Stocks Sink Amid Commodities 'Melt-up' Rally As War Rattles Markets

Stocks sank to one-year lows in Europe on Friday when bonds, commodities and crude rallied as investors ran for cover in the face of escalating war in Ukraine, with Russia seizing a big nuclear plant.

The rout in Asian and European stocks were set to spillover into Wall Street, with U.S. stock index futures down about 0.7%.

The STOXX index of 600 European companies was sank 3% to 424 points, its lowest levels since late March last year, leaving the benchmark down 14% in correction territory, meaning 10% or more below its January record high.

Euro zone banks, whose exposures to Russia are being closely watched, sank 5%.

The MSCI All Country stocks index shed 1% to 684 points, down just over 10% for the year.

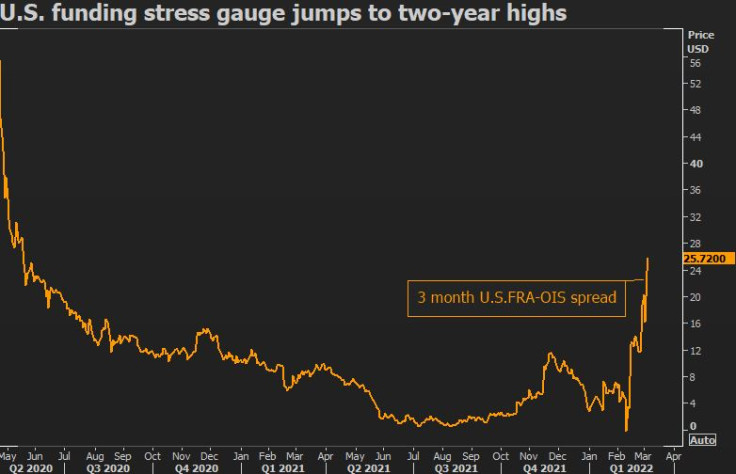

Worries about how Russia's invasion of Ukraine will develop rippled across asset classes, with a closely watched measure of money-market stress and dollar funding conditions rising to its highest level since May 2020, reflecting increased risk of banks hoarding the greenback and thereby squeezing liquidity.

Euro zone government bond yields fell, and the euro was poised for its biggest weekly fall in seven years against the Swiss franc, and down to levels seen in May 2020 against the dollar as investors worried that higher commodity prices will dent European Union growth.

"It shows how skittish things are and we are not in normal times," said Mike Kelly, head of global multi-asset at PineBridge Investments.

With a 25 basis point interest rate increase by the Federal Reserve later this month now all but certain, economic data like U.S. non-farm payrolls on Friday before the opening bell on Wall Street were taking a back seat, said Michael Hewson, chief markets analyst at CMC Markets.

"You have escalating inflation risk, you have huge uncertainty about what's going to happen next on the headline front, and a Russian president who wouldn't rule out nuclear weapons - that is a pretty toxic backdrop," Hewson said.

Graphic: fRAOIS:

COMMODITIES 'MELT-UP'

BofA said the widely-tracked CRB commodity index has seen its strongest start to any year since 1915 amid worries over supplies from Russia, one of the world's biggest exporters of raw materials.

"We are seeing the commodity 'melt-up' continue with no sign of a let-up," ED&F Man Capital Markets wrote in a note.

Crude oil, which has hit its highest level in a decade this week, was set for its strongest weekly gains since mid 2020, while corn hit a 10-year high, with wheat futures up 40% on the week.

Aluminium touched a record high in London and is heading for its biggest weekly gain on record amid fears of a squeeze in the metal from Russia. Nickel reached an 11-year high for similar reasons.

"People came into this situation thinking commodities had had enough of a run already but the war has added a new lease of life," PineBridge's Kelly said

"Skyrocketing inflation is what people fear and the best hedge for that is energy and industrial metals," Kelly said.

On the economic data front, the U.S. employment report on Friday is expected to show another month of strong job growth, with a wave of Omicron COVID-19 variant infections significantly diminished.

Graphic: worldstockmarketcap:

CRUDE AND GOLD FIRM

Investors sought refuge in safe-haven U.S. Treasuries, sending yields on benchmark 10-year yields lower to 1.7854%. Oil prices firmed, with the market also focused on whether the OPEC+ producers, including Saudi Arabia and Russia, would increase output from January.

Brent crude futures for May rose 2% to $112.59 a barrel.

Gold prices also rose on Friday, eyeing their best weekly gain since May 2021. Spot gold gained 0.6% to $1,947.

MSCI's broadest index of Asia-Pacific shares ex-Japan tumbled as much as 1.5% to 585.6, the lowest level since November 2020, taking the year-to-date losses to 7%.

Stock markets across Asia were in a sea of red, with Japan losing 2.2%, South Korea 1.1%, China 0.9% and Hong Kong 2.5% while commodities-heavy Australia was down 0.6%.

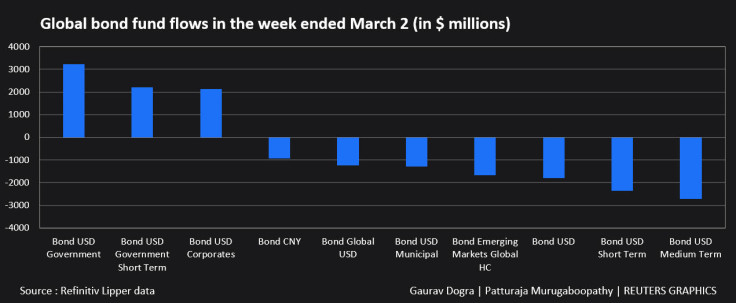

Graphic: Global bond fund flows in the week ended March 2:

© Copyright Thomson Reuters {{Year}}. All rights reserved.