring a repeat of the price plunge in 2015 and early 2016, when oil prices dropped below $30 per barrel.

One key question facing OPEC is how non-member nations will respond. Oil experts anticipate higher production from the U.S., Canada, and Brazil, and Russia also holds plenty of cards in determining the future direction of oil prices. If shale plays remain economically viable, then OPEC needs to anticipate substantial production that's out of its control, and that could make it difficult for the cartel to achieve its strategic goals over the long run.

Most analysts see OPEC walking a fine line between supporting oil prices while not allowing them to explode higher. By doing so, the cartel hopes that producers beyond its control won't count on a big boom in making decisions to expand production capacity, while still giving its member countries enough cash flow to remain financially healthy.

• 7 of 8 People Are Clueless About This Trillion-Dollar Market

OPEC has a large impact on the crude-oil market, and it will continue to wield influence over the energy sector for the foreseeable future. OPEC's control isn't complete, but energy investors still have to pay close attention to the cartel's actions in considering how to position themselves for the future of the energy industry.

The Motley Fool has a disclosure policy.