Coronavirus-Related Unemployment Claims Take Down Registration Sites

KEY POINTS

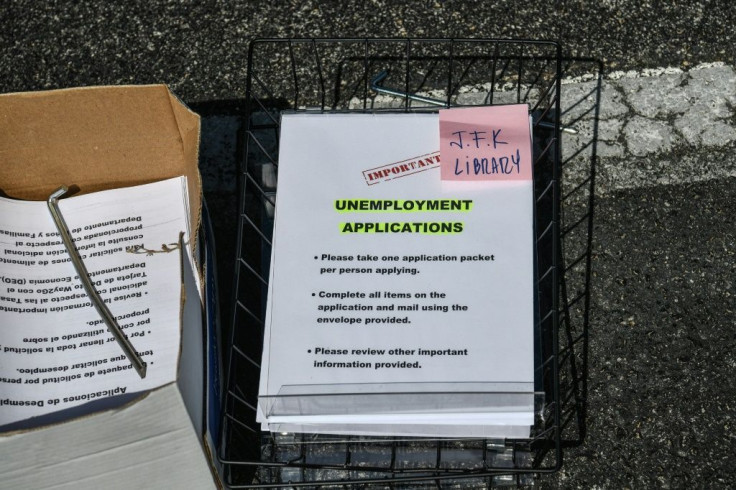

- Unemployment claim rollouts overwhelmed some state systems

- Washington, Michigan, Arkansas, Florida, New York, Pennsylvania affected

- Congress may want to redefine 'small business'

Washingtonians anxious to apply for unemployment benefits "should just wait it out," a state official said after the website for coronavirus job loss benefits became overloaded within minutes of opening Saturday (April 18) at 8 p.m. (11 p.m. EST).

On Monday at 9 a.m. (EST) Washington's Unemployment Security Department's website had this posted: "ALERT: Our system update is complete and eServices is online. However, both the site and our phone lines are experiencing extremely high volumes. Pages are loading slowly and call wait times are long.

"Please keep trying or come back and try later.

"If you are calling to submit your weekly claim, please try back after 5 p.m."

The system received a tsunami of calls immediately, according to a state official.

"It was in tens of thousands, it already was dramatically higher than ever before and this is significantly more than that,” Nick Demerice, public affairs director for the state Department of Employment Security told The Seattle Times. “What we saw was a massive load, right after 8 p.m. We added more capacity, but those sites just got overwhelmed. Quite a few folks were able to get all the way through, but from a lot of folks we also are hearing frustration.”

The Michigan Department of Labor and Economic Opportunity reported similar problems last week.

In March, Arkansas, Florida, New York and Pennsylvania reported massive backlogs in their telephone and website unemployment registrations.

The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) provided aid to individuals with support for the private enterprises. Some of the aid is through unemployment relief. Providing taxpayers with $1,200 stimulus checks and supposed small business loans are two other legs of the program.

Any company that has fewer than 500 employees at any one given location is potentially eligible, but the fund ran dry. Now questions are arising about a loophole in lawmakers definition of small business.

Shake Shack (SHAK) and Sandwich chain Potbelly (PBPB) are under fire after receiving a $10 million loans (the maximum permitted). Steakhouse chain Ruth's Hospitality (RUTH) managed to secure $20 million in loans. It seemingly skirted the $10 million loan limit by arranging two separate $10 million loans to different entities.

© Copyright IBTimes 2025. All rights reserved.