After Alphabet, It's Microsoft's Turn To Disclose Cloud Revenue

In a major win for investor transparency, Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) officially disclosed YouTube and Google Cloud revenue when it reported fourth-quarter earnings results earlier this week. Investors and regulators have been pressuring the company for years to share those figures, which Alphabet stubbornly resisted. That all changed when Alphabet promoted Google CEO Sundar Pichai to Alphabet CEO at the end of 2019, with co-founders Larry Page and Sergey Brin stepping aside from daily operations.

MarketWatch astutely points out that the move was inevitable, since Alphabet's long-standing rationale for obfuscating the figures was that Page himself didn't even know detailed segment results. Having an absentee chief executive was already a poor excuse for withholding information from investors, but Pichai was more involved, and as soon as he became Alphabet's primary decision-maker, the writing was on the wall.

How Google Cloud compares to AWS

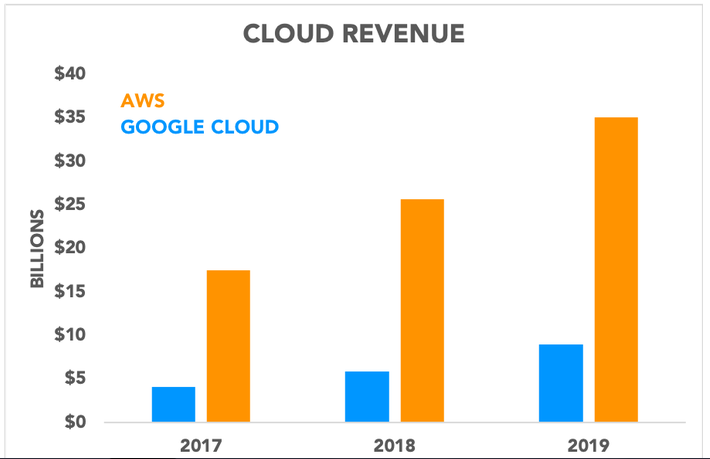

Amazon.com (NASDAQ:AMZN) is the undisputed leader in the market for cloud infrastructure. Amazon Web Services (AWS) enjoys roughly 50% market share, easily dwarfing rivals, including Microsoft (NASDAQ:MSFT) Azure and Google Cloud. It comes as no surprise that Google Cloud revenue is much smaller than AWS, but now investors know exactly how big that gap is.

Google Cloud generated $8.9 billion in sales last year, a fraction of the $35 billion in revenue that AWS brought in. While Amazon provides operating income for its cloud segment, Alphabet does not, so investors can't directly compare profitability. Amazon recently adjusted the estimated useful life of its servers, which will spread out depreciation expense and bolster AWS profitability. Amazon first disclosed AWS numbers back in 2015, as its cloud-computing business was clearly becoming increasingly important to the bottom line.

"Given our position as a challenger, we're investing aggressively, focused on building out our go-to-market capabilities, executing against our product road map and extending the global footprint of our infrastructure focused on 21 markets and six industries," CFO Ruth Porat said on the conference call with analysts. Porat also added that the company continues to hire aggressively, with Google Cloud being among the divisions with the "most sizable head count increases."

Your turn, Microsoft

That brings us to Microsoft, which has similarly withheld detailed numbers for its booming Azure cloud business for years. The enterprise software juggernaut does disclose revenue for its broader intelligent cloud segment (which includes Azure), as well as Azure's revenue growth.

Intelligent cloud revenue was $11.9 billion last quarter, while Azure revenue jumped 64% on a constant currency basis. However, lacking the context of Azure's revenue base, knowing the growth rate is of limited use for investors. Additionally, Microsoft CEO Satya Nadella certainly knows how big that business is -- prior to being named CEO, Nadella was the executive in charge of Azure -- so the company can't use Alphabet's excuse.

With its two biggest cloud rivals disclosing cloud revenue, it's time for Microsoft to follow suit.

This article originally appeared in the Motley Fool.

Evan Niu, CFA owns shares of Amazon. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), Amazon, and Microsoft and recommends the following options: long January 2021 $85 calls on Microsoft and short January 2021 $115 calls on Microsoft. The Motley Fool has a disclosure policy.