RIM Activist Investor Wants New CEO or Sale Now

BlackBerry developer Research in Motion (RIM) needs a new transformational CEO or to be put up for auction now, Toronto activist investor Victor Alboini told IBTimes.

The board needs to evaluate strategic options including whether to sell the company, Alboini said. Last month, Alboini, through his Jaguar Financial investment unit, bought a stake in RIM, which he said still remains below 5 percent.

Alboini told IBTimes he's been in touch with many other institutional investors about RIM, although he declined to identify any of them. Now would be idea for a takeover, he added.

Shares of Waterloo, Ontario-based RIM plunged about 23 percent in early Friday trading after the company reported second-quarter results that missed analysts' diminished expectations.

In early U.S. trading, RIM shares were at $23.12, down $6.44.

Alboini, a BlackBerry devotee who said he's been in touch with other investors in Canada and the U.S., said RIM's board needs to remove co-CEOs Michael Laziridis and James Balsillie, who also founded the company, and replace them with someone from outside who might be able to execute a turnaround.

Alternatively, with the company's market capitalization around $11.9 billion now, a technology suitor like Samsung Electronics, Microsoft or Nokia might be tempted into a takeover bid for all of Research in Motion, particularly because of its continuing hold of the enterprise e-mail market.

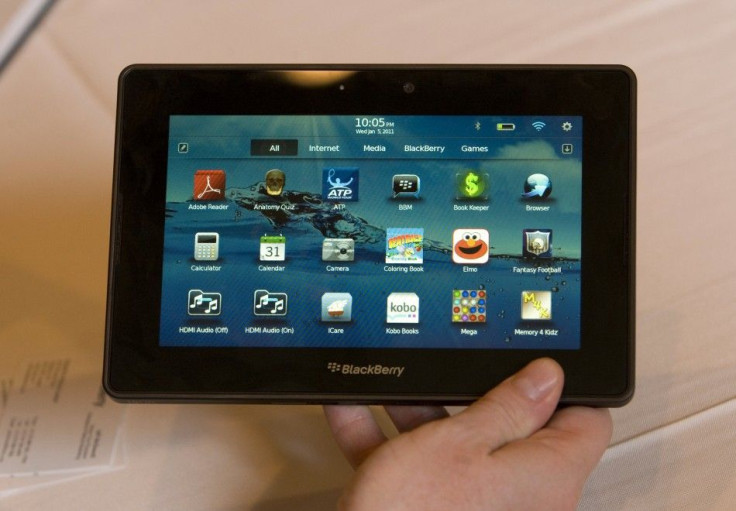

RIM made a mistake in shipping the BlackBerry PlayBook before it was ready, Alboini told IBTimes. The current version can't synchronize e-mail with BlackBerrys, which makes it a pointless purchase, he said.

That may be one reason why RIM shipped only 200,000 PlayBooks in the quarter, less than half what analysts expected. It shipped more than 10.2 million BlackBerries.

Alboini didn't criticize the $780 million RIM disclosed it paid for a group of 4,500 wireless patents from Nortel Networks. It was part of a syndicate that included Apple, Microsoft and Ericsson that paid a total of $4.5 billion for them.

Intellectual property is a very valuable asset right now, the Canadian mergers and acquisitions specialist said. Coupled with RIM's own portfolio, the patents would only make the company more attractive to a bidder.

Alboini told IBTimes Microsoft, which released its Windows 8 OS for tablets this week, and Samsung Electronics, ought to be invited to look at RIM first, along with Finland's Nokia. He didn't mention whether Ottawa would permit a foreign takeover of one of Canada's most successful companies.

He also said RIM's sales of more than 56 percent of products outside North America and the U.K. demonstrates the global appeal of the BlackBerry. RIM said traditional strong markets in Indonesia and China had continued to do well in the quarter.

The enterprise value of RIM, based on early Friday trading, is $13 billion, the amount investment bankers evaluate in any takeover or break-up analysis.

© Copyright IBTimes 2025. All rights reserved.