Emerging Market Currency Sell-off: Investors Need To Discriminate Between Individual EMs

The real lesson from the current emerging market currencies sell-off (the worst in five years) is that investors need to discriminate between individual emerging markets because the emerging world has become a far more diverse place over the past decade, according to Capital Economics.

“In the past, financial crises have tended to sweep from one EM to another, primarily because they shared many of the same vulnerabilities. The financial crisis that began in Thailand in 1997 swept through the rest of Asia, hit Russia and also caused a wobble in parts of Latin America. Today the emerging world is a very different place,” Neil Shearing of Capital Economics wrote in a note.

However, investors today are still treating the emerging world with little differentiation. Growing concerns about the impact of slower growth in China, further stimulus cuts by the U.S. Federal Reserve and mounting political problems in Turkey, Argentina and Ukraine all led to a global flight from emerging market assets.

The EM currency bloodbath http://t.co/ahDjsGSvOz pic.twitter.com/Dp7u0JFhuB

- Sam Ro (@bySamRo) January 24, 2014The Turkish lira plunged to a record low, while South Africa’s rand slumped to a five-year low and Ukraine’s hryvnia sank to a four-year low. The Russian ruble dropped to a four-year low, Brazil’s real fell to a five-month low and the Indian rupee slipped to a two-month low.

Meanwhile, Argentina’s peso suffered its steepest daily decline since the country’s 2002 financial crisis, as the South American nation’s central bank stepped back from its efforts to protect the currency.

Shearing noted that for the past three years, Argentina’s authorities have been selling foreign exchange reserves to cushion the fall in the currency that would otherwise result from a combination of capital flight and deterioration in the country’s current account balance.

The consequence has been that FX reserves have fallen from a peak of $47 billion in March 2011 to a seven-year low of $25 billion in November last year (latest data). “It seems that that the authorities have decided that the price of defending the currency is too great and have bowed to the inevitable,” Shearing said.

In light of the recent development, Shearing stressed that “the need for investors to discriminate between individual EMs has never been greater.”

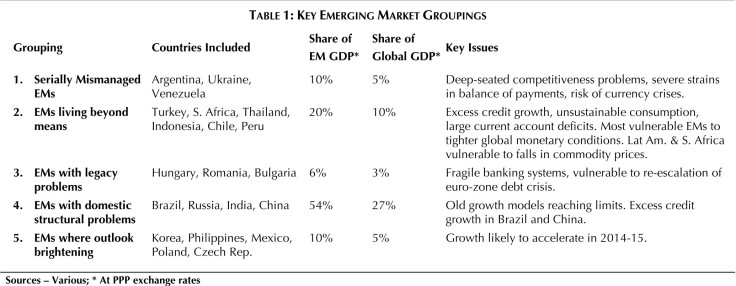

He placed the 56 emerging markets Capital Economics follows into five separate categories and listed the countries in specific groups that have been in the spotlight recently.

© Copyright IBTimes 2025. All rights reserved.