U.S. Labor Market Still Tight As Job Openings Remain Elevated

U.S. job openings fell less than expected in May, pointing to a still tight labor market that could keep the Federal Reserve on an aggressive monetary policy path as it battles high inflation.

Though a survey from the Institute for Supply Management on Wednesday showed its measure of services sector employment contracted in June for the third time in the last five months, businesses complained they were "unable to fill positions with qualified applicants," and that "demand for talent is higher."

The Fed is trying to cool demand for labor and the overall economy to bring inflation down to its 2% target.

"As long as the labor market remains strong, the Fed is likely to keep interest rates moving upward to slow activity down," said Christopher Rupkey, chief economist atFWDBONDS in New York. "The data today still argue for a 75-basis-point rate hike later this month rather than 50 basis points."

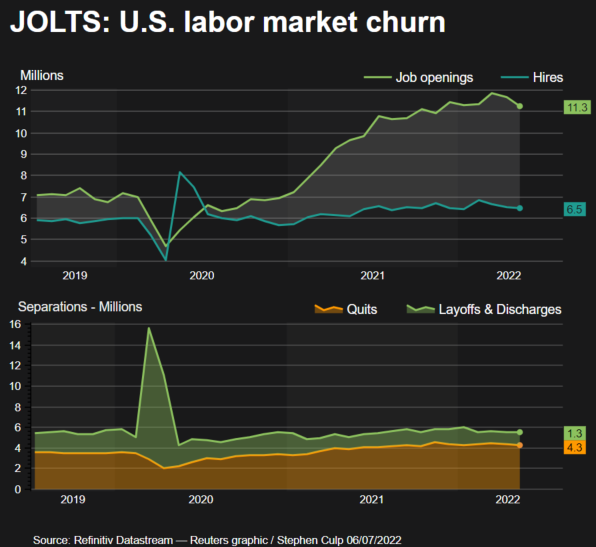

Job openings, a measure of labor demand, dropped 427,000 to 11.3 million on the last day of May, the Labor Department said in its monthly Job Openings and Labor Turnover Survey, or JOLTS report. It was the second straight monthly decline in job openings after a record high of 11.9 million in March.

The decrease in vacancies was led by professional and business services, with 325,000 fewer job openings. Job openings at manufacturers of long-lasting goods dropped 138,000, while there were 70,000 fewer unfilled positions in the nondurable goods manufacturing industry.

Economists polled by Reuters had forecast 11.0 million vacancies. The job openings rate fell to 6.9% from 7.2% in April. Hiring was little changed at 6.5 million.

GRAPHIC:

The U.S. central bank last month raised its policy rate by three-quarters of a percentage point, its biggest hike since 1994. Another similar-sized rate hike is expected in July. The Fed has increased its benchmark overnight interest rate by 150 basis points since March.

Rising interest rates, inflation and tighter financial conditions have darkened the economic outlook, with consumer spending rising modestly in May and housing starts as well as building permits and factory output softening.

That is hurting business sentiment, resulting in layoffs in the housing and technology sectors. Some technology companies have also been freezing hiring. But worker shortages persist in other industries despite recession fears stalking the economy.

Job openings increased in the trade, transportation and utilities sector in May. There were more unfilled jobs in the leisure and hospitality industry as well as healthcare and social assistance.

There were 1.9 job openings for every unemployed worker in May, underscoring the labor market's tightness.

Stocks on Wall Street were trading mostly lower. The dollar rose against a basket of currencies. U.S. Treasury prices fell.

GRAPHIC:

SERVICES HUMMING ALONG

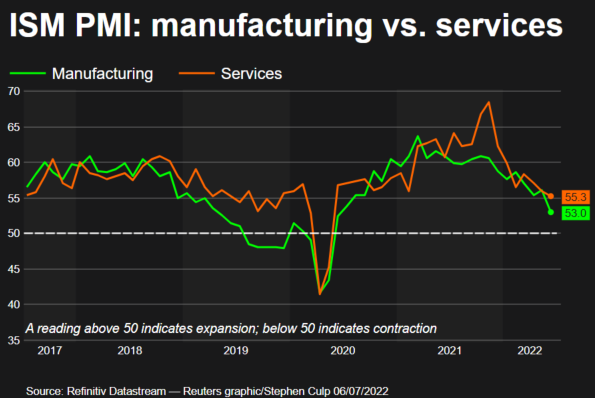

A separate report from the Institute for Supply Management on Wednesday showed its non-manufacturing activity index slipped to 55.3 last month from a reading of 55.9 in May. The third straight monthly decline pushed the index to its lowest level since May 2020, when the economy was battling the initial wave of the COVID-19 pandemic.

Economists had forecast the non-manufacturing index would decrease to 54.3. A reading above 50 indicates expansion in the services sector, which accounts for more than two-thirds of U.S. economic activity. The sector is being underpinned by a rotation in spending back to services from goods.

The survey's services industry employment gauge dropped to 47.4, the lowest reading since July 2020, from 50.2 in May.

It was the third time this year that the index has dropped below 50 and largely reflected worker shortages. Businesses in the survey noted that it was "extremely hard to find truck drivers," and that "availability of candidates to fill open roles continues to keep employment levels from increasing."

With the labor market still tight, voluntary resignations remained high. About 4.3 million people quit their jobs in May, little changed from April.

Though layoffs and discharges increased by 77,000 to 1.4 million, they remained low by historical standards. They increased in the wholesale trade industry and the federal government.

© Copyright Thomson Reuters {{Year}}. All rights reserved.