What Is A DAO Or Decentralized Autonomous Organization?

When Bitcoin first launched in 2009, it sparked an imagination of what else is possible to achieve with blockchain technology. After all, Bitcoin's blockchain was specialized to produce a counter-inflationary cryptocurrency, but other blockchains can produce something else entirely.

With the onset of smart contracts, pioneered by the Ethereum blockchain, that something became DAO — Decentralized Autonomous Organization. Inheriting blockchain's property of decentralization, a new kind of governance rose to prominence.

DAO as higher level DApp explained

Smart contracts are used for any human activity that can be described in legal terms. And if something can be legally constructed, it can also be translated into digital code. After all, natural language itself is a type of code. From this, we gained cryptocurrency at the most basic level of recording transactions and limiting coin issuance.

Higher up, we gained decentralized exchanges, borrowing and lending protocols, and even blockchain games. When connected to a web interface, these smart contracts transformed into DApps.

Although less popular, smart contracts also found their way to provide community governance. This is where DAO, the Decentralized Autonomous Organization, comes in. Because they are powered by smart contracts, DAOs are:

- Autonomous: It governs itself without the input of central authority

- Decentralized: Community members vote on proposals and changes via tokens

- Transparent: Smart contracts remove the possibility of corruption and underhanded behavior

Anyone holding DAO tokens becomes a community member of that DAO, while smart contracts for that particular DAO set the baseline rules, such as how many votes are needed to pass a proposal. Therefore, for the proposal to pass, it has to pass a consensus, just like in a real-world parliament.

When such a rule goes through, smart contracts integrate it, and it becomes a new baseline for the organization. From this method, we gain a new type of governance. Whether it is a government, family, or a corporation, the default organization in human society has always been a hierarchical one.

With smart contract DAOs, it became possible for the first time in history to change this dynamic.

At their peak in November 2021, DAOs held $13.2 billion AUM (assets under management). As of Feb. 1, DAO projects account for $9 billion. Just over 35 percent of DAOs hold over $1 million in their treasuries.

Inner workings of DAOs

The question that arises when ascertaining DAOs is how decentralized they really are? Of course, when they start, they are highly centralized because the core development team lays out all the baseline rules. Likewise, they hold 100 percent of tokens before DAO launches on public mainnet, and they are issued.

However, because smart contracts are embedded in a blockchain, all the rules are publicly visible and the code itself can be audited. If the baseline rules for the project meet market demand, DAO then goes through the next phase, attracting funds and issuing tokens to grant governance rights.

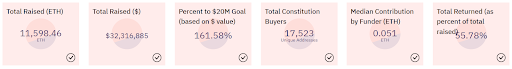

Case in point, ConstitutionDAO was created to buy a rare copy of the U.S. Constitution. The idea was so popular that the initial funding overshot by 137 percent, to $47.4 million (at the time, ETH price was much higher) total funding.

Unfortunately, the CEO of Citadel Securities, Kenneth Griffin, ended up outbidding ConstitutionDAO. However, thanks to the power of tokens, the proceeds are in the process of returning to them. Reminder, the word token means a representation of staking or equity. In the blockchain world, tokens themselves are ERC-20 smart contracts that interact with other smart contracts.

Therefore, tokens (smart contracts) interact with DAO's core smart contract to transparently manage and govern a project. Although ConstitutionDAO failed, it did so because of a billionaire, not because of the concept itself. Likewise, we may see Blockbuster video-chain revived with BlockbusterDAO.

This relatively recent DAO aims to buy Blockbuster IP from its current owner, Dish Network, and create a self-governing platform for funding indie movies, as well as funding a digital distribution platform akin to Netflix.

When are we successful?

— R3WIND (@R3WINDxyz) December 26, 2021

When we win an Oscar AND a Golden Globe for a Blockbuster Original Film.

When we reach $1B in Annual Reocurring Revenue (ARR).

When we lead all DAOs in Total Value Locked (TVL).

To summarize how DAOs work in brief points:

- Development team creates a set of rules, smart contracts, for a specific or generalist project

- DAO receives funding by token issuance when launching on public mainnet

- People who want to have their say in the project buy these tokens to gain voting rights

- With DAO treasury filled, they can be used to fulfill the DAOs initial goal

The robust elegance of DAO comes from the fact that once the rules are set, they cannot be changed, even by the creators. Because of token distribution, they now hold the power of change in their wallets. Of course, holders with more tokens gain more voting rights.

How to get started with DAOs?

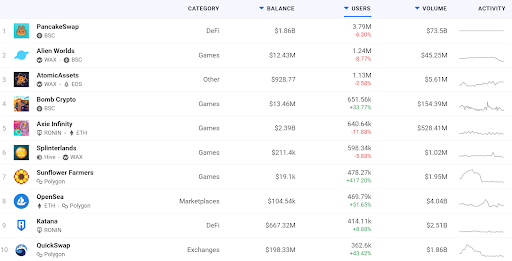

The first thing to look up is the DAO aggregator that lists all the DAOs across categories, giving you a nifty overview. One such site is DeepDAO.io. For instance, if you are into NFTs, Rarible (RARI) token gives you voting rights on the Rarible platform and rewards you with tokens when you trade with NFTs.

As you can see, DAOs can be used to govern all types of activities available in the blockchain space, whether it is financial, charity, or gaming. One of the most popular DAOs not listed is MakerDAO, which generated the world's first decentralized stablecoin DAO.

It is up to you which DAO project fits your interests best. With a MetaMask wallet, it is easy to connect to each one and gain voting rights and rewards.

Rahul owns no cryptocurrencies.

International Business Times holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

© Copyright IBTimes 2025. All rights reserved.