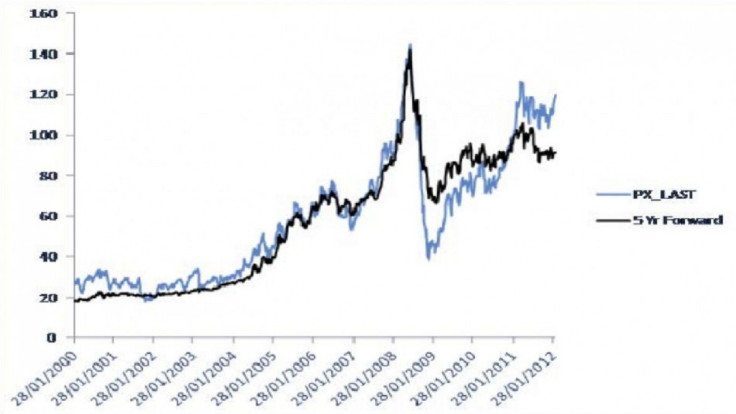

Oil Price Forecast 2012 from Jim O'Neill of Goldman Sachs [CHART]

In his most recent Viewpoint, Goldman Sachs Asset Management Chairman Jim O'Neill gave somewhat of an oil price forecast for 2012 and beyond.

O'Neill, who earned a Ph.D. for researching oil prices and their consequences, said he uses the five-year forward oil price as the simple broad guide for the equilibrium oil price, or the price at which supply meets demand on a fundamental level.

For a few years now, O'Neill said five-year forward oil prices suggest that long-term oil prices have settle around $80 to $100 per barrel, which is noticeably lower than spot oil prices and the oil price forecast of many other experts.

On Friday, WTI oil settled at $109.77 per barrel and Brent oil (shown on chart below) settled at $125.47 per barrel.

Source: Goldman Sachs Asset Management

O'Neill gave several reasons that could explain the $80 to $100 per barrel equilibrium, and why oil prices may not rise much higher.

On the demand side, data showed that OECD oil demand actually fell in 2011. China, moreover, is falling in love with a softer future GDP growth.

On the supply side, China is continuing to explore alternative sources of energy, including nuclear energy. In the U.S., natural gas is emerging as an alternative energy source.

The U.S. is the largest oil consumer in the world and accounts for over 20 percent of global demand and China is the second largest oil consumer in the world.

Having observed the beginnings of the stabilization of the longer term price since late 2009, I find it a lot more difficult to be as bullish as many others, said O'Neill.

© Copyright IBTimes 2025. All rights reserved.