Raytheon Sells Military GPS Business, After Cutting 8,000 Aerospace Jobs

KEY POINTS

- The military GPS business comprises a workforce of 700 employees

- Raytheon posted adjusted earnings of $0.40 per share on sales of $14.1 billion in the second quarter

- United Technologies Corp. and Raytheon merged to form Raytheon Technologies in June.

Raytheon Technologies (RTX) completed the $1.9 billion sale of its military global positioning system business to Britain’s BAE Systems on Friday.

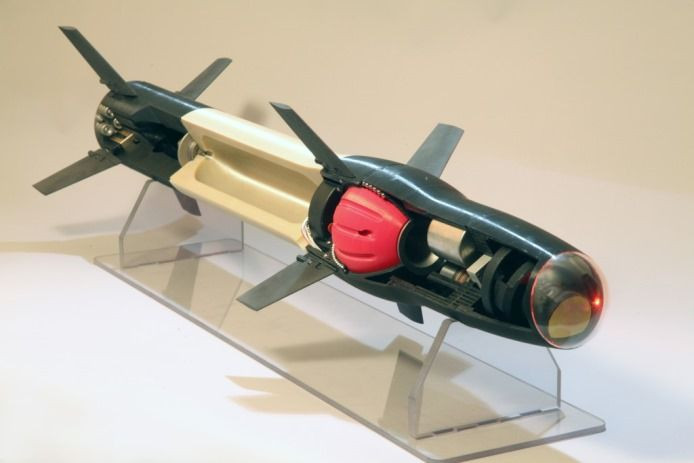

The military GPS business, which designs and builds advanced, hardened, secure GPS products, comprises a workforce of 700 employees.

“This partnership will enable us to build on our market leadership and bring new discriminating capabilities to our customers, including the U.S. Department of Defense and its allies,” said Greg Wild, director of Military GPS. “We’re excited to be joining the BAE Systems family. They appreciate our legacy of innovation and will provide opportunities for continued business growth and success.”

The transaction comes in the wake of the merger of defense contractors United Technologies Corp. and Raytheon to form Raytheon Technologies in June. The U.S. Department of Justice approved that merger in March, but conditioned it upon the divestiture of UTC’s military GPS business, among other things.

Earlier this week, Raytheon said it cut 8,000 jobs in its commercial aviation division due to the decimation of air travel.

The coronavirus’s impact on plane travel “has proven to be a lot worse” than what Raytheon originally expected, Raytheon Chief Executive Officer Greg Hayes said.

“Looking ahead, we expect the pressures in commercial aerospace to persist as [original equipment manufacturer] production levels and aftermarket activity remain low,” he added. “As a result, we are taking difficult but necessary actions to strengthen the business, including achieving the previously announced cost and cash savings this year.”

General Electric’s (GE) aviation unit, which competes with Raytheon, said it would cut 13,000 jobs – about a quarter of its workforce.

On Wednesday, Raytheon said it posted adjusted earnings of $0.40 per share on sales of $14.1 billion in the second quarter.

"During the quarter, we continued to deliver good performance in our defense business, while we saw challenges in commercial aerospace as expected," Hayes said. "Our balance sheet remains strong and the resiliency of our defense business will help us weather this storm as we continue to capitalize on growth opportunities supported by our record backlog.”

© Copyright IBTimes 2025. All rights reserved.