Italy's technocratic government approved ?4.5 billion ($5.58 billion) in spending cuts for this year aimed at slashing the size of Italy's bloated public sector and delaying a new tax increase until after the first half of 2013.

Apple is highly expected to release its sixth generation iPhone, presumably called the iPhone 5, at some point of time later this year and if ongoing rumors turn to be true, the handset will get major upgrade in terms of its current form factor.

Golar LNG, Xyratex Ltd, Silvercorp Metals, Silver Wheaton, Seagate Technology, Western Digital Corp, Banco Santander SA and eBay Inc. are among the companies whose shares are moving in pre-market trading Friday.

Earnings season for the second quarter is almost here, with America's biggest aluminum producer, Alcoa Inc., announcing its results on Monday and JPMorgan Chase & Co. disclosing a portion of its total derivatives-trading losses on Friday the 13th.

During the second quarter, average rents increased to record levels in 74 of the 82 U.S. markets tracked by real estate data firm Reis Inc. (NYSE: REIS), according to a report released Thursday. A number of factors are driving the trend.

Since its May 17 pricing at $38 a share, the stunning collapse in the value of Facebook (Nasdaq: FB) the No. 1 social networking site has made history ? for its sheer size and magnitude.The IPO market remains weak.

U.S. stock index futures point to a slightly lower open Friday as the interest rate cuts announced by central banks in Europe and China on Thursday failed to convince investors that the measures will be sufficient to rejuvenate the struggling global economy.

Mauritius has conveyed its readiness to cooperate with India to plug in the loopholes in the Double Taxation Avoidance Agreement (DTAA), the tax treaty that exists between the two countries.

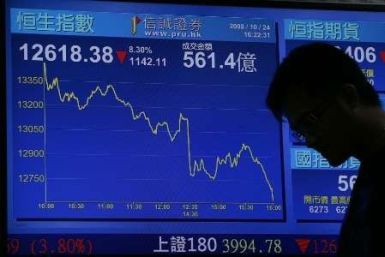

Asian stock markets declined Friday as investors remained cautious ahead of U.S. employment data due later in the day while major central bank?s actions to stimulate the global economy failed to calm market jitters.

European markets fell Friday as investors were not encouraged by the rate cuts announced by central banks.

The top after-market NYSE gainers Thursday were: Vanceinfo Technologies, Denbury Resources, Patriot Coal, McMoRan Exploration and First Tennessee National Corp. The top after-market NYSE losers were: iSoftStone Holdings, Teradata Corp, Leapfrog Enterprises, Hexcel Corp and Kronos Worldwide Inc.

The top after-market Nasdaq gainers Thursday were Xyratex Ltd, Celldex Therapeutics Inc, Sequenom Inc, Fifth Street Finance Corp and Applied Micro Circuits Corporation.The top after-market Nasdaq losers were: Informatica Corporation, Alexza Pharmaceuticals Inc, ValueVision Media Inc, Amtech Systems Inc and Alaska Communications Systems Group Inc.

Asian markets fell Friday as central bank measures in Europe and China could not allay investor concerns about the intensifying debt crisis looming over the euro zone and the worsening global economic downturn.

It's been a rough week for Apple's iOS team.In addition to Apple's first reports of a malicious program in their App Store, hundreds of newly-updated iOS apps have been crashing on launch and functionally unusable. The problem seems to have been traced to problems with the App Store's binary system and its FairPlay DRM. According to developer Marco Armet, apps that run perfectly for development teams are being corrupted when sent through the App store to consumers.

The mouse has a new likeness that will hang above over the chain's 500 restaurants.

Some airline companies appear to be faring much better in gaining passenger traffic thanks to a soaring demand for air travel and limited carrier choices -- a trend that has given U.S. airlines wide leeway to maintain overcrowded planes and shoddy customer service.

Investors in Research In Motion Ltd should not re-elect one-time lead director John Richardson to the board of the struggling BlackBerry maker at Tuesday's annual meeting, proxy advisory firm Glass Lewis said.

The race to become Yahoo Inc's next chief executive appears to have come down to two candidates: current interim CEO Ross Levinsohn and Hulu CEO Jason Kilar.

Who needs to swim at a beach on the coast when you can frolic in some of the United States' most scenic countryside?

The European summit may have increased investor confidence, but weak consumer spending across Europe, along with the rise of the dollar against the euro, is slowing down the global economy, pushing many companies to trim their earnings forecasts.

In Presumed Guilty, Jose Baez questions Casey Anthony's sanity and questions why the prosecution didn't deliver bombshell evidence they had in their back pocket.

Google Glasses are incredibly ambitious, but it appears that Google is no longer alone in exploring the avenue of wearable tech solutions. Apple was reportedly granted a patent on Tuesday in relation to peripheral treatment for head-mounted displays. Of all the companies to build a Project Glass rival, Google should worry most about Apple.

What Cooper did in public should definitely not be called a coming out. It was a dragging out of a perfectly secure gay man -- a throwing of a Christian to the media lions.

To some extent, monetary easing has been accommodated because of stable-to-lower inflationary pressures.

Consumers, spooked by months of sluggish hiring and a global slowdown, pulled back on spending in June, which took a toll on top U.S. retailers' sales.

Shares of BlackBerry developer Research in Motion (Nasdaq: RIMM) soared as much as 6.8 percent Thursday despite any corporate news.

In what can be labeled as a form of reverse surveillance, the ACLU of New Jersey has released a Police Tape app to let residents secretly video or record any encounters they have with police.

Government subsidies for sugar farmers are facing fresh opposition, despite the farmers' successful efforts to defeat a recent bid to eliminate the subsidies that opponents argue endangers public health, reduces employment and costs consumers and businesses billions of dollars.

Amazon.com Inc. (Nasdaq: AMZN), the No. 1 e-retailer, could ship as many as 17 million of its Kindle Fire tablets this year, said Victor Anthony, analyst with Topeka Capital Markets.

Volkswagen AG (Frankfurt: VOW) will complete its long-sought purchase of Porsche Automobil Holding SE (Frankfurt: PAH3), following years of on-again, off-again courtship between the two companies.