2 Ways To Get Out Of Paying Taxes On Your Social Security Benefits

Taxes are an unpleasant -- but essential -- part of life. And unfortunately, you won't be able to escape them even in retirement.

Not only could you be faced with income taxes if your savings are stashed in a 401(k) or traditional IRA, but you may also have to pay taxes on your Social Security benefits. Considering half of baby boomers expect their benefits to make up the majority of their income in retirement, according to a survey from American Advisors Group, taxes could put a serious damper on your senior years.

However, if you're strategic about it, you may be able to avoid taxes on your benefits altogether. Here's how.

1. Make sure your income is below the federal income limit

Your benefits may be subject to both federal and state taxes, and the amount you pay in federal taxes (if you owe them at all) depends on how much you're earning.

To determine whether you owe federal taxes on your benefits, you'll need to know what's called your "combined income" -- which consists of your adjusted gross income, your nontaxable interest, and half of your annual Social Security benefit amount. So, for example, if you're receiving $20,000 per year in benefits and withdrawing $30,000 per year from your 401(k), your annual combined income would be $10,000 + $30,000, or $40,000.

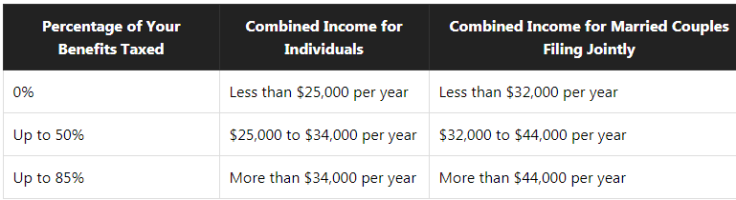

The good news is no matter how much you're earning, you won't have to pay federal taxes on 100% of your benefit amount. But you may face taxes on up to 85% of your benefits if you're earning above a certain limit:

The only way to get out of paying federal taxes entirely is if you're earning less than $25,000 per year (or $32,000 per year for married couples) in combined income. For most people, it's not worth intentionally keeping your income that low just to avoid paying taxes on it.

However, there is one caveat: Qualified Roth IRA withdrawals generally don't count toward your combined income. That means if you're strategic about your retirement withdrawals, you can earn more than the income limit while still avoiding taxes. It's also a good incentive to start saving in a Roth IRA now, because it can help you get out of paying income taxes and Social Security taxes in retirement.

2. Move to a state that doesn't tax benefits

Regardless of whether you owe federal taxes on your benefits, you may be able to get out of paying state taxes depending on where you live. Not all states have a Social Security tax, and the states that currently do not tax benefits include:

Also, West Virginia will be added to the list in the near future. As a result of a bill that passed in early 2019, taxpayers will be able to avoid paying taxes on 100% of their Social Security benefits by 2022 -- good news for soon-to-be retirees in the state.

Retirees in Illinois, however, should keep an eye out for changes in their tax laws. Although Social Security benefits currently aren't taxed at the state level, there's a chance that may change. Because the state is struggling financially, some lawmakers are considering taxing benefits to bring in extra income. That may or may not happen, but if you're planning on retiring in Illinois, it's a good idea to consider how Social Security taxes could affect your retirement.

Looking at the big picture in retirement

Although lowering (or eliminating) taxes is a great way to stretch your retirement income, it's important to look at the big picture to see if there are other ways to maximize your money.

For example, if you currently live in a state that taxes benefits, you may consider moving to a different state to avoid handing over that cash to Uncle Sam. But before you start packing your bags, make sure you've considered your entire financial situation. If the overall cost of living is higher or you'll face other hefty taxes -- like sky-high property taxes -- in your new state, the Social Security tax break you receive may not be worth it.

Additionally, think about whether there are any other ways to reduce your taxes in retirement. Investing in a Roth IRA is one way, but you may also choose to invest in a health savings account (HSA). HSAs allow you to invest tax-deductible dollars, let that money grow over time, and then withdraw it tax-free as long as it goes toward medical costs. Since healthcare costs can be significant in retirement, saving money on taxes can help stretch your savings even further.

If Social Security benefits are going to be a significant source of income in retirement, it's crucial to maximize them the best you can. Saving money on taxes is one way to do that, but it's also important to be strategic about your entire retirement plan. By going into your senior years with a solid understanding of how taxes will affect your retirement income, you'll be more prepared for any challenges life throws your way.

This article originally appeared in the Motley Fool.

The Motley Fool has a disclosure policy.