Analysis: Potential U.S. Recession Could Feed An Already Vicious Bear Market

The prospect of a U.S. recession could mean more pain for battered stocks, despite a recent rebound that has taken the benchmark index to its highest level in more than a month.

Data on Thursday showed the U.S. economy contracted for the second straight quarter - fulfilling an often-cited definition of a recession. Robust job growth accompanying the current slowdown has sparked debate on whether the economy is actually in a recession this time around, and the official arbiter of recessions - the National Bureau of Economic Research - has not yet declared one.

If the U.S. does turn out to be in a recession, however, history shows the rough ride stock investors have endured this year may get even bumpier.

Bear markets accompanied by a recession tend to be steeper than those without an economic downturn, according to the Wells Fargo Investment Institute. Among bear markets since 1946, the average decline with a recession was 35.8% versus 27.9% on average without a recession, their data showed.

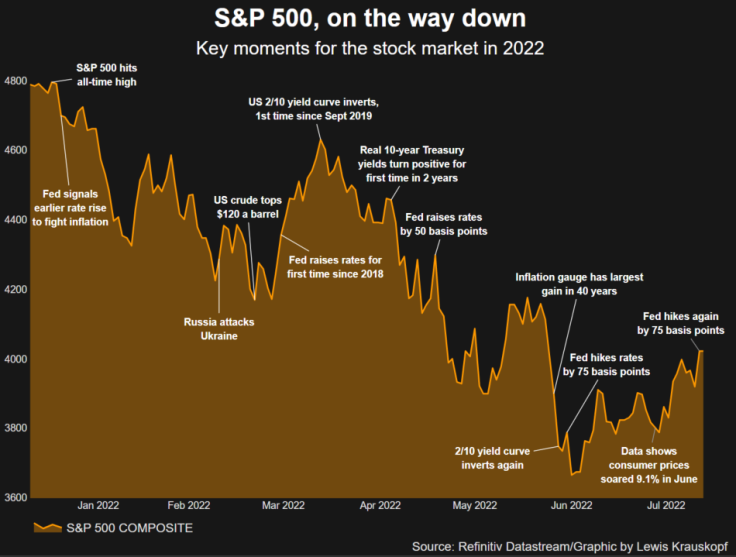

At its low point in mid-June, the S&P 500 had dropped 23.6% from its high. It has since rebounded over 10%.

Sameer Samana, senior global market strategist at Wells Fargo Investment Institute, said the stock market may have only partially priced an economic downturn, despite its big drop this year.

"We have gone a good ways toward discounting a recession at least with respect to historical averages. The bad news is there could be as much as another 10% more down" from the recent lows, he said.

Graphic: S&P 500 timeline,

To be sure, not everyone believes the U.S. economy is in a recession. Federal Reserve chair Jerome Powell on Wednesday said a strong employment market made it unlikely that a recession had started, while the White House is vigorously pushing back against recession chatter as it seeks to calm voters ahead of the Nov. 8 midterm elections.

Some investors have also pointed to data showing the economy remains on solid footing. Corporate profits, for example, are continuing to rise, with second-quarter S&P 500 earnings on track to have climbed 7.6% from a year ago, according to Refinitiv IBES.

Still, data from Deutsche Bank showed that since 1947, there have never been two successive quarters of negative economic growth without an accompanying recession. Thursday's data showed gross domestic product fell at a 0.9% annualized rate last quarter.

A recession is "almost a slam dunk over the next 12 months," wrote Jim Reid, the bank's head of thematic research, but added that he wants "to see more evidence of employment rolling over before we would call the current U.S. environment a recession."

In another ominous sign, a key part of the U.S. Treasury yield curve has been inverted for much of this month, with the yield on the 2-year note rising above the 10-year yield. Such inversions have historically preceded U.S. recessions.

Inflation at 40-year highs and weakening growth could further fuel fears of stagflation, a toxic mix of slowing growth and high inflation that has hurt equities in the past. UBS Global Wealth Management earlier this month said the S&P 500 could fall to 3,300 in such a scenario, an 18% decline from Wednesday's close.

Janus Henderson Investors is recommending "a defensive position within risk assets to weather the slowdown that is unfolding," the firm's director of research Matt Peron said in emailed comments. Peron likes shares of healthcare and software companies in the current environment, as well as real estate investment trusts.

"We continue to believe we are not out of the woods yet on the pressure the economy will feel from inflation and rate increases," Peron said.

© Copyright Thomson Reuters {{Year}}. All rights reserved.