Higher Mortgage Rates, Prices Weigh On U.S. Home Sales In February

U.S. home sales fell by the most in a year in February as rising mortgage rates and a perennial shortage of houses priced out first-time buyers from the market.

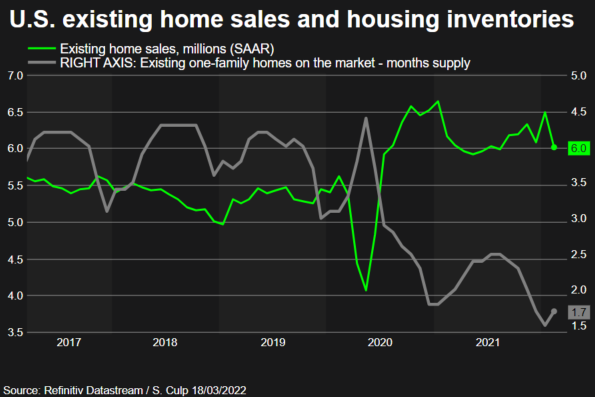

Existing home sales dropped 7.2% to a seasonally adjusted annual rate of 6.02 million units last month, the largest decrease since February 2021, the National Association of Realtors said on Friday.

Though the decline reversed January's jump, sales remained above their pre-pandemic level. Economists polled by Reuters had forecast sales would decrease to a rate of 6.10 million units.

"It looks like the rise in mortgage rates has cooled the demand from home buyers and if that's the case, a further reduction in sales activity is likely as mortgage rates have moved even higher in March," said Christopher Rupkey, chief economist at FWDBONDS in New York.

Sales fell in all four U.S. regions. Home resales account for the bulk of U.S. home sales. They dropped 2.4% on a year-on-year basis in February.

Graphics: Existing home sales:

Mortgage rates surged in February, with the 30-year fixed rate approaching a three-year high, according to data from mortgage finance agency Freddie Mac. It averaged 4.16% in the week ending March 17, rising above 4.0% for the first time since May 2019.

Mortgage rates are set to increase further after the Federal Reserve on Wednesday raised its policy interest rate by 25 basis points, the first hike in more than three years, and laid out an aggressive plan to push borrowing costs to restrictive levels by 2023.

A separate report from the Conference Board on Friday showed a gauge of future U.S. economic activity rebounded in February, suggesting the expansion would persist despite tighter monetary policy and uncertainty caused by Russia's invasion of Ukraine.

U.S. stocks were trading mixed. The dollar rose against a basket of currencies.

Graphic: Leading indicators:

TIGHT SUPPLY

Higher mortgage rates and rising homes prices amid a prolonged housing shortage will reduce affordability, especially for first-time buyers. The median existing house price increased 15% from a year earlier to $357,300 in February. Sales remained concentrated in the upper-price end of the market.

Bank of America Securities expects strong house price growth will continue this year and into 2023 because of tight supply.

According to the NAR, the typical monthly mortgage payment has surged 28% from a year ago, a huge burden for first-time buyers, who accounted for only 29% of sales last month. Economists and realtors say a 40% share of first-time buyers is needed for a robust housing market.

"The strength of the 2022 housing market is dependent upon the wave of millennial homebuyers reaching peak first-time homebuyer age and finding a way into this booming housing market," said Mike Fratantoni, chief economist at the Mortgage Bankers Association in Washington.

There were 870,000 previously owned homes on the market in February, down 15.5% from a year ago. Supply is likely to remain tight as builders struggle with shortages and high prices for key materials like lumber, which is used for framing.

Data from the Commerce Department on Thursday showed the backlog of homes yet to be build reached a fresh record high in February. A National Association of Home Builders survey this week showed homebuilder confidence dropped to a six-month low in March due to supply constraints and inflation.

At February's sales pace, it would take 1.7 months to exhaust the current inventory, down from 2.0 months a year ago. A six-to-seven-month supply is viewed as a healthy balance between supply and demand.

All-cash sales accounted for 25% of transactions last month, up from 22% a year ago. Individual investors or second-home buyers made up 19% of sales last month, up from 17% in February 2021.

Houses typically stayed on the market for 18 days last month, down from 20 days in February 2021.

Eighty-four percent of homes sold in February were on the market for less than a month.

© Copyright Thomson Reuters {{Year}}. All rights reserved.