Could Ethereum Help You Retire Early?

KEY POINTS

- Ethereum is a blockchain technology platform used for trading DeFi apps and NFTs.

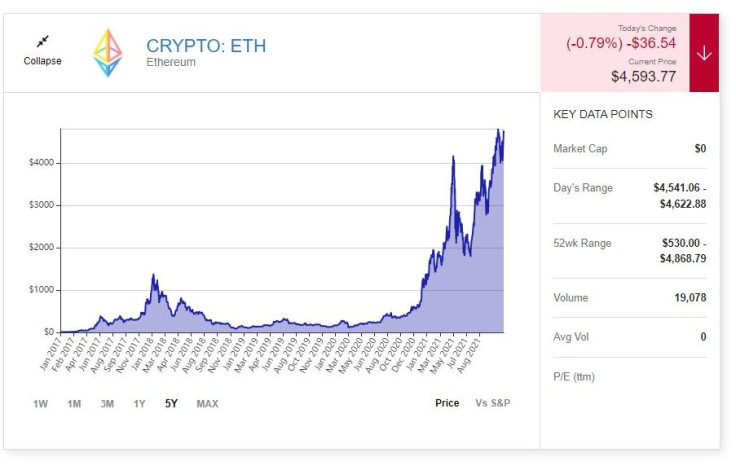

- An Ether token is valued at over $4,600, up from less than one dollar 6 years ago.

- An investment in Ethereum should be part of a diversified retirement portfolio.

Cryptocurrency investments have gotten a lot of attention lately, due in part to the huge returns that some, like Ethereum ( ETH -0.79% ) have generated.

What is Ethereum? It is a blockchain technology platform that allows software developers and programmers to create applications that can be transacted using a token called Ether. Among the items that are traded using Ether are NFTs, or non-fungible tokens, as well as decentralized finance applications. Ethereum has a market cap of about $516 billion, making it the second-largest cryptocurrency behind Bitcoin .

In this relatively new realm of cryptocurrency, Ethereum is certainly one of the mainstream options. A recent survey by Bankrate found that 49% of Millennials, 37% of Gen Xers, and 22% of Baby Boomers are comfortable investing in crypto assets. In fact, a growing number of people are considering crypto assets in their retirement portfolios. Should Ethereum be part of your investment strategy -- and could it help you retire early?

Meteoric rise

Since Ethereum launched in 2015, it has been on a rocket ship. When it debuted in August 2015, one Ether token was trading at a value of $2.77 -- and that immediately dropped to $0.75 the next day. Today, one Ether token is valued at over $4,600.

So, if you invested $100 in Ethereum back in August of 2015 at $0.75 per token, it would have bought you about 134 tokens. Those 134 tokens would be worth about $600,000 today, as each currently trades at a price of roughly $4,660 as of midday on Nov. 30. Had you invested in it back when it was valued at around $1 per token, you would surely be on your way to retiring early. But there is no sense beating yourself up over missing that boat, as most people did.

Also, keep in mind that Bitcoin was at about $8,000 per token at the beginning of 2020 and less than two years later it is at almost $60,000.

The question now is, should you invest in Ethereum -- and if so, how much?

Can you bank on it?

With just one token now trading at around $4,660, you don't have to invest that much. You can invest in Ethereum through exchanges or digital wallets for any amount you like, investing in a percentage of an ether coin.

However, investing in this relatively new asset class comes with risk. While Ethereum is the second-largest cryptocurrency, and it has a first-mover advantage, there are many new competitors that will seek to eat into its market share with faster and more efficient platforms. However, it should be noted that Ethereum is in the process of developing Ethereum 2.0, which is expected to make it more secure, scalable, and sustainable.

There are also regulatory concerns, as Congress has been mulling cryptocurrency oversight, so future legislation or regulations could have an impact.

Investors should also be prepared for wild short-term volatility, as this new industry remains very speculative. On the other hand, the industry, and Ethereum in particular, show a great deal of promise, as many believe blockchain technology will play a major role in the future of technology.

Given the uncertainty, it is not recommended to risk large portions of your retirement assets on Ethereum or any other cryptocurrency asset. But it might be something to consider as an aggressive growth option in a diversified portfolio. An allocation of up to 5% might be OK for those with a high risk tolerance, but don't invest more than you can reasonably afford to lose.

As for retiring early, investing in a diversified portfolio can get you there with patience and commitment.

This article first appeared in The Motley Fool.

This article represents the opinion of the writer, who may disagree with the “official” recommendation position of a Motley Fool premium advisory service. We’re motley! Questioning an investing thesis – even one of our own – helps us all think critically about investing and make decisions that help us become smarter, happier, and richer.

Dave Kovaleski owns shares of Ethereum. The Motley Fool owns shares of and recommends Bitcoin and Ethereum. The Motley Fool has a disclosure policy.