Block Shares Extend Losses As Hindenburg Report Weighs

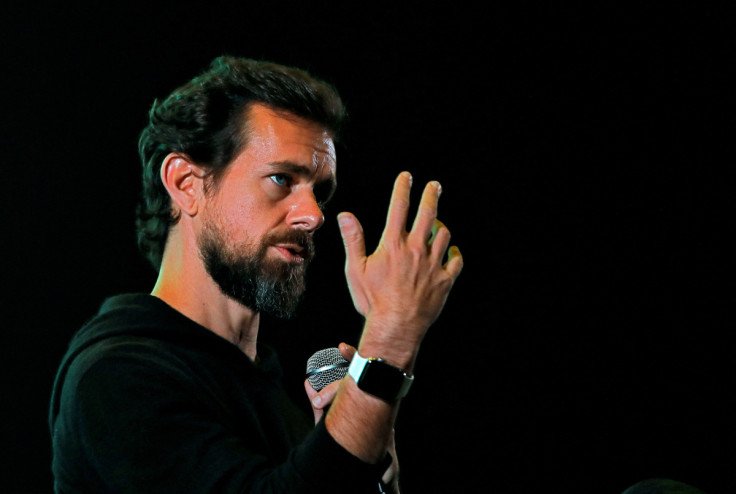

Shares of Twitter co-founder Jack Dorsey's Block Inc fell 4% in morning trading on Friday, a day after the payments firm's Cash App business became the latest target of U.S. short seller Hindenburg Research.

In a report, Hindenburg has alleged that Block overstated its user numbers and understated its customer acquisition costs.

The company called the report "factually inaccurate and misleading" and said it will work with the U.S. securities regulator to explore legal action against Hindenburg.

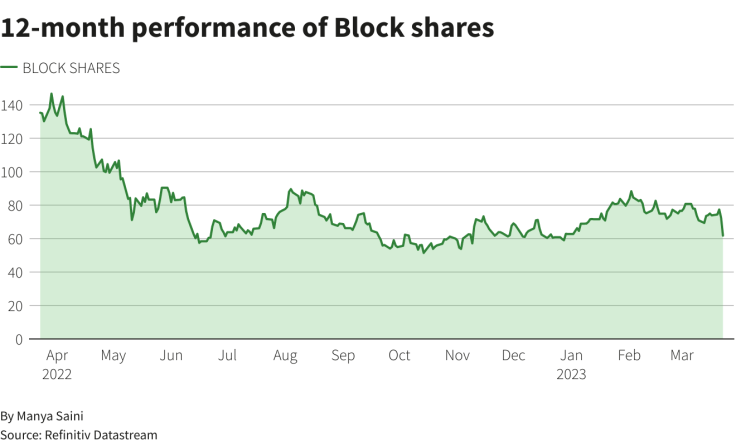

Block shares were trending on retail investor focused forum Stocktwits under 'extremely bearish' sentiment after giving up all the gains made so far this year on Thursday and closing 15% lower.

"The major problem with Block despite the multitude of allegations leveled by Hindenburg is it is still losing money. This is not the environment for money losing companies," Thomas Hayes, chairman and managing member at Great Hill Capital said.

"It is a 'shoot first, ask questions later' stock at this point."

(Graphic: 12-month performance of Block shares -

)

Brokerage RBC Capital Markets said the report will have a negative overhang on the shares for some time, but its view on the stock remained unchanged.

Hindenburg in its report said that while CEO Dorsey has touted Cash App's mention in hip-hop songs as an evidence of its mainstream appeal, its review showed the rappers describe it as a means to "scam, traffic drugs or even pay for murder".

Morningstar analysts said the action of rappers is not compelling proof of extensive issues but the more troubling allegation is that Block is aware of widespread fraud on its platform.

Brokerage Jefferies said in a note that most of the issues raised by Hindenburg are known, while pointing out that the short seller has not questioned the accuracy of the company's financials.

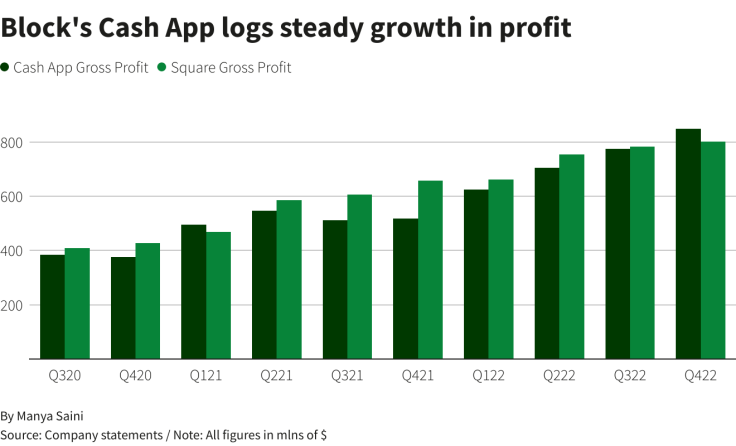

(Graphic: Block's Cash App logs steady growth in profit -

)

Short sellers typically sell borrowed securities and aim to buy these back at a lower price.

© Copyright Thomson Reuters {{Year}}. All rights reserved.