Kansas City Fed Jackson Hole 2012: Ben Bernanke Will Likely Disappoint On QE3 Hopes

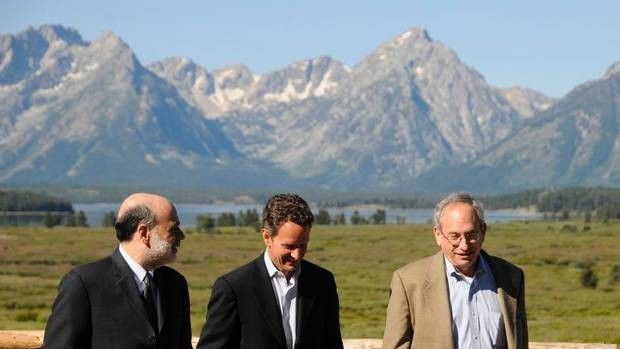

Federal Reserve Chairman Ben Bernanke's much-anticipated speech on Aug. 31 at the Federal Reserve Bank of Kansas City Economic Symposium in Jackson Hole, Wyo., has every one in "wait mode."

The Fed Chairman's speech, scheduled at 10 a.m. E.T., follows weeks of speculation about whether the central bank will carry out a third round of quantitative easing, or QE3.

While this topic should give Bernanke plenty of room to review both the actions the Fed has taken to date and to discuss what remains in its "toolkit," economists and Fed watchers think investors looking for him to lay out specific plans for new stimulus are probably in for a disappointment.

"We anticipate a relatively dovish speech, signaling a high probability of additional Fed easing at their Sept. 12-13 meeting," Ethan Harris, North American economist at Bank of America Merrill Lynch, wrote in a report. "While a change in the Fed's rate guidance is very likely, Bernanke is probably not ready to pre-announce QE3. Hence his remarks could disappoint the markets."

The central bank bought $2.3 trillion of debt from 2008 to 2011 in two rounds of quantitative easing. It has also kept its benchmark interest rate at zero to 0.25 percent since December 2008 and has pledged to hold it there until at least 2014.

Bernanke's speech on Friday is the headline act, but investors were also keen to hear what European Central Bank President Mario Draghi has to say about the ECB's options for aiding the European debt crisis.

However, Draghi canceled his trip to Jackson Hole as he prepares for a meeting of the ECB's Governing Council that may see him announce details of a new bond-buying program. A spokesman in Frankfurt said Draghi won't go because of the "heavy workload" foreseen in the next few days.

While none of ECB's six-member Executive Board members will attend Jackson Hole, Bundesbank Chief Jens Weidmann, a member of the Governing Council, still plans to attend.

Bank of England's superstar Executive Director for Financial Stability, Andy Haldane, is also going.

The Fed signaled last week it's ready to take further steps to spur the economic recovery. The Aug. 1 Federal Open Market Committee minutes noted that "many members judged that additional monetary accommodation would likely be warranted fairly soon unless incoming information pointed to a substantial and sustainable strengthening in the pace of the economic recovery."

"This is a very strong easing bias. Thus, one question the markets will be looking for Bernanke to address is what conditions would lead the Fed to follow through with additional accommodation fairly soon? A second is what form any accommodation would take," Harris said.

Conventional wisdom views Bernanke's speech at Jackson Hole as a reliable signal of future Fed policy. However, a review of recent speeches done by Harris and his colleagues suggests it has not been quite so clear an indicator in real time.

For example, in 2010 Bernanke emphasized the cost-benefit trade-off for various tools, and the Fed did not implement QE2 until more than two months later. In 2011 he put substantial focus on the need for fiscal policy action and argued that "monetary policy is not a panacea." A repeat performance would likely result in markets pricing lower the probability of near-term Fed QE.

If Bernanke's speech on "Monetary Policy Since the Crisis" this Friday turns out to be just a walk down memory lane, the market would obviously be disappointed.

Bernanke has already done two retrospectives on what the Fed has done. In March he gave a series of lectures at George Washington University, with the last one on "The Aftermath of the Crisis" that described and defended the Fed's actions since late 2007. Then in April he gave a speech entitled, "Some Reflections on the Crisis and the Policy Response," although that speech focused on the emergency liquidity tools rather than the subsequent accommodating policy stance.

Market expectations about near-term Fed easing seem to be quite high going into the meeting. According to Bank of America Rates Strategists Priya Misra's estimates, the bond market is pricing in about an 80 percent chance of QE at one of the next several meetings.

Bank of America's U.S. equity strategist Savita Subramanian is also concerned about excessive optimism in the stock market. Stocks are more than 10 percent above their early June lows, despite generally disappointing data.

Presumably this reflects both the relative calm in Europe and expectations of QE3. If Bernanke does disappoint, one or both of the equity or rates markets could weaken modestly, according to Harris.

Harris expect Bernanke to take three further steps at Jackson Hole.

First, underscore the bias statement in the minutes: If the economy does not improve substantively we will ease further. Second, discuss the Fed's options in greater detail, building on some of the discussion already noted in the minutes. Third, argue vigorously that unconventional policy is both necessary and effective.

However, Harris does not expect an outright signal of QE3.

Furthermore, Bernanke will likely remind everyone that monetary policy is not a panacea and will likely point to the pressing need to deal with the fiscal cliff. Bernanke is also likely to note that unconventional policy comes with costs as well as benefits.

© Copyright IBTimes 2025. All rights reserved.