Why HP Shares Gained: Investors Bet on Recovery

Shares of Hewlett-Packard closed up 3.6 percent over their Friday close, when they were hammered after the company announced the demise of the TouchPad.

Shares closed Monday at $24.45, a decent recovery from Friday's $22.75. They traded as high as $25.23.

Bargain hunters made HP the sixth most actively traded issue on the NYSE. It was the top gainer among the Dow Jones Industrials, which rose 37 points. Shares of tablet leader Apple rose 41 cents to $356.44.

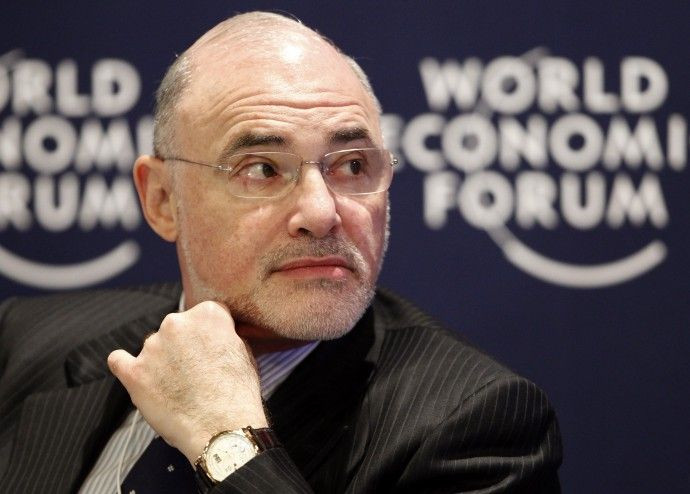

Several analysts reviewed the stock and rated HP a buy, among them Gleacher's Brian Marshall -- who set a new target price of $39, down from $50, based on new CEO Leo Apotheker's decision to exit the tablet business and spend $10.3 billion to acquire Autonomy, a British software company that adds high-value content.

HP has been the most aggressive [company] at expanding its enterprise infrastructure portfolio and offers the most room for improvement at an attractive valuation, Marshall wrote to investors.

While No. 2 IBM is already better-positioned in the same space, HP -- whose shares dropped 20 percent Aug. 19 -- is a better value, the analyst said, because the shares are priced more attractively.

Palo Alto, Calif.-based HP holds the dubious distinction of possessing one of the lowest valuations of any technology company, Marshall said. The hammering simply priced the overall enterprise value of HP at attractive levels.

HP's August bashing wasn't the first time the shares had been punished after poor third-quarter results or predictions. Apotheker and HP Chairman Ray Lane also said they plan to meet with big HP shareholders as this week to further discuss their strategy. Lane, a former president of Oracle, told the Financial Times, changes of this magnitude are hard to comprehend and swallow at the current share price.

The vast majority of HP shares are owned by big institutions, about 75 percent, which should allow for the investor calls to be made quickly.

At the same time, there are risks HP will fail to execute its new strategy, which also includes exiting the PC business, either via a sale or spinoff to shareholders. HP currently is the world's biggest PC maker, ahead of Dell.

Also, adding Autonomy to HP's software, middleware and enterprise products and refocusing the company on the corporate market might not pan out, Marshall said.

Another risk could be if the company's printer business, long the world's biggest and a source of high profit, comes under pressure from HP's longtime partner, Canon, or rivals, including Lexmark, Xerox, Seiko Epson and Samsung.

© Copyright IBTimes 2025. All rights reserved.