Financial Crisis Turns Five Years Old Today: Deutsche Bank Looks Back

The global financial crisis turned five years of age on Thursday, according to a report by Jim Reid, head of Global Fundamental Credit Strategy, that traces the beginning of the world's economic troubles to Aug. 9, 2007.

"It's hard to believe that it's 5 years ago today that the financial world started to appreciate the magnitude of the problems that would be the soundtrack to our lives over the last 5 years," Reid wrote, adding that "the real warning signs of trouble occurred 6 months earlier with the precipitous drops in the sub-prime indices however the global ramifications were first arguably felt on August 9th 2007 as BNP Paribas stopped withdrawals from 3 of its investment funds as it couldn't value their holdings following the subprime fallout."

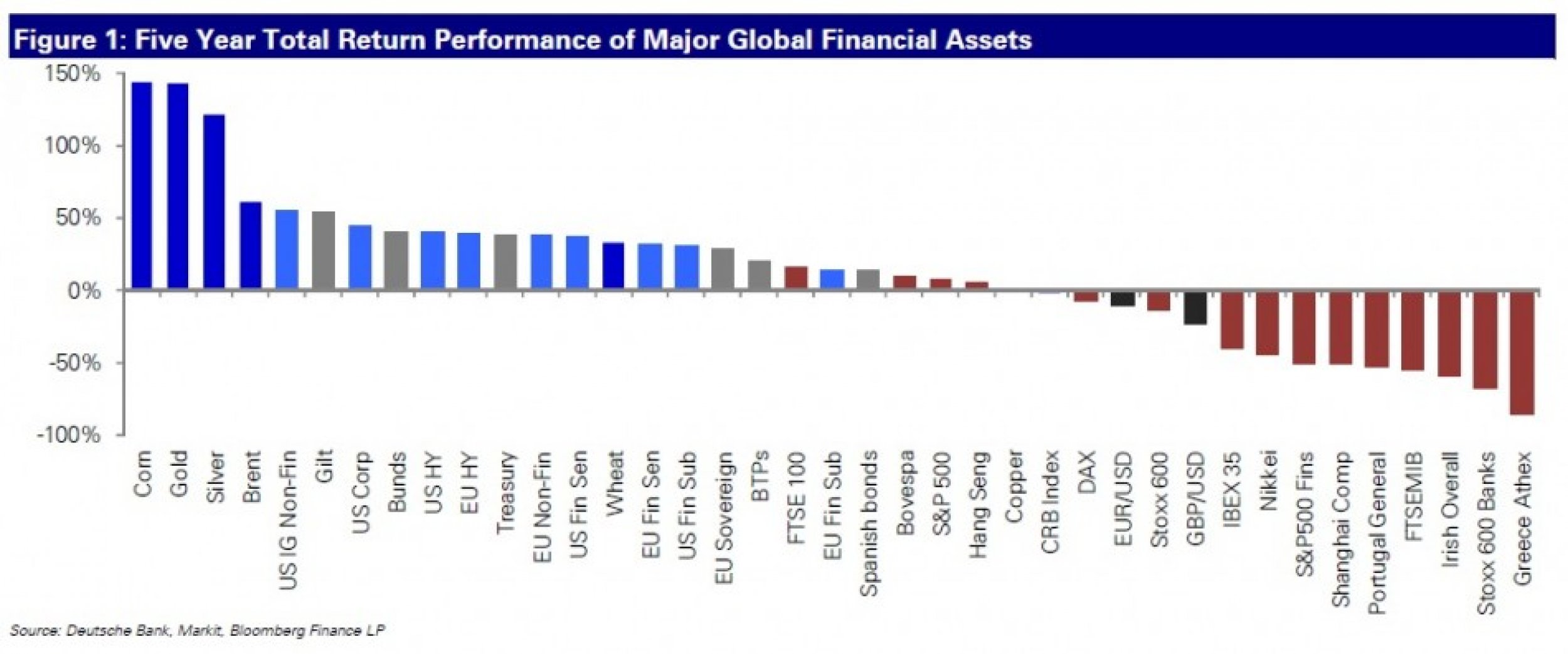

The note goes on to describe the state of various asset markets since then, as illustrated in the graph below, and notes that while stock markets have fared from poorly to horrendously, "Overall one would have to say that for many commodities and most fixed income assets, it's been a pretty good 5-year crisis."

The market has especially seen an appetite for certain food-based commodities, like corn, and given current global conditions, including a massive drought that is hitting agricultural commodities in the United States, that pattern seems likely to hold.

Investors might find it useful to consider, however, that five year olds are quite finicky about food.

"Five-year-olds may begin to really develop and assert their food preferences. Many kids who happily gobbled up vegetables as toddlers and preschoolers may suddenly decide that they only want pasta with butter and cheese -- for every meal, every day," warns About.com's guide to parenting five-year olds.

Forewarned is forearmed.

© Copyright IBTimes 2025. All rights reserved.