Federal Loan Program That Backed Failed Solar Firm Solyndra Has Officially Wiped Out Losses, Energy Agency Says

The U.S. Department of Energy’s controversial loan program for risky and innovative companies -- including the now-defunct solar firm Solyndra LLC and Tesla Motors Inc. -- has officially wiped out its losses. On top of that, the federal agency says it now expects to earn more than $5 billion from the program, according to a new report.

The results offer a sense of vindication to the Obama administration and the program’s backers. During the 2012 presidential elections, Republicans seized on the failure of Solyndra and a handful of other clean-energy firms as examples of wild misspending and “crony capitalism” during President Barack Obama’s first administration. Energy officials maintained that the program, which began under the George W. Bush administration, was critical for advancing the types of cutting-edge technologies necessary for reducing greenhouse gas emissions and fighting climate change.

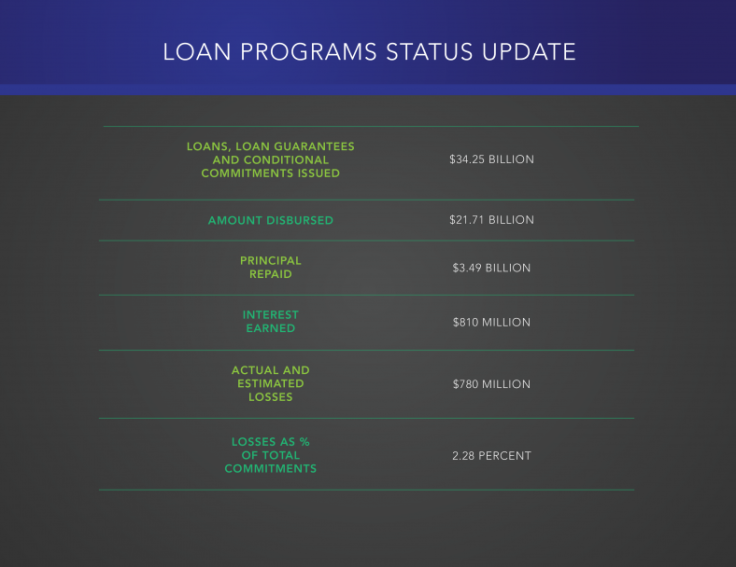

Projects funded by the Loan Programs Office made $810 million in interest payments in September, according to the report released Wednesday. That’s higher than the $780 million in losses from loans it sustained when startups including electric-car maker Fisker Automotive, panel manufacturer Abound Solar and Solyndra went bankrupt after taking large government loans.

"Taxpayers are not only benefiting from some of the world's most innovative energy projects... but these projects are making good on their loan repayments," Peter Davidson, executive director of the Loan Programs Office, told Reuters. “Every month money continues to roll in” from interest payments, he said, and losses aren’t expected to rise significantly.

"We feel very confident that going forward our portfolio is much less risky than it has been," he told Reuters.

Davidson took over the loan office last year after the program went 18 months without a permanent head. One of his primary tasks has been to revive the DOE initiative, which quietly operated under the radar in the years following the Solyndra debacle.

The California-based solar manufacturer took $527 million in loan guarantees in 2009 to build cylindrical “thin-film” solar panels from a factory in Fremont. Two years later, it filed for bankruptcy, in part due to the plummeting price of Chinese solar panels, which made it harder for fledgling, less-proven technologies to survive. Despite all the political backlash sparked by that failure and others, the combined losses accounted for only about 2 percent of all the money issued under the program.

The loan office has seen a few high-profile successes -- chief among them Tesla Motors. In May 2013, the California electric-car maker, backed by Elon Musk, paid back its $465 million loan nine years early. Biofuels maker Abengoa SA, which got $132.4 million in federal loan guarantees, opened the nation’s third commercial-scale biorefinery in Kansas in October.

The Loan Programs Office has the authority from Congress to issue nearly $60 billion in total loans and loan guarantees. The program has so far issued more than half of that chunk, of which nearly $22 billion has been disbursed to 20 projects.

The $5 billion return it expects to earn exceeds those from many venture capital and private equity investments in clean energy, Michael Morosi, an analyst at Jetstream Capital LLC, which invests in renewable energy, told Bloomberg News.

“People make a big deal about Solyndra and everything, but there’s a lot of VC capital that got torched right alongside the DOE capital,” Morosi said. “A positive return over 20 years in clean tech? That’s not a bad outcome.”

© Copyright IBTimes 2025. All rights reserved.