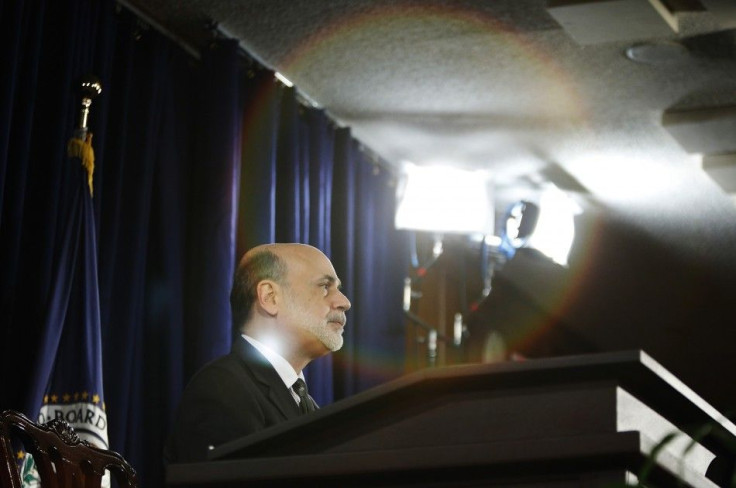

Bernanke Reaffirms Fed Mission In Speech to Economics Club

Federal Reserve Chairman Ben Bernanke gave his first public speech Monday since the U.S. central bank approved a new round of monetary stimulus last month, reiterating that its approach to monetary policy "is the same as it's always been."

The speech before the Economic Club of Indiana was remarkably simple in its level of intellectual complexity, a throwback to various appearances by Bernanke in front of college audiences earlier this year. Rather than testifying before Congress, explaining the wonky rationale behind monetary policy to peers or answering complicated questions from the Washington press corps, he simply was explaining what the Fed does.

Using the informal "So, what's the scoop on quantitative easing?" as an introduction to his remarks, Bernanke went over the Fed's objectives, how monetary and fiscal policy decision-making differed, the effects of Fed policy on savers, and the checks and balances the institution is subject to.

Nothing groundbreaking was covered in the speech, although the chairman once again drew the line in the sand against critics who had suggested the Fed's actions could lead to a situation where the economy gets out of the central bank's hand.

"The Federal Reserve's price stability record is excellent, and we are fully committed to maintaining it," Bernanke said.

Perhaps plumbing deeper political waters to make up for the simplicity of his words, he shot down arguments that the Fed is allowing irresponsible fiscal policy by maintaining loose monetary policy for extended periods.

"I sometimes hear the complaint that the Federal Reserve is enabling bad fiscal policy by keeping interest rates very low and thereby making it cheaper for the federal government to borrow," Bernanke said. "I find this argument unpersuasive. The responsibility for fiscal policy lies squarely with the administration and the Congress."

One noteworthy point made by Bernanke came as he was framing a response to criticism that his institution was "sowing the seeds of future inflation."

"Increased bank reserves held at the Fed don't necessarily translate into more money or cash in circulation, and, indeed, broad measures of the supply of money have not grown especially quickly, on balance, over the past few years," the chairman noted.

That particular dynamic, while true, is not considered a particular victory of Bernanke's policy goals, since slow growth in the money supply indicates lending activity is lagging.

The financial markets showed no overt reaction to the chairman's words. The benchmark S&P 500 Index of U.S. equities closed up 3.82 points, or 0.27 percent to 1,444.49.

© Copyright IBTimes 2025. All rights reserved.